Canadian National (CNI) Q3 Earnings Beat Estimates, Rise Y/Y

Canadian National Railway Company’s CNI third-quarter 2021 earnings (excluding 67 cents from non-recurring items) of $1.21 per share (C$1.52) surpassed the Zacks Consensus Estimate of $1.12. The bottom line increased year over year. Results were aided by higher freight rates and fuel surcharges.

Quarterly revenues of $2,852.1 million (C$3,591 million) topped the Zacks Consensus Estimate of $2,771.2 million. The top line also improved year over year, driven by a double-digit revenue increase at some of the business units.

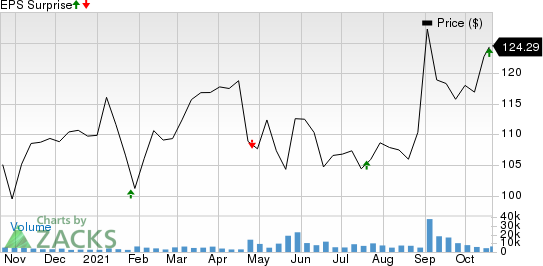

Canadian National Railway Company Price and EPS Surprise

Canadian National Railway Company price-eps-surprise | Canadian National Railway Company Quote

Freight revenues (C$3,427 million), which contributed 95.4% to the top line, increased 5% year over year as economic activities gather pace. Freight revenues at the Grain and fertilizers segment declined 16% while the same at the automotive unit decreased 23% year over year. Freight revenues at the petroleum and chemicals, metals and minerals, forest products, coal and intermodal units increased 21%, 20%, 1%, 43% and 7%, respectively.

Both overall carloads (volumes) and revenue ton miles (RTMs) decreased 1% year over year. Segmentwise, carloads in the Petroleum and chemicals, metals and minerals and coal improved 9%, 13%, and 60%, respectively. Carloads at the forest products, grain and fertilizer, intermodal and automotive segment declined 2%, 19%, 6% and 31% year over year, respectively. Freight revenues per carload and freight revenues per RTM improved 6% each in the reported quarter.

Operating expenses (on a reported basis) for the third quarter shot up 10% to C$2,250 million due to higher fuel costs among other factors. Average fuel price rose 46.6% in the reported quarter. Adjusted operating income increased 10% year over year to C$1,079 million. Adjusted operating ratio (defined as operating expenses as a percentage of revenues) improved to 59% from the year-ago quarter’s 59.9%. Lower value of the metric is desirable.

Liquidity

This presently Zacks Rank #3 (Hold) company generated free cash flow of C$754 million during the September quarter compared with the year-ago quarter’s C$506 million. Cash and cash equivalents amounted to C$2,194 million as of Sep 30, 2021 compared with C$569 million at December 2020 end. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

2021 Outlook

Canadian National anticipates current-year earnings per share to increase 10% from adjusted earnings of C$5.31 reported in 2020. Volumes, measured in revenue ton miles (RTMs), are expected to increase in low-single digits during the current year. The company still estimates free cash flow of C$3-C$3.3 billion for 2021 while the same was reported as C$3.2 billion in 2020.

CEO to Retire

In a separate development, the company announced that Jean-Jacques Ruest will retire at the end of January 2022 (or later when his successor is appointed) as its president and chief executive officer and as a member of the railroad operator’s board. Ruest has been associated with Canadian National for more than 25 years now. He was elevated to the CEO’s post in 2018.

We remind investors that TCI Fund Management Ltd, which is a major shareholder at Canadian National with more than 5% interest, was not happy with the company’s performance and its decision to pursue the Kansas City Southern KSU buyout deal, which eventually fell through last month following a regulatory setback. Another Canadian railroad operator Canadian Pacific Railway Limited CP Is now slated to acquire Kansas City Southern.

Unhappy with Canadian National’s performance, TCI Fund Management, which is run by billionaire Chris Hohn, was looking to replace Ruest and four other board members for some time. Reacting to Ruest’s impending retirement, TCI reportedly issued the following statement “Dismissing the same CEO that the board put in place just three short years ago is a good start, but it does not address the fundamental problem of a lack of leadership, failed strategic oversight, and the vacuum of operational expertise at the board level”.

TCI wishes to see Jim Vena fill Ruest’s shoes. Incidentally, the former was recently at the helm of Union Pacific UNP. However, only time will tell if this comes true.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Union Pacific Corporation (UNP) : Free Stock Analysis Report

Canadian National Railway Company (CNI) : Free Stock Analysis Report

Kansas City Southern (KSU) : Free Stock Analysis Report

Canadian Pacific Railway Limited (CP) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance