Cadence (CDNS) Q1 Earnings Top Estimates, Revenues Down Y/Y

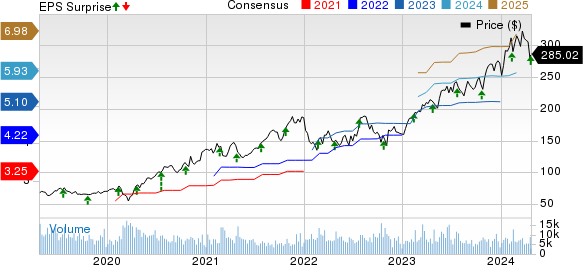

Cadence Design Systems CDNS reported first-quarter 2024 non-GAAP earnings per share (EPS) of $1.17, which beat the Zacks Consensus Estimate by 3.5%. However, it decreased 9.3% year over year.

Revenues of $1.009 billion missed the Zacks Consensus Estimate by 0.5% and decreased 1.2% on a year-over-year basis. The top line was affected by weakness in Product & Maintenance revenues. CDNS ended the quarter with a backlog of $6 billion and current remaining performance obligations of $3.1 billion.

Management provided full-year guidance for 2024. The company highlighted that the design activity continued to be robust owing to transformative generational trends such as hyperscale computing, 5G and autonomous driving, bolstered by the proliferation of AI. CDNS has also expanded its well-established partnerships with strategic partners like NVIDIA, GlobalFoundries and IBM.

Cadence Design Systems, Inc. Price, Consensus and EPS Surprise

Cadence Design Systems, Inc. price-consensus-eps-surprise-chart | Cadence Design Systems, Inc. Quote

Revenues for 2024 are now projected to be in the range of $4.56-$4.62 billion compared with the previous guidance of $4.55-$4.61 billion. The Zacks Consensus Estimate is currently pegged at $4.59 billion, which indicates growth of 12.3% from the year-ago levels.

Non-GAAP EPS for 2024 is expected to be between $5.88 and $5.98 compared with the previous guidance of $5.87 and $5.97. The Zacks Consensus Estimate is pegged at $5.93, which suggests a rise of 15.2% from the prior-year actuals.

Non-GAAP operating margin for 2024 is forecasted to be in the range of 42-43%. Management envisions operating cash flow between $1.35 billion and $1.45 billion. CDNS expects to utilize 50% of the free cash flow to repurchase shares in 2024.

For second-quarter 2024, revenues are estimated to be in the $1.03 million-$1.05 billion band. The company reported sales of $977 million in the year-ago quarter.

Non-GAAP EPS for second-quarter 2024 is anticipated to be between 73 and 77 cents. CDNS reported an EPS of $1.22 in the year-ago quarter.

Non-GAAP operating margin is estimated to be between 38.5% and 39.5% for the second quarter.

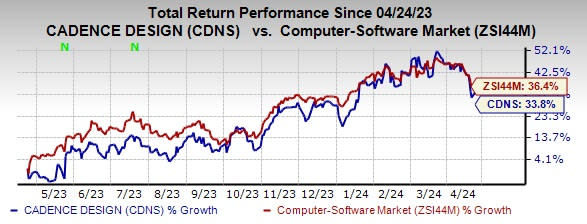

The stock is down 5.8% in the pre-market trading on Apr 23. Shares of Cadence have gained 33.8% compared with the sub-industry’s growth of 36.4% in the past year.

Image Source: Zacks Investment Research

Performance in Details

In the first quarter, Product & Maintenance revenues (90.5% of total revenues) of $913 million fell 5.3% year over year. Services revenues (9.5%) of $96 million increased 65.5% year over year. Our estimate for revenues from the Product & Maintenance and Service segments was $945.6 million and $62.7 million, respectively.

Geographically, the Americas, China, Other Asia, Europe, the Middle East and Africa, and Japan contributed 46%, 12%, 20%, 17% and 5%, respectively, to total revenues in the quarter under review.

Product-wise, Custom IC Design & Simulation, Digital IC Design & Signoff, Functional Verification, Intellectual Property, and Systems Design & Analysis accounted for 22%, 29%, 25%, 12% and 12% of total revenues, respectively.

The System Design & Analysis business benefited from AI-driven design optimization platforms integrated with its physics-based analysis solutions.

The Digital IC business benefited from the rapid adoption of digital full flow. CDNS’ digital solutions were adopted by 50 additional customers during the year.

The Functional Verification business benefited from the rising complexity of system verification and software bring-up. The Verisium platform witnessed accelerating customer adoption.

Recently, the company unveiled the latest Palladium Z3 Emulation and Protium X3 FPGA Prototyping systems. The latest systems offer more than double the capacity and a significant performance increase compared to Palladium Z2 and Protium X2 systems. This helps to facilitate quicker design deployment and reduce time to market.

The Custom IC business benefited owing to the rapid adoption of the Virtuoso Studio solution.

The IP business business benefited owing to AI and multichiplet based architectures. In the first quarter, CDNS partnered with Intel Foundry to provide design software and IP solutions at multiple Intel advanced nodes.

In the first quarter, total non-GAAP costs and expenses increased 6.1% year over year to $627 million.

Non-GAAP gross margin remained constant at 89.1%. Non-GAAP operating margin contracted 430 bps on a year-over-year basis to 37.8%.

Balance Sheet & Cash Flow

As of Mar 31, 2024, CDNS had cash and cash equivalents of $1.012 billion compared with $1.008 billion as of Dec 31, 2023.

Long-term debt was $299.8 million as of Mar 31, 2024, compared with $299.7 million as of Dec 31, 2023.

Cadence generated an operating cash flow of $253 million in the reported quarter compared with the prior quarter’s $272 million. Free cash flow was $204 million compared with $238 million in the previous quarter.

The company repurchased shares worth $125 million in the first quarter.

Zacks Rank & Other Key Picks

Cadence currently carries a Zacks Rank #2 (Buy).

Some other top-ranked stocks from the broader technology space are Badger Meter BMI, Pinterest PINS and Arista Networks ANET. Each stock presently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Badger Meter’s 2024 EPS has increased 9.9% in the past 60 days to $3.89. BMI’s long-term earnings growth rate is 12.3%.

Badger Meter’s earnings surpassed the Zacks Consensus Estimate in each of the last four quarters, delivering an average surprise of 12.7%. BMI shares have risen 35.8% in the past year.

The Zacks Consensus Estimate for PINS’s 2024 EPS has increased 0.7% in the past 60 days to $1.34. PINS’s long-term earnings growth rate is 20.1%.

Pinterest’s earnings beat the Zacks Consensus Estimate in three of the last four quarters, delivering an average earnings surprise of 37.4%. Shares of PINS have gained 13% in the past year.

The Zacks Consensus Estimate for ANET’s 2024 EPS has increased 0.4% in the past 60 days to $7.49. ANET’s long-term earnings growth rate is 17.5%.

Arista Networks’ earnings beat the Zacks Consensus Estimate in each of the last four quarters, delivering an average earnings surprise of 13.3%. Shares of ANET have gained 62.7% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Badger Meter, Inc. (BMI) : Free Stock Analysis Report

Cadence Design Systems, Inc. (CDNS) : Free Stock Analysis Report

Arista Networks, Inc. (ANET) : Free Stock Analysis Report

Pinterest, Inc. (PINS) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance