The CAC40 Tests Resistance in a Downtrend

DailyFX.com -

Talking Points

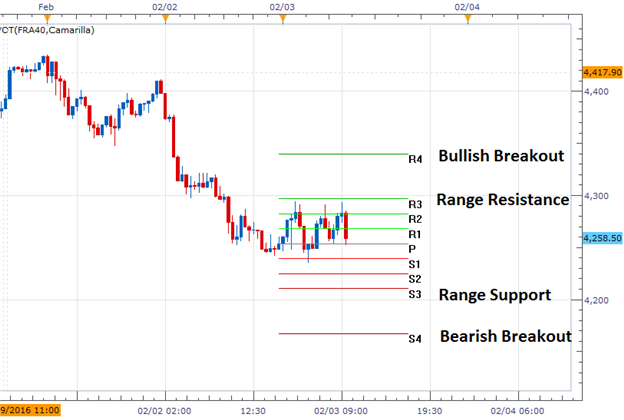

The CAC40 retraces to resistance in a downtrend

R3 resistance is found at 4,209

SSI reads at an extreme +3.41

CAC40 1 Day Chart

(Created using Trading View Charts)

Sign up for our FREE equities trading guide HERE!

The CAC40 is trading up modestly this morning, after the Index broke to a new monthly low yesterday at 4348. Currently the Index is trading under key resistance, which is found at 4295. This area on the graph is represented by today’s R3 Camarilla Pivot point, and so far, today price has been rejected below this value. In the event that resistance holds, traders may look for the CAC40 to return towards values of support. This includes today’s S3 support pivot, which resides at 4,209.

In the event that prices do reverse from the R3 pivot, it opens up the possibility that the CAC40 may continue its downtrend under 4,165. A breakout below S4 support would allow traders to target a lower low near 4079. This value is found by extrapolating 1-X of today’s 86-point range from the S4 pivot at 4,165. Alternatively, in the event that prices continue to rise, and move above today’s R4 pivot point at 4294, it would nullify any retracement opportunities on the creation of a new higher high.

SSI (Speculative Sentiment Index) for the CAC40 (Ticker FRA40) is currently reading at +3.413. This value is considered extreme, with over three positions long for every short. When taken as a constrain signal, SSI in this scenario favors a move towards new lows.

To Receive Walkers’ analysis directly via email, please SIGN UP HERE

Contact and Follow Walker on Twitter @WEnglandFX.

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.

Yahoo Finance

Yahoo Finance