C.H. Robinson (CHRW) Q4 Earnings & Revenues Beat, Up Y/Y

C.H. Robinson Worldwide’s CHRW fourth-quarter 2020 earnings of $1.08 per share surpassed the Zacks Consensus Estimate of 94 cents. The bottom line also surged 47.9% year over year.

Total revenues of $4,549.5 million not only outperformed the Zacks Consensus Estimate of $4,125.9 million, but also increased 19.9% year over year owing to higher pricing and increased volumes across most of the company’s service lines, thanks to improvement in freight environment.

Total operating expenses dipped 1.9% year over year to $433.8 million, primarily due to cost saving initiatives. Adjusted gross profits climbed 10.7% year over year to $640.6 million, primarily owing to higher pricing and volumes at the Global Forwarding business segment as well as contributions from the Prime Distribution Services acquisition.

The company returned $112.8 million to its shareholders in the fourth quarter through a combination of cash dividends ($2.5 million) and share repurchases ($110.3 million). Capital expenditures totaled $13.7 million in the quarter under review. For the full year, capital expenditures were $54 million. The company anticipates capital expenditures to be $55 million-$65 million in 2021, with the maximum reserved for technology spends.

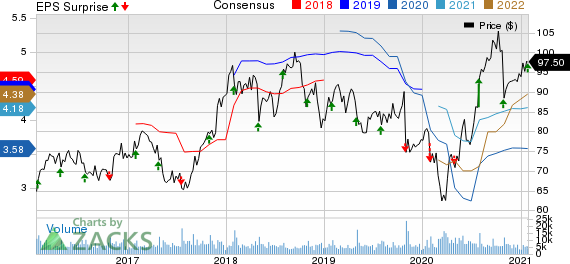

C.H. Robinson Worldwide, Inc. Price, Consensus and EPS Surprise

C.H. Robinson Worldwide, Inc. price-consensus-eps-surprise-chart | C.H. Robinson Worldwide, Inc. Quote

Segmental Results

At North American Surface Transportation (“NAST”), total revenues were $3,089.67 million (up 10.8%) in the fourth quarter. Segmental revenues increased due to higher truckload pricing and increase in less than truckload ("LTL") shipments. Adjusted gross profits at the segment inched up 1.6% with a 4 percentage point benefit from the Prime acquisition in March 2020. NAST results include Robinson Fresh transportation, which was previously reported under a separate segment.

Total revenues at Global Forwarding summed $1,030.36 million, up 71.7% year over year. Higher pricing in ocean and air, increased charter flights, and larger shipment sizes boosted results. Adjusted gross profits at the segment surged 39.6% year over year.

A historical presentation of the results on an enterprise basis is given below:

Transportation: The unit (comprising Truckload, Intermodal, LTL, Ocean, Air, Customs and Other logistics services) delivered adjusted gross profits of $618.60 million in the quarter under consideration, up 11% from the prior-year figure.

Adjusted gross profits at the Truckload segment dipped 1.4% year over year to $277.51 million. Volumes declined 3.5% year over year. LTL adjusted gross profits increased 3.7% year over year to $117.86 million with volumes increasing 20% in the quarter.

Adjusted gross profits at the Ocean transportation segment ascended 53% year over year to $112.41 million. The same at the air transportation segment surged 37.7% to $35.72 million. Meanwhile, customs-adjusted gross profits augmented 4.6% to $23.98 million.

Other logistics services’ adjusted gross profits soared 28.7% to $51.11 million.

Sourcing: Adjusted gross profits at the segment inched up 1.5% to $21.98 million.

Liquidity

This Zacks Rank #3 (Hold) company exited the fourth quarter with cash and cash equivalents of $243.80 million compared with $447.86 million at the end of 2019. Long-term debt was $1,093.30 million compared with $1,092.45 million at 2019-end. You can see the complete list of today's Zacks #1 Rank (Strong Buy) stocks here.

Sectorial Snapshot

Let’s take a look at some of the other recently released earnings reports from companies within the Zacks Transportation sector.

United Airlines UAL, carrying a Zacks Rank #3, incurred a loss (excluding 6 cents from non-recurring items) of $7 per share in the fourth quarter of 2020, wider than the Zacks Consensus Estimate of a loss of $6.56. Meanwhile, operating revenues of $3,412 million lagged the Zacks Consensus Estimate of $3,420.4 million.

J.B. Hunt Transport Services JBHT, carrying a Zacks Rank #3, reported earnings of $1.44 per share, beating the Zacks Consensus Estimate of $1.27. Total operating revenues of $2,737.7 million also surpassed the Zacks Consensus Estimate of $2,514.3 million.

Delta Air Lines DAL, carrying a Zacks Rank #4 (Sell), incurred a loss (excluding $1.34 from non-recurring items) of $2.53 per share in the fourth quarter of 2020, wider than the Zacks Consensus Estimate of a loss of $2.43. Total revenues of $3,973 million topped the Zacks Consensus Estimate of $3,754.5 million.

Just Released: Zacks’ 7 Best Stocks for Today

Experts extracted 7 stocks from the list of 220 Zacks Rank #1 Strong Buys that has beaten the market more than 2X over with a stunning average gain of +24.4% per year.

These 7 were selected because of their superior potential for immediate breakout.

See these time-sensitive tickers now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

C.H. Robinson Worldwide, Inc. (CHRW) : Free Stock Analysis Report

Delta Air Lines, Inc. (DAL) : Free Stock Analysis Report

United Airlines Holdings Inc (UAL) : Free Stock Analysis Report

J.B. Hunt Transport Services, Inc. (JBHT) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance