Byline Bancorp Inc (BY) Surpasses Analyst Earnings Estimates in Q1 2024

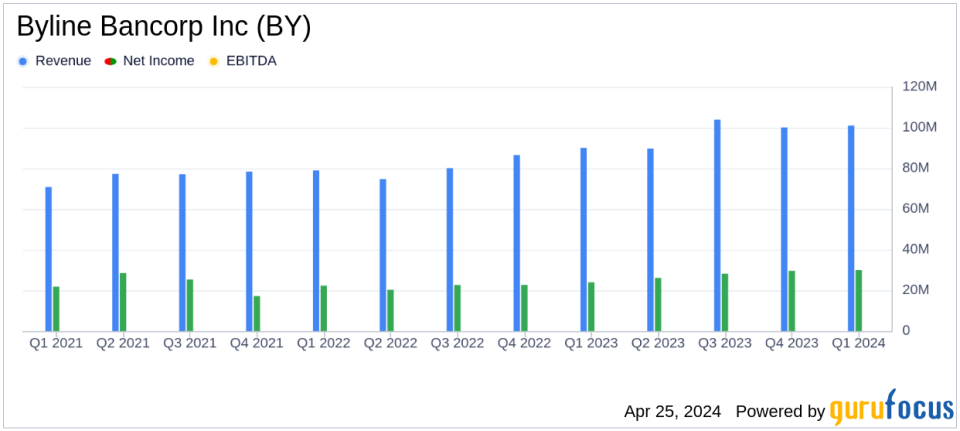

Net Income: Reported $30.4 million for Q1 2024, exceeding the estimated $27.75 million.

Diluted EPS: Achieved $0.70, surpassing the estimated $0.64.

Total Revenue: Reached $101.0 million, surpassing the estimated $98.06 million.

Net Interest Income: Recorded at $85.5 million, showing a decrease from the previous quarter's $86.3 million.

Non-Interest Income: Increased to $15.5 million, up 6.7% from the previous quarter.

Provision for Credit Losses: Decreased to $6.6 million, down from $7.2 million in the previous quarter.

Efficiency Ratio: Slightly increased to 51.94% from 51.63% in the previous quarter.

Byline Bancorp Inc (NYSE:BY) released its 8-K filing on April 25, 2024, unveiling a first-quarter net income of $30.4 million, or $0.70 per diluted share, surpassing the analyst estimates of $0.64 per share and a net income of $27.75 million. The reported revenue of $101.01 million also exceeded the forecasted $98.06 million, marking a significant achievement for the company.

Byline Bancorp Inc, headquartered in Chicago, operates as the holding company for Byline Bank. The bank caters to small-and-medium-sized businesses, financial sponsors, and consumers, offering a comprehensive suite of banking products and services. Byline Bank also provides trust and wealth management services and operates Byline Financial Group, a subsidiary offering equipment leasing solutions.

Key Financial Highlights

The first quarter of 2024 saw Byline Bancorp achieve a total revenue of $101.01 million, with a net interest income of $85.54 million, slightly down from the previous quarter's $86.28 million. Non-interest income stood at $15.47 million, reflecting a 6.7% increase from the fourth quarter of 2023. The bank's efficiency ratio slightly increased to 51.94%, indicating a marginal rise in non-interest expenses which totaled $53.81 million for the quarter.

Byline Bancorp's balance sheet showed robust growth, with total assets reaching $9.4 billion, marking a 6.0% increase from the end of 2023. Total deposits grew by $173.2 million to $7.35 billion, and total loans and leases saw an increase of $99.5 million, reaching $6.8 billion.

Operational and Strategic Developments

Roberto R. Herencia, Executive Chairman and CEO, expressed satisfaction with the quarter's outcomes, highlighting the surpassing of $9.0 billion in total assets and $1.0 billion in stockholders' equity. He remains optimistic about future opportunities to enhance the bank's value. Alberto J. Paracchini, President, echoed these sentiments, noting solid earnings, profitability, and growth in loans and deposits. He also pointed out the stable credit quality and well-managed expenses.

The provision for credit losses was $6.6 million, a decrease from the previous quarter, reflecting a stable credit environment. Notably, the bank declared a quarterly cash dividend of $0.09 per share, consistent with previous quarters, payable on May 21, 2024, to shareholders of record as of May 7, 2024.

Market Position and Future Outlook

Byline Bancorp's strategic initiatives and solid financial performance position it as a formidable entity in the Chicago banking sector. The bank's focus on expanding its commercial and industrial loan portfolio, coupled with effective cost management and stable asset quality, supports a positive outlook for continued growth and profitability.

The bank plans to further capitalize on market opportunities and enhance shareholder value through strategic initiatives and maintaining a strong balance sheet. As Byline Bancorp continues to execute its business strategy effectively, it remains well-positioned to navigate the dynamic banking landscape and foster sustained growth.

For more detailed financial information and future updates, investors and stakeholders are encouraged to refer to the full 8-K filing and upcoming communications from Byline Bancorp Inc.

Explore the complete 8-K earnings release (here) from Byline Bancorp Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance