Who Has Been Buying Red Moon Resources Inc. (CVE:RMK) Shares?

It is not uncommon to see companies perform well in the years after insiders buy shares. The flip side of that is that there are more than a few examples of insiders dumping stock prior to a period of weak performance. So before you buy or sell Red Moon Resources Inc. (CVE:RMK), you may well want to know whether insiders have been buying or selling.

What Is Insider Selling?

Most investors know that it is quite permissible for company leaders, such as directors of the board, to buy and sell stock in the company. However, most countries require that the company discloses such transactions to the market.

We would never suggest that investors should base their decisions solely on what the directors of a company have been doing. But it is perfectly logical to keep tabs on what insiders are doing. For example, a Harvard University study found that 'insider purchases earn abnormal returns of more than 6% per year'.

View our latest analysis for Red Moon Resources

Red Moon Resources Insider Transactions Over The Last Year

The CEO & Director, Patrick Laracy, made the biggest insider sale in the last 12 months. That single transaction was for CA$400k worth of shares at a price of CA$0.40 each. So it's clear an insider wanted to take some cash off the table, even below the current price of CA$1.20. As a general rule we consider it to be discouraging when insiders are selling below the current price, because it suggests they were happy with a lower valuation. However, while insider selling is sometimes discouraging, it's only a weak signal. It is worth noting that this sale was only 24% of Patrick Laracy's holding. Patrick Laracy was the only individual insider to sell shares in the last twelve months.

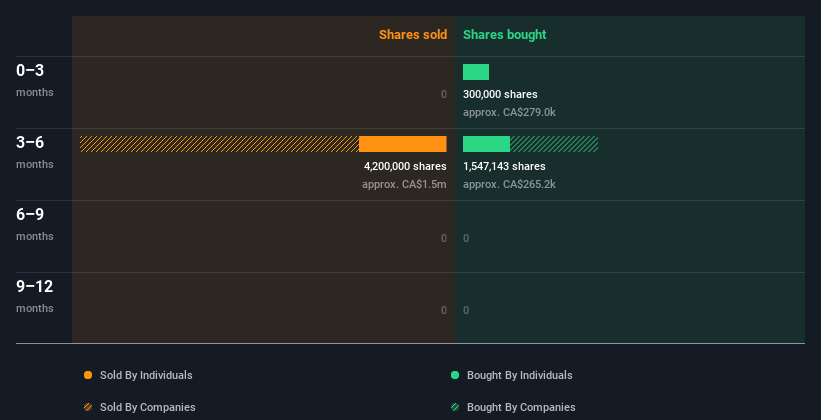

Over the last year, we can see that insiders have bought 847.14k shares worth CA$404k. But they sold 1.00m shares for CA$400k. Overall, Red Moon Resources insiders were net buyers during the last year. They paid about CA$0.48 on average. We don't deny that it is nice to see insiders buying stock in the company. However, we do note that they were buying at significantly lower prices than today's share price. You can see a visual depiction of insider transactions (by companies and individuals) over the last 12 months, below. If you click on the chart, you can see all the individual transactions, including the share price, individual, and the date!

There are always plenty of stocks that insiders are buying. So if that suits your style you could check each stock one by one or you could take a look at this free list of companies. (Hint: insiders have been buying them).

Insiders at Red Moon Resources Have Bought Stock Recently

It's good to see that Red Moon Resources insiders have made notable investments in the company's shares. Independent Director John Anderson spent CA$280k on stock, and there wasn't any selling. That shows some optimism about the company's future.

Does Red Moon Resources Boast High Insider Ownership?

For a common shareholder, it is worth checking how many shares are held by company insiders. We usually like to see fairly high levels of insider ownership. From our data, it seems that Red Moon Resources insiders own 6.1% of the company, worth about CA$5.4m. Whilst better than nothing, we're not overly impressed by these holdings.

So What Does This Data Suggest About Red Moon Resources Insiders?

It is good to see the recent insider purchase. And an analysis of the transactions over the last year also gives us confidence. But on the other hand, the company made a loss during the last year, which makes us a little cautious. On this analysis the only slight negative we see is the fairly low (overall) insider ownership; their transactions suggest that they are quite positive on Red Moon Resources stock. While we like knowing what's going on with the insider's ownership and transactions, we make sure to also consider what risks are facing a stock before making any investment decision. To that end, you should learn about the 4 warning signs we've spotted with Red Moon Resources (including 1 which doesn't sit too well with us).

Of course Red Moon Resources may not be the best stock to buy. So you may wish to see this free collection of high quality companies.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions, but not derivative transactions.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

Yahoo Finance

Yahoo Finance