Houses to hit record prices in weeks

Five Australian capitals at record home values

National home price index to reach record high within two months, at current rate of growth

Sydney house prices surge beyond $1 million

Home values in nearly every Australian capital city are at record highs after a blockbuster quarter, with national home prices to reach their most expensive ever in as little as eight weeks.

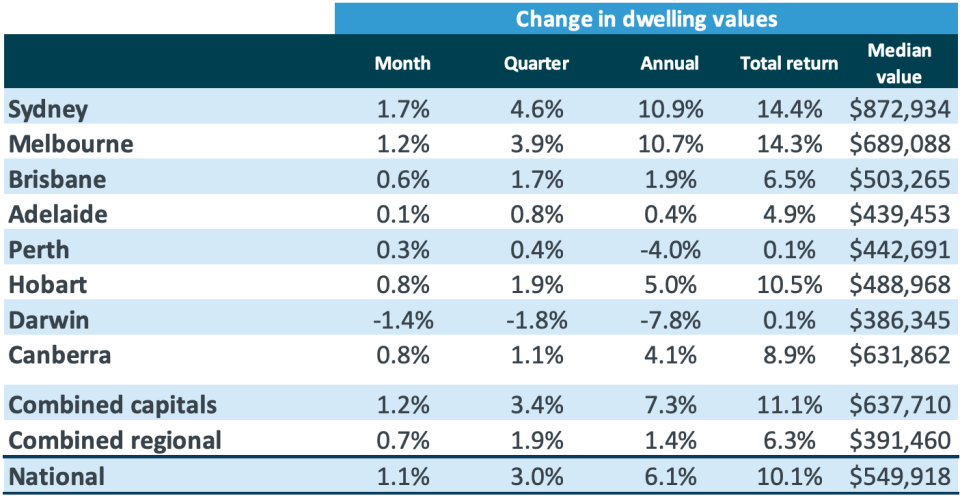

Property prices across Australia grew 1.1 per cent over February, bringing total yearly growth to 10.1 per cent, the latest CoreLogic Home Value Index revealed on Monday.

And if the country maintains its accelerating rate of growth, Australian home prices will reach record prices within weeks.

Cheap vs affordable: What's the difference?

‘Ticking time bomb’: $3,600 problem coming for Aussie home-owners

In fact, values in five Australian capital cities are already at record highs, with buyers in Melbourne, Brisbane, Canberra, Hobart and Adelaide facing property prices at levels not seen before.

Sydney saw huge growth over February, etching price gains of 1.7 per cent, while Melbourne soared 1.2 per cent.

The two cities also recorded a return to double-digit annual price growth, with home values in Sydney growing a staggering 10.9 per cent over the year to a median value of $872,934.

Standalone house prices have also hit a median value of $1,001,357.

Melbourne saw its home values increase 10.7 per cent over the year to a median value of $689,088.

In fact, every capital city bar Darwin recorded positive growth, with national housing values now 7.9 per cent higher than they were when they bottomed out in June 2019.

Interest rate cuts fuel record growth

The rocketing prices come after the Reserve Bank of Australia last year cut the official interest rate three times to a record low of 0.75 per cent amid stagnating wage growth and poor GDP figures.

And as coronavirus steamrolls a domestic economy already reeling from a catastrophic bushfire season, another interest rate cut may be on the cards for Tuesday.

Lawless noted the low mortgage rates and better access to housing credit helped drive price growth, with the national price index in February only 1.2 per cent below its former 2017 record high.

“At the current run rate of growth, the national index is likely to reach a new nominal high over the next two months,” he added.

“The primary factors driving this rebound remain in place and include an extremely low cost of debt and improved borrowing capacity. However, considering the sluggish pace of household income growth, housing affordability is eroding rapidly which is likely to see some parts of the market become less active.”

Dark days over for Perth?

The fallen darling of the Australian housing market, Perth, could be nearing the end of the tunnel, Lawless said.

The western city recorded positive monthly growth of 0.3 per cent and quarterly growth of 0.4 per cent.

While the struggling hub is still down 4 per cent on an annual basis, Lawless said its rise in February marked the fourth consecutive month where dwelling values haven’t fallen.

That’s something Perth hasn’t seen since 2014.

“Although Perth values are now trending higher, the recovery period is likely to be a long one, with Perth housing values remaining 21.0 per cent below their peak,” Lawless added.

Affordability pressures increase

Sydney, Melbourne and Hobart all face increasing affordability challenges as price growth outpaces income growth.

This will see homes in the cities’ outer urban rings see growth as buyers look further afield.

However, these challenges could also see property prices slow as potential buyers back away from the difficult markets.

Coronavirus hits market

“A more significant downturn in consumer sentiment related to the coronavirus outbreak could become a determining factor that impacts the market over coming months,” added Lawless.

“While housing demand is now relatively insulated from a downturn in foreign buyers, the economic impact on key export sectors such as education, tourism and commodities is likely to result in weaker economic conditions and lower consumer sentiment.”

The Australian share market saw one of its worst days on Friday, with the ASX plunging more than 3 per cent in early trade as the respiratory disease threat grew more severe.

And in early Monday trade, the ASX200 mimicked its Friday performance, shedding more than 2 per cent in minutes.

The virus is also expected to see tourist numbers to Australia fall by around 40 per cent in the first six months of 2020, hitting the university, tourism and hospitality sectors.

Make your money work with Yahoo Finance’s daily newsletter. Sign up here and stay on top of the latest money, news and tech news.

Follow Yahoo Finance Australia on Facebook, Twitter, Instagram and LinkedIn.

Yahoo Finance

Yahoo Finance