Buyers: These 10 suburbs will be ‘property danger zones’ in 2019

Australian buyers are enjoying a more affordable property market, but as they gear up to jump in, they should be aware of areas with unusually poor outlooks.

The national property market has softened 5.6 per cent over the last 12 months and most experts predict the downturn will continue for a while still.

While the more accessible entry points are likely making buyers salivate, there are several areas where the price recovery will not be as strong and properties may not provide strong investment potential, RiskWise Property Research has warned.

In particular, buyers should be cautious of suburbs with a large pipeline of units set to enter the market, CEO Doron Peleg said.

Areas where the pipeline of units has the potential to tip it into an oversupply should also be approached with caution.

“Increased scrutiny of residential property loan applications and restrictions on foreign investors have led to a significant reduction in investor activity and changed the market landscape and consumer sentiment,” Peleg explained, adding that political uncertainty around negative gearing and capital gains tax benefits are also having a negative effect.

“You have the potential for a major disaster.”

Danger zones

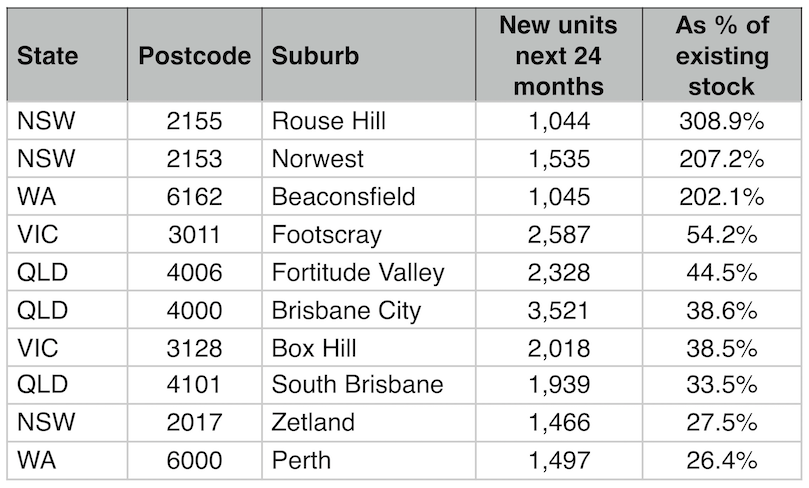

Peleg said nearly all of Australia’s capital cities have a potential unit oversupply, but highlighted 10 “danger zones” for buyers.

“Currently, there are a large number of high-rise properties in our capital cities being offered to a smaller number of investors. This is because there are less investors in the market mainly due to credit restrictions,” Peleg said.

“Also, lenders are being more cautious about their loan-to-value ratios (LVRs) and more discerning about who to lend to, meaning there are less buyers in the property market.”

He said areas black-listed by lenders can force buyers to fork out significantly more for deposits, up to 30 per cent, further reducing demand.

“This has resulted in a reduction in activity and this has a major impact on the market. Lenders understand that oversupplied suburbs carry a greater degree of risk – and those risks are just as real for the investors who buy in those suburbs.”

Make your money work with Yahoo Finance’s daily newsletter. Sign up here and stay on top of the latest money, news and tech news.

Now read: Here’s how much you REALLY need to earn to buy a house in your city

Now read: Home prices in this city to PLUMMET another $60K, experts predict

Now read: Mortgage brokers dealt massive blow: What it means for borrowers

Yahoo Finance

Yahoo Finance