Bushfires could burn victims’, firefighters’ credit scores

Bushfire victims who have lost their homes and their belongings to the blazes will have more than just the loss of property to contend with.

Lawyers and credit experts are warning that natural disasters mean people often end up with unpaid bills – and that this can harm your credit rating for years to come.

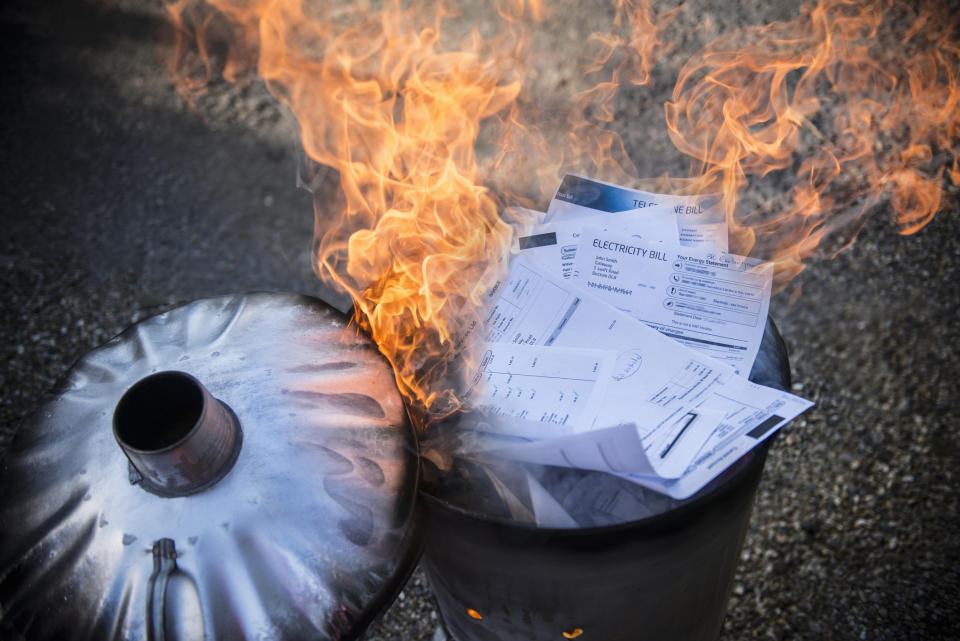

“Particularly after the fires, floods even cyclones we find people had missed paying a bill quite simply because the bill was blown out of their mailbox, went up in smoke or they had to move out of their home because it was uninhabitable but the bills kept coming to the address,” said consumer and financial law firm MyCRA Lawyers CEO Graham Doessel.

“Most utility companies, banks and insurers send out bills automatically and would have no idea your home has been razed.”

Related story: Free legal help offered to Aussies hit by bushfires

Related story: How bushfire-affected Australians can get free tax help

Related story: Here’s how you can help local businesses ravaged by bushfires

One of Doessel’s clients said she suffered a stroke from the trauma of her home burning down four years ago, and lost track of some of her bills as she struggled to piece her life back together.

The oversight led to a default judgement on her credit file, and then impacted her ability to obtain finance for things like a phone.

“I rang one company and told them my story and they removed the judgement straight away – but HSBC won’t budge, I have told them I am happy to pay the bill, but they won’t agree to remove the default and I need it removed,” the woman said.

When people are fleeing for their lives, their bills are the last thing on their mind, said Doessel – but you need to keep in touch with your utility providers, he said.

According to Fair Go Finance CEO Paul Walshe, your accounting falling into hardship may reflect negatively for your credit score.

But if you’ve lost your home to a bushfire and that has impacted your ability to pay your bills and make repayments, there are a few things you can do:

How bushfire-affected victims can protect their credit score

When you get a chance, take stock, make a list of your bills, and get in touch with each provider and let them know about your circumstances, said Doessel.

“If you are suffering hardship ask for an extension or a moratorium on payment for three months or even request the debt be forgiven.

“Most companies have the discretion to forgive a debt in extreme cases, as no company wants to be the catalyst that drives a customer to suicide over a bill.”

Finder.com.au’s personal finance expert Kate Browne said most telcos, banks and utility providers have financial hardship policies that can help.

“If you think you might be late paying your bills or will need to cancel your contract due to property destruction, the best thing to do is apply for this aid as soon as possible,” she told Yahoo Finance.

If you start missing repayments on your mortgage, get in touch with your lender and establish a payment arrangement, Walshe said. “Then we will restructure the loan so that future reporting is in line with this arrangement.”

If you’re not sure of the extent of the impact, get in touch with the lender to defer payments, and work with them to restructure your loan.

Volunteer firefighters at risk of bad credit ratings

According to Doessel, even volunteer fireys and emergency service workers are at risk of missing a bill payment as their main focus is being on the frontlines battling the blazes.

“Most people won’t even realise this has happened for years down the track, it’s only when they apply for a home loan, credit card or even a new mobile phone and get rejected that they find out,” he said.

You can check your credit rating for free on websites such as Credit.com, Finder.com.au, Credit Savvy, GetCreditScore, and Credit Simple whenever you want.

However, note that your credit score may vary between different sites as different credit bureaus receive different sources of information.

Make your money work with Yahoo Finance’s daily newsletter. Sign up here and stay on top of the latest money, news and tech news.

Yahoo Finance

Yahoo Finance