Bull of the Day: Qualys (QLYS)

Headquartered in Redwood City, CA, Qualys Inc. (QLYS) provides cloud security and compliance solutions, like the QualysGuard Cloud Platform, to businesses and organizations looking to protect their IT systems and applications from cyber-attacks.

Q3 Earnings Come In Strong

Revenues jumped 15% year-over-year to $83 million, just beating the Zacks Consensus Estimate of $82 million. Non-GAAP net income hit $27.2 million in Q3, or 66 cents per share.

Non-GAAP operating income increased 28% to $33.1 million, while non-GAAP gross margin was 82% for the quarter.

Qualys now has almost 800 customers that use its free Global IT Asset Discovery and Inventory solution. The company also saw nice growth in its Qualys Cloud Agent subscriptions and multi-product adoption.

And, Qualys expanded its cloud platform to the Canadian market, which brings total global operation sites to eight locations.

Qua

Year-to-date, QLYS is up 17.7%. Estimates have been rising lately too, pushing the stock towards a Zacks Rank #1 (Strong Buy).

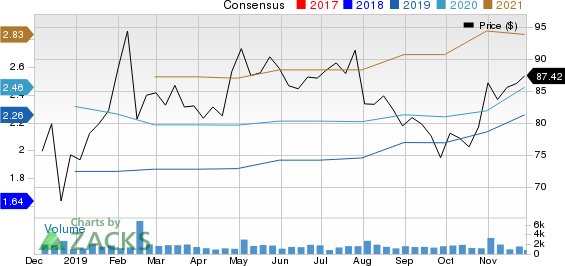

For the current fiscal year, Qualys’ earnings are expected to grow about 29% year-over-year. Five analysts have revised their estimate upwards in the past 60 days, and the Zacks Consensus Estimate has jumped 20 cents higher from $2.06 to $2.26 per share during the same time frame.

2020 looks strong too, and earnings could see growth of 8.8%; next year’s consensus estimate sits at $2.46 per share, with five upward revisions as well in the last 60 days.

Bottom Line

Management raised its GAAP non-GAAP EPS guidance for the year, and revenues are expected to grow 15%, falling in the range of $321.1 million and $321.8 million. If you’re an investor looking for a broad computer and technology stock to add to your portfolio, make sure to keep QLYS on your shortlist.

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through Q3 2019, while the S&P 500 gained +39.6%, five of our strategies returned +51.8%, +57.5%, +96.9%, +119.0%, and even +158.9%.

This outperformance has not just been a recent phenomenon. From 2000 – Q3 2019, while the S&P averaged +5.6% per year, our top strategies averaged up to +54.1% per year.

See their latest picks free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Qualys, Inc. (QLYS) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance