Bull of the Day: Service Now (NOW)

ServiceNow NOW, a leading SAAS workflow company, has emerged as a highly compelling stock with robust growth, technological advancements, and strong fundamentals. With a Zacks Rank #1 (Strong Buy), a bullish technical chart pattern, and a series of strategic announcements, ServiceNow stock demonstrates potential for near, and long-term success.

ServiceNow provides cloud computing services that automate digital workflows to accelerate enterprise IT operations. The company’s Now Platform enables companies to enhance productivity by streamlining systems and automating manual and complex processes.

NOW stock has been an exceptional performer in the last 10 years. Over that period, it has compounded at an annual rate of 29.7%, far outperforming the broad market.

Image Source: Zacks Investment Research

Fundamentals

During its most recent earnings statement ServiceNow handily exceeded expectations, reporting profit of $0.84 per share, well above analysts’ estimates of $0.47 per share. ServiceNow boasts a Zacks Rank #1 (Strong Buy) reflecting the positive trajectory of its earnings revisions. Analysts are in unanimous agreement in upgrading FY23 and FY24 earnings estimates.

Image Source: Zacks Investment Research

NOW has been delivering strong financial results for many years. After running at a net loss for several years after IPO, it flipped net profitable in 2018, and has grown earnings from $0.17 to $2.42 per share since then. Additionally, ServiceNow is putting up 20% annual sales growth, showcasing its ability to expand its customer base and gain market share in a competitive landscape.

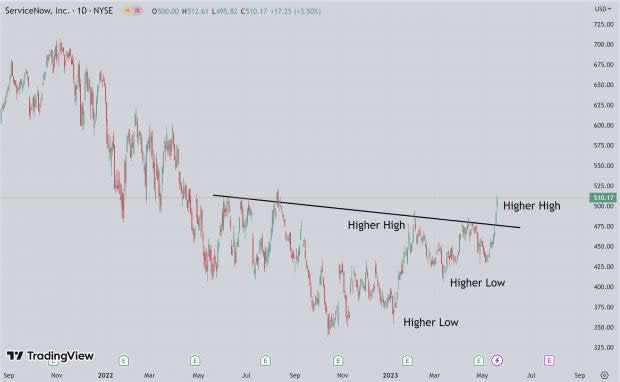

Technical Setup

From a technical perspective, ServiceNow exhibits a very bullish chart pattern. The stock price has shown strong momentum, and just broke out above a level of resistance. Additionally, NOW has been stair-stepping higher since the beginning of the year building higher lows and higher highs, indicating increasing demand for NOW shares. It is clear that selloffs are met with robust buying.

Image Source: TradingView

Share Buyback Program

ServiceNow recently announced its first share buyback program, which demonstrates management's confidence in the company's long-term prospects. Share repurchases can boost shareholder value by reducing the number of outstanding shares, potentially increasing earnings per share and signaling a commitment to returning capital to investors.

AI Initiatives

ServiceNow is at the forefront of innovation, leveraging artificial intelligence to enhance its platform and drive productivity for IT professionals worldwide. The company unveiled a new generative AI controller that connects AI tools with its platform, enabling more efficient workflows and intelligent automation.

ServiceNow announced a partnership with Nvidia to develop a specialized generative AI solution, which further solidifies its commitment to leveraging cutting-edge technology to deliver transformative solutions.

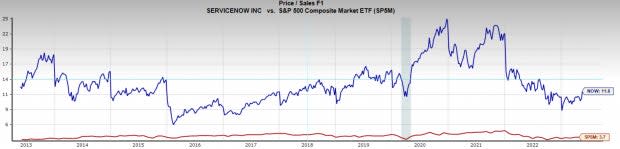

Valuation

ServiceNow commands a premium valuation at 11.8x forward sales, reflecting the market's recognition of its growth prospects and strong fundamentals. While above the market average of 3.7x, the valuation remains slightly below its 10-year median of 12.5x. This suggests that the market is pricing in the company's potential for continued growth and profitability, making ServiceNow an attractive investment opportunity.

Image Source: Zacks Investment Research

Conclusion:

ServiceNow is being driven higher by its upward trending earnings revisions, high annual sales growth, and strong technical performance. The company's strategic initiatives, including the introduction of a share buyback program and its innovative AI advancements, underscore its commitment to technological advancement and shareholders’ interests.

Although trading at a premium valuation, ServiceNow's growth potential and solid fundamentals make it an appealing investment in the near and long term.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

ServiceNow, Inc. (NOW) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance