I Built A List Of Growing Companies And First Financial Bankshares (NASDAQ:FFIN) Made The Cut

Like a puppy chasing its tail, some new investors often chase 'the next big thing', even if that means buying 'story stocks' without revenue, let alone profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.'

So if you're like me, you might be more interested in profitable, growing companies, like First Financial Bankshares (NASDAQ:FFIN). Even if the shares are fully valued today, most capitalists would recognize its profits as the demonstration of steady value generation. Loss-making companies are always racing against time to reach financial sustainability, but time is often a friend of the profitable company, especially if it is growing.

View our latest analysis for First Financial Bankshares

First Financial Bankshares's Earnings Per Share Are Growing.

The market is a voting machine in the short term, but a weighing machine in the long term, so share price follows earnings per share (EPS) eventually. It's no surprise, then, that I like to invest in companies with EPS growth. We can see that in the last three years First Financial Bankshares grew its EPS by 14% per year. That's a good rate of growth, if it can be sustained.

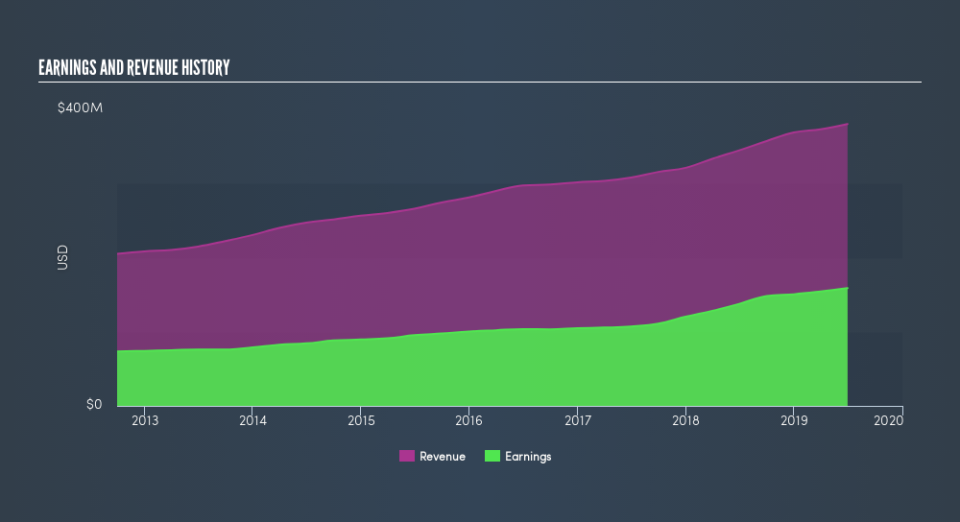

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. Not all of First Financial Bankshares's revenue this year is revenue from operations, so keep in mind the revenue and margin numbers I've used might not be the best representation of the underlying business. While we note First Financial Bankshares's EBIT margins were flat over the last year, revenue grew by a solid 10% to US$380m. That's progress.

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

The trick, as an investor, is to find companies that are going to perform well in the future, not just in the past. To that end, right now and today, you can check our visualization of consensus analyst forecasts for future First Financial Bankshares EPS 100% free.

Are First Financial Bankshares Insiders Aligned With All Shareholders?

Like that fresh smell in the air when the rains are coming, insider buying fills me with optimistic anticipation. Because oftentimes, the purchase of stock is a sign that the buyer views it as undervalued. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

Although we did see some insider selling (worth -US$308.4k) this was overshadowed by a mountain of buying, totalling US$1.3m in just one year. I find this encouraging because it suggests they are optimistic about the First Financial Bankshares's future. We also note that it was the Director, Johnny Trotter, who made the biggest single acquisition, paying US$428k for shares at about US$30.65 each.

On top of the insider buying, it's good to see that First Financial Bankshares insiders have a valuable investment in the business. Notably, they have an enormous stake in the company, worth US$213m. This suggests to me that leadership will be very mindful of shareholders' interests when making decisions!

While insiders already own a significant amount of shares, and they have been buying more, the good news for ordinary shareholders does not stop there. The cherry on top is that the CEO, F. Dueser is paid comparatively modestly to CEOs at similar sized companies. I discovered that the median total compensation for the CEOs of companies like First Financial Bankshares with market caps between US$2.0b and US$6.4b is about US$5.1m.

The CEO of First Financial Bankshares only received US$1.5m in total compensation for the year ending December 2018. That looks like modest pay to me, and may hint at a certain respect for the interests of shareholders. While the level of CEO compensation isn't a huge factor in my view of the company, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. It can also be a sign of good governance, more generally.

Is First Financial Bankshares Worth Keeping An Eye On?

One positive for First Financial Bankshares is that it is growing EPS. That's nice to see. Better yet, insiders are significant shareholders, and have been buying more shares. That makes the company a prime candidate for my watchlist - and arguably a research priority. Now, you could try to make up your mind on First Financial Bankshares by focusing on just these factors, or you could also consider how its price-to-earnings ratio compares to other companies in its industry.

The good news is that First Financial Bankshares is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance