British Pound Remains a Sell until this Changes

DailyFX.com -

Why and how do we use the SSI in trading? View our video and download the free indicator here

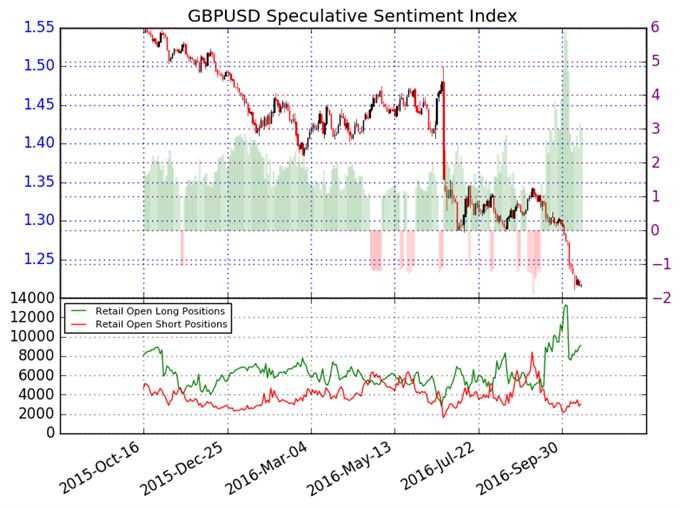

GBPUSD – Retail FX traders remain heavily long the British Pound versus the US Dollar, and until that changes we see little reason to call for meaningful GBP/USD strength. Indeed, the majority of traders last turned long the GBP as it traded below $1.3250 through mid-September; the currency has since shed a remarkable 1000+ points versus the US Dollar.

Past performance is not indicative of future results, but our data has historically shown Retail FX traders do poorly in strong currency trends. In that sense we can view our proprietary data as a bellwether for the GBP/USD price trend. As long as ‘the crowd’ remains long and continues buying, our bias will remain firmly in favor of GBP weakness.

See next currency section: XAUUSD - Gold Prices Near a Potentially Significant Turning Point

--- Written by David Rodriguez, Senior Strategist for DailyFX.com

To receive the Speculative Sentiment Index and other reports from this author via e-mail, sign up for his distribution list via this link.

Contact David via Twitter at http://www.twitter.com/DRodriguezFX

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.

Yahoo Finance

Yahoo Finance