Brighthouse Financial Inc CEO Eric Steigerwalt Sells 25,000 Shares

Eric Steigerwalt, President and Chief Executive Officer of Brighthouse Financial Inc (NASDAQ:BHF), sold 25,000 shares of the company on February 26, 2024, according to a recent SEC filing. The transaction was executed at an average price of $46.96 per share, resulting in a total value of $1,174,000.

Brighthouse Financial Inc is a provider of life insurance and annuity products in the United States. The company offers a range of products designed to help clients protect their financial future and provide retirement income. Brighthouse Financial Inc operates through three segments: Annuities, Life, and Run-off. The company's product portfolio includes variable, fixed, index-linked, and income annuities, as well as term and universal life insurance products.

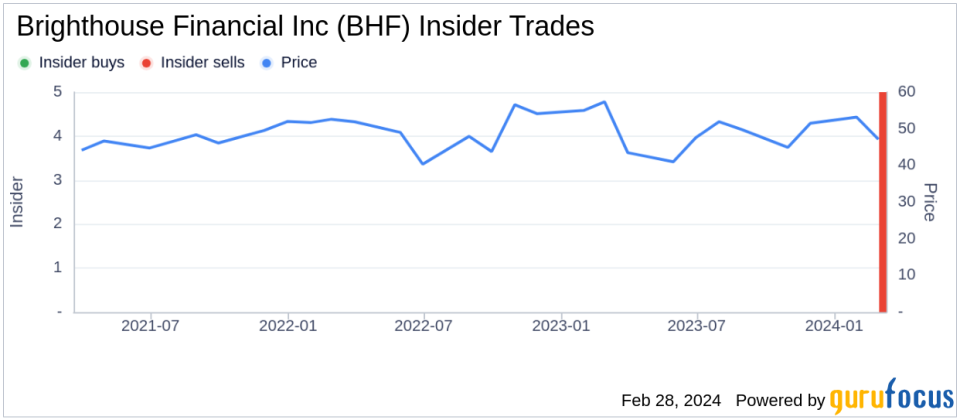

Over the past year, the insider has sold a cumulative total of 25,000 shares and has not made any purchases of the company's stock. The recent sale by Eric Steigerwalt follows a pattern observed over the past year, where there have been no insider buys and five insider sells for Brighthouse Financial Inc.

On the date of the insider's recent transaction, shares of Brighthouse Financial Inc were trading at $46.96, giving the company a market capitalization of $2.963 billion.

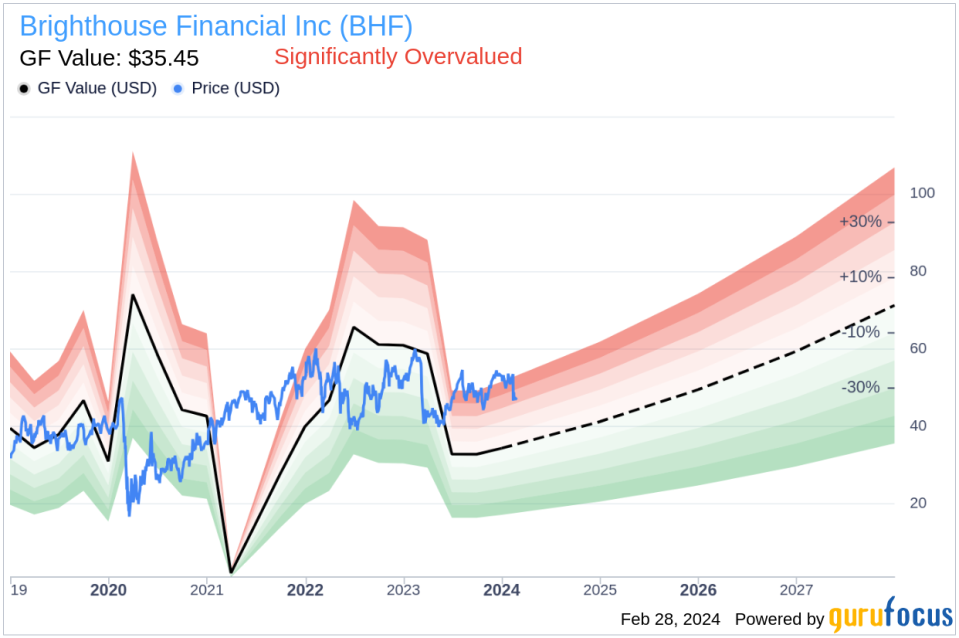

The stock's price relative to its GuruFocus Value indicates that Brighthouse Financial Inc is significantly overvalued. The price-to-GF-Value ratio stands at 1.32, with the GF Value estimated at $35.45 per share. The GF Value is a proprietary intrinsic value estimate from GuruFocus, which factors in historical trading multiples, a GuruFocus adjustment factor based on the company's past performance, and future business performance estimates from Morningstar analysts.

The insider trend image above reflects the recent selling activity by insiders of Brighthouse Financial Inc, with no insider purchases recorded over the past year.

The GF Value image provides a visual representation of the stock's current valuation in comparison to its intrinsic value, as estimated by GuruFocus.

For more detailed information on insider transactions and stock performance for Brighthouse Financial Inc (NASDAQ:BHF), investors and analysts are encouraged to visit the company's profile on GuruFocus.com.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance