Bright Horizons Family Solutions Inc. Reports Strong Q1 2024 Earnings, Surpassing Analyst ...

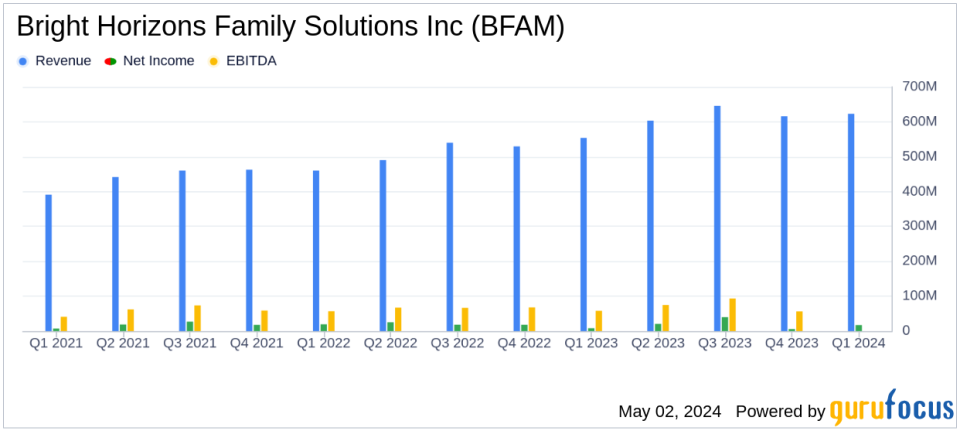

Revenue: Reported $623 million, marking a 12% increase year-over-year, exceeding estimates of $615.81 million.

Net Income: Achieved $17 million, up 109% from the previous year, below the estimated $26.17 million.

Earnings Per Share (EPS): Recorded at $0.29, a significant rise from $0.14 year-over-year, below the estimated $0.46.

Adjusted EBITDA: Increased by 7% to $75 million, reflecting solid operational performance.

Income from Operations: Grew by 30% to $40 million, driven by enrollment gains and tuition price increases.

Cash Flow: Generated $116.3 million from operations, a substantial improvement from $67.3 million in the same period last year.

2024 Outlook: Reaffirmed revenue expectations between $2.6 billion to $2.7 billion and adjusted EPS ranging from $3.00 to $3.20.

Bright Horizons Family Solutions Inc. (NYSE:BFAM) disclosed its financial performance for the first quarter of 2024 on May 2, 2024, revealing a notable increase in revenue and net income. The company announced these results in its 8-K filing, which also included a reaffirmation of its financial guidance for the full year.

Bright Horizons Family Solutions Inc, a leading provider of high-quality early education and child care, family care solutions, and workforce education services, reported a revenue of $623 million for Q1 2024, a 12% increase from the previous year. This growth was driven by enrollment gains and tuition price increases. The company's net income saw an impressive 109% increase to $17 million, with diluted earnings per share rising to $0.29, up from $0.14 in Q1 2023.

Financial Highlights and Operational Performance

The company's income from operations increased by 30% to $40 million, primarily due to higher gross profit contributions from both the full-service center-based child care and back-up care segments. Despite facing challenges such as decreased pandemic-related government support and increased overhead costs, Bright Horizons managed robust growth. Adjusted EBITDA rose by 7% to $75 million, and adjusted net income increased by 5% to $30 million, with diluted adjusted earnings per share reaching $0.51.

Strategic Developments and Future Outlook

Stephen Kramer, the CEO of Bright Horizons, expressed satisfaction with the company's performance, attributing it to strong execution across all business segments. The company remains optimistic about meeting its 2024 goals, projecting annual revenues between $2.6 billion and $2.7 billion, and adjusted earnings per share between $3.00 and $3.20.

Liquidity and Capital Resources

As of March 31, 2024, Bright Horizons reported $63.7 million in cash and cash equivalents, with an additional $389.8 million available under its revolving credit facility. The company's strong cash flow generation capabilities were evident as cash from operations increased to $116.3 million, up from $67.3 million in the prior year. This financial strength supports ongoing investments and strategic initiatives aimed at expanding its service offerings.

Comprehensive Financial Analysis

The detailed financial statements of Bright Horizons reveal a solid balance sheet with total assets of $3.79 billion. The company's commitment to growth and operational efficiency is evident from its strategic investments in fixed assets and acquisitions, such as the 2022 acquisition of Only About Children, a leading child care operator in Australia.

In conclusion, Bright Horizons Family Solutions Inc. has started 2024 on a strong note, with financial figures significantly surpassing analyst expectations. The company's strategic initiatives and robust operational performance not only enhance its market position but also offer promising prospects for its stakeholders. Investors and analysts are encouraged to follow the upcoming earnings call for more detailed insights and strategic directions from the company's leadership.

For more detailed information and to access the earnings call, please visit the Investor Relations section of Bright Horizons' website at www.brighthorizons.com.

Explore the complete 8-K earnings release (here) from Bright Horizons Family Solutions Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance