Boyd Gaming (BYD) Q2 Earnings Miss, Revenues Beat Estimates

Boyd Gaming Corporation BYD reported mixed second-quarter 2019 results, wherein earnings missed the Zacks Consensus Estimate but revenues surpassed the same. Notably, the company’s earnings have either missed or met the consensus estimate in the trailing four quarters.

Adjusted earnings in the quarter under review came in at 46 cents per share, which lagged the Zacks Consensus Estimate by a couple of cents. The bottom line, however, increased 21.1% year over year on higher margins.

Revenues totaled $846.1 million, which exceeded the consensus estimate of $840 million. The top line also improved 37.2% on a year-over-year basis. Revenue growth can primarily be attributed to year-over-year gain at the Downtown Las Vegas, and Midwest and South segments.

Notably, the company’s second-quarter results also include revenues worth $228.5 million realized from the acquisitions of Ameristar Kansas City, Ameristar St. Charles, Belterra Resort and Belterra Park, Valley Forge Casino Resort and Lattner Entertainment.

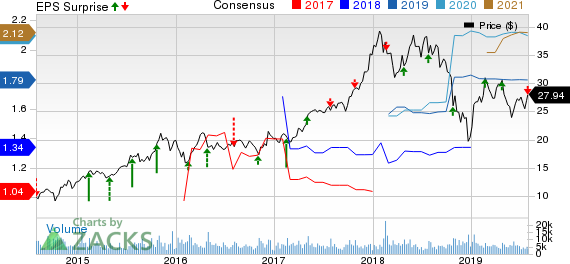

Boyd Gaming Corporation Price, Consensus and EPS Surprise

Boyd Gaming Corporation price-consensus-eps-surprise-chart | Boyd Gaming Corporation Quote

Segmental Details

Las Vegas Locals

Revenues at this segment amounted to $220.9 million, up 0.4% year over year. Moreover, the segment’s EBITDAR increased to $71.4 million from $70.2 million in the year-ago quarter. This segment recorded the highest second-quarter adjusted EBITDAR in the 14 years.

Downtown Las Vegas

At this segment, revenues rose 5.4% to $64.5 million. Adjusted EBITDAR increased to $15.9 million from $13.5 million in the prior-year quarter driven by growth at all three downtown properties. The segment also benefited from the company’s solid Hawaiian customer base.

The Midwest and South Segment

Revenues at this segment improved 67.1% to $560.7 million. Adjusted EBITDAR was $165.1 million, up from $98.5 million in the year-ago period. Additionally, the segment reported a fifth straight quarter of same-store adjusted EBITDAR growth in the quarter under review.

Modifications to marketing programs and operational capabilities drove the segment’s revenues and EBITDAR. Further, the acquisition of Valley Forge Casino Resort and Lattner Entertainment contributed to the segment’s quarterly performance.

Other Financial Details

As of Jun 30, 2019, Boyd Gaming had cash on hand of $239.4 million. Total debt amounted to $3.95 billion.

For 2019, Boyd Gaming continues to expect total adjusted EBITDA of $885-$910 million.

Zacks Rank & Key Picks

Boyd Gaming carries a Zacks Rank #3 (Hold). Better-ranked stocks worth considering in the same space include International Game Technology PLC IGT, Melco Resorts & Entertainment Limited MLCO and PlayAGS, Inc. AGS, each carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

International Game Technology, Melco Resorts & Entertainment and PlayAGS have an impressive long-term earnings growth rate of 10%, 22.1% and 12%, respectively.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

International Game Technology (IGT) : Free Stock Analysis Report

Boyd Gaming Corporation (BYD) : Free Stock Analysis Report

PlayAGS, Inc. (AGS) : Free Stock Analysis Report

Melco Resorts & Entertainment Limited (MLCO) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance