Botanix Pharmaceuticals (ASX:BOT) Shareholders Have Enjoyed An Impressive 129% Share Price Gain

It might seem bad, but the worst that can happen when you buy a stock (without leverage) is that its share price goes to zero. But if you buy shares in a really great company, you can more than double your money. For instance the Botanix Pharmaceuticals Limited (ASX:BOT) share price is 129% higher than it was three years ago. How nice for those who held the stock! Better yet, the share price has gained 155% in the last quarter.

Check out our latest analysis for Botanix Pharmaceuticals

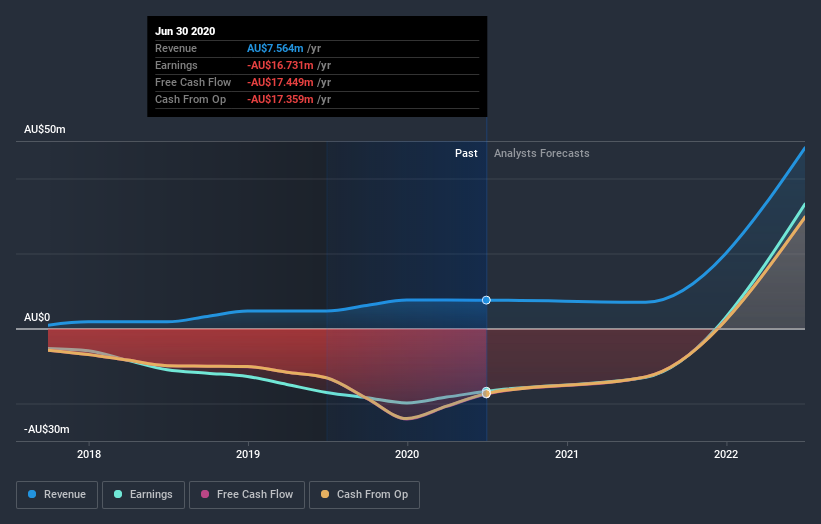

Botanix Pharmaceuticals isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

Over the last three years Botanix Pharmaceuticals has grown its revenue at 62% annually. That's much better than most loss-making companies. Along the way, the share price gained 32% per year, a solid pop by our standards. This suggests the market has recognized the progress the business has made, at least to a significant degree. That's not to say we think the share price is too high. In fact, it might be worth keeping an eye on this one.

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

This free interactive report on Botanix Pharmaceuticals' balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

It's nice to see that Botanix Pharmaceuticals shareholders have gained 50% (in total) over the last year. So this year's TSR was actually better than the three-year TSR (annualized) of 32%. These improved returns may hint at some real business momentum, implying that now could be a great time to delve deeper. It's always interesting to track share price performance over the longer term. But to understand Botanix Pharmaceuticals better, we need to consider many other factors. Consider for instance, the ever-present spectre of investment risk. We've identified 2 warning signs with Botanix Pharmaceuticals , and understanding them should be part of your investment process.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

Yahoo Finance

Yahoo Finance