Is Botanix Pharmaceuticals (ASX:BOT) In A Good Position To Invest In Growth?

We can readily understand why investors are attracted to unprofitable companies. Indeed, Botanix Pharmaceuticals (ASX:BOT) stock is up 146% in the last year, providing strong gains for shareholders. But the harsh reality is that very many loss making companies burn through all their cash and go bankrupt.

In light of its strong share price run, we think now is a good time to investigate how risky Botanix Pharmaceuticals' cash burn is. In this article, we define cash burn as its annual (negative) free cash flow, which is the amount of money a company spends each year to fund its growth. First, we'll determine its cash runway by comparing its cash burn with its cash reserves.

See our latest analysis for Botanix Pharmaceuticals

When Might Botanix Pharmaceuticals Run Out Of Money?

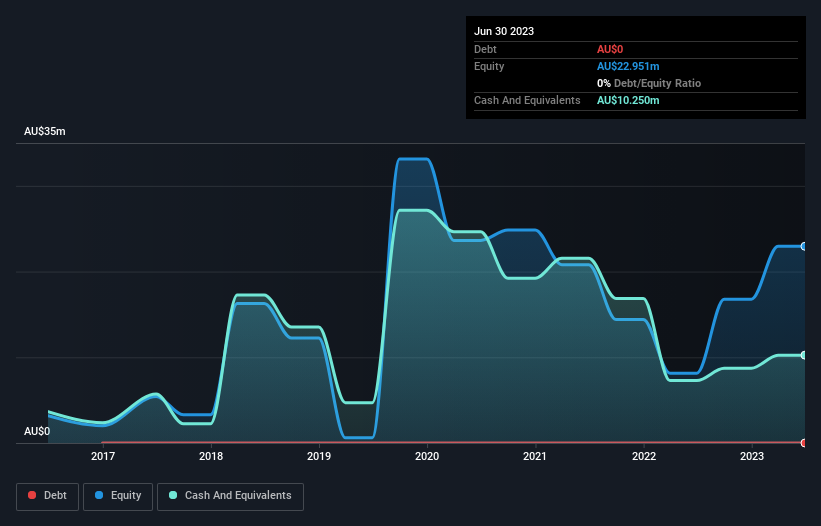

A company's cash runway is calculated by dividing its cash hoard by its cash burn. When Botanix Pharmaceuticals last reported its balance sheet in June 2023, it had zero debt and cash worth AU$10m. Looking at the last year, the company burnt through AU$19m. That means it had a cash runway of around 6 months as of June 2023. To be frank, this kind of short runway puts us on edge, as it indicates the company must reduce its cash burn significantly, or else raise cash imminently. Importantly, if we extrapolate recent cash burn trends, the cash runway would be noticeably longer. Depicted below, you can see how its cash holdings have changed over time.

How Well Is Botanix Pharmaceuticals Growing?

At first glance it's a bit worrying to see that Botanix Pharmaceuticals actually boosted its cash burn by 36%, year on year. The good news is that operating revenue increased by 37% in the last year, indicating that the business is gaining some traction. On balance, we'd say the company is improving over time. In reality, this article only makes a short study of the company's growth data. You can take a look at how Botanix Pharmaceuticals is growing revenue over time by checking this visualization of past revenue growth.

Can Botanix Pharmaceuticals Raise More Cash Easily?

Since Botanix Pharmaceuticals has been boosting its cash burn, the market will likely be considering how it can raise more cash if need be. Issuing new shares, or taking on debt, are the most common ways for a listed company to raise more money for its business. One of the main advantages held by publicly listed companies is that they can sell shares to investors to raise cash and fund growth. By comparing a company's annual cash burn to its total market capitalisation, we can estimate roughly how many shares it would have to issue in order to run the company for another year (at the same burn rate).

Botanix Pharmaceuticals has a market capitalisation of AU$230m and burnt through AU$19m last year, which is 8.3% of the company's market value. Given that is a rather small percentage, it would probably be really easy for the company to fund another year's growth by issuing some new shares to investors, or even by taking out a loan.

How Risky Is Botanix Pharmaceuticals' Cash Burn Situation?

Even though its cash runway makes us a little nervous, we are compelled to mention that we thought Botanix Pharmaceuticals' revenue growth was relatively promising. We don't think its cash burn is particularly problematic, but after considering the range of factors in this article, we do think shareholders should be monitoring how it changes over time. On another note, we conducted an in-depth investigation of the company, and identified 4 warning signs for Botanix Pharmaceuticals (1 is significant!) that you should be aware of before investing here.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies, and this list of stocks growth stocks (according to analyst forecasts)

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Yahoo Finance

Yahoo Finance