BOK Financial Corp (BOKF) Q1 Earnings: Misses Analyst Expectations on EPS, Aligns with Revenue ...

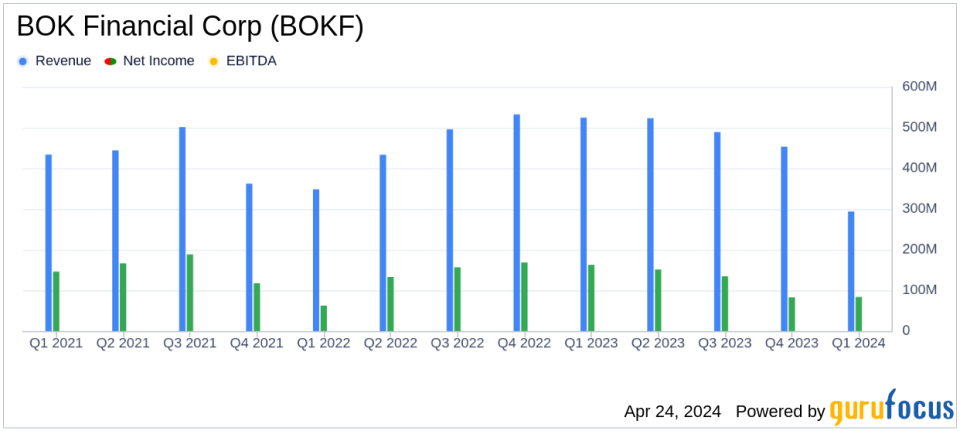

Net Income: Reported $83.7 million, or $1.29 per diluted share, falling short of the estimated $110.94 million and $1.73 per share.

Revenue: Fees and commissions revenue increased to $200.6 million, driven by higher mortgage banking and fiduciary and asset management revenue.

Operating Expense: Decreased by $43.7 million to $340.4 million, primarily due to reduced non-personnel expenses.

Loans: Period-end loans grew by $268 million to $24.2 billion, with significant growth in commercial loans.

Credit Quality: Improved with nonperforming assets decreasing to $122 million or 0.51% of outstanding loans and repossessed assets.

Deposits: Increased by $1.4 billion to $35.4 billion by period end, with a notable rise in interest-bearing transaction account balances.

Capital Ratios: Common equity Tier 1 capital ratio was 11.99%, and total capital ratio stood at 13.15%.

BOK Financial Corp (NASDAQ:BOKF) released its 8-K filing on April 24, 2024, reporting a quarterly net income of $84 million, or $1.29 per share, for the first quarter of 2024. This figure falls short of the analyst estimates which projected earnings of $1.73 per share. However, the company's reported revenue aligned with expectations, showcasing a robust financial framework despite economic challenges.

BOK Financial Corp, headquartered in Tulsa, Oklahoma, stands as the largest financial institution in the state. It offers a diverse range of financial products and services across its primary segments: commercial banking, consumer banking, and wealth management. The company is particularly noted for its commercial banking services, which include extensive lending, treasury, and cash management services, contributing significantly to its revenue.

Financial Performance and Strategic Decisions

The first quarter saw BOK Financial navigate through various challenges, including a slight decline in net interest revenue which totaled $293.6 million, down by $3.1 million from the previous quarter. The net interest margin also saw a minor contraction to 2.61%. Despite these hurdles, the company managed to increase its fees and commissions revenue to $200.6 million, bolstered by higher mortgage banking and fiduciary and asset management revenues.

Operational expenses were reduced significantly by $43.7 million to $340.4 million, primarily due to a decrease in non-personnel expenses and a strategic reduction in FDIC special assessment expenses recognized in the previous quarter. The loan portfolio expanded with period-end loans growing by $268 million to $24.2 billion, driven by a rise in commercial loans.

Capital and Credit Quality

BOK Financial maintained strong capital ratios with a tangible common equity ratio of 8.21% and a Tier 1 capital ratio of 12.00%. The company's credit quality also improved, with nonperforming assets decreasing to $122 million or 0.51% of outstanding loans and repossessed assets, down from 0.62% in the previous quarter.

The company's strategic decisions, including retaining VISA B shares and repositioning its securities portfolio, are anticipated to enhance future net interest margins and revenue. Notably, the CEO highlighted the robust asset quality and disciplined risk management as foundational to the company's stable performance.

Outlook and Projections

Looking ahead, BOK Financial is poised to potentially benefit from the upcoming gain in the second quarter from the monetization of its VISA B shares. This strategic move is expected to offset the realized losses from the repositioning of its securities portfolio. The company's focus on growing its commercial loan portfolio and maintaining strong credit metrics underlines its strategic approach to leveraging its robust capital and liquidity positions.

In conclusion, while BOK Financial's earnings per share for the first quarter did not meet analyst expectations, its alignment with projected revenues and strategic financial management provide a balanced outlook for the company's performance in the upcoming quarters.

Explore the complete 8-K earnings release (here) from BOK Financial Corp for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance