45% growth: Is it time to pay attention to Bitcoin again?

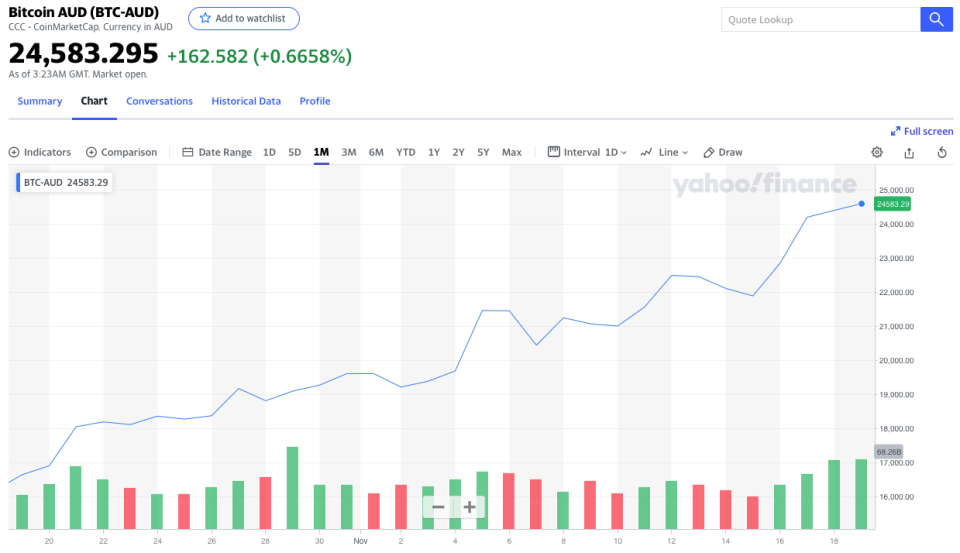

If you haven’t been paying attention, Bitcoin prices have shot up from $16,677 to $24,241.70 in the last month – that’s an increase of 45 per cent.

The prices are starting to creep up to levels we considered bubble territory back in 2017, when it hit a peak of US $19,783 on 17 December.

When the Covid-19 pandemic began to spread across the globe in earnest in March, Bitcoin prices fell off a cliff, but since then, Bitcoin has steadily rallied.

On Wednesday, the cryptocurrency hit $US18,147 at 10:15pm AEDT, Business Insider reported, representing its highest level in three years with a market capitalisation of US$336 billion.

Only in five other days in the coin’s history has the price been higher than US$17,000, according to Deutsche Bank analysts.

Also read: Bitcoin gains: Where to next?

Also read: PayPal now lets all US users buy, sell and hold cryptocurrency

Why is Bitcoin on the rise again?

According to cryptocurrency exchange BTC Markets CEO Caroline Bowler, the demand for Bitcoin has been driven by a few factors.

One of them is that the digital currency has cemented itself as a “deflationary asset class”, which means it’s a type of investment that investors run to for safety in times when the economy is going badly.

“Interest rates are at an extraordinary low, and investors – including retail investors – are looking for returns. Digital assets are showing that return, particularly as the offerings diversify,” said Bowler.

Three years ago, Bitcoin was still an obscure, niche investment – but since then, it’s had backing from major institutional investors, investment trusts, pension schemes and university endowments, said eToro cryptoasset analyst Simon Peters.

“[This] shows how far Bitcoin has come,” he said.

Data sets that analyse the health of the digital currency by looking at data from the blockchain, the technology that underpins cryptocurrency, are also reporting “strong signals that justify the recent price rises,” he added.

Other factors have also added to Bitcoin’s tailwinds: PayPal has announced it will allow trading of Bitcoin and other tokens through its platform, with this initiative to roll out globally in 2021, and well-known US investors like Real Vision Group and Global Macro Investor CEO Raoul Pal and former chairman and president of Duquesne Capital Stanley Druckenmiller have publicly talked about owning Bitcoin.

Former sceptic JP Morgan also published positive research about the cryptocurrency more than once this year, stating it had “longevity as an asset class”.

How high can Bitcoin prices go?

In late July, Bitcoin’s price surpassed US$10,000, a significant figure according to the crypto community, Peters said. Since then, it’s been climbing higher and higher.

“It has continued to rally and retail investors are eyeing up opportunities that Bitcoin has to offer.”

Experts are now expecting Bitcoin’s price to break past US$20,000. The last time this happened was December 2017, when it was pushed up by retail investors experiencing “crypto FOMO”. By early April 2018, the bubble had popped, and it was back around the US $7,000 mark.

However, investors are convinced that this time is different. Experts are receiving fewer inquiries about the currency than they used to.

Digital currency exchange Amber CEO Aleksandar Svetski told Yahoo Finance that Google searches for Bitcoin “barely register” compared to the 2017 mania, with the current high price tag a new baseline for the cryptocoin. “By the time retail [investors] wake up, Bitcoin will be well on its way to $100,000,” he said.

Osprey Funds CEO Greg King told Bloomberg that the excitement for the price rise was “a more grounded excitement”.

“The longer that Bitcoin persists and the more on-ramps that get built and the more that interest increases, I think it’s becoming more and more real in investor’s minds – everyone has progressed three years further down the adoption curve.”

According to Peters, the $20,000 mark is “clearly the next target” for Bitcoin – and it looks within reach.

“Should we surpass that this year, which I believe is possible, then we are into uncharted territory as sentiment remains positive,” he said.

“Will it be a Merry Christmas for Bitcoin holders, we’ll have to wait and see but the signs look promising.”

A previous version of this story incorrectly stated that the growth in Bitcoin price was 145 per cent. This has now been corrected.

Want to make next year your best yet? Join us for an Hour of Power at 10am AEDT Tuesday 24 November to discover 21 ways to make your money work for you in 2021.

Sign up here to our free newsletter and get the latest tips and news straight to your inbox. Follow Yahoo Finance Australia on Facebook, Twitter, Instagram and LinkedIn.

Yahoo Finance

Yahoo Finance