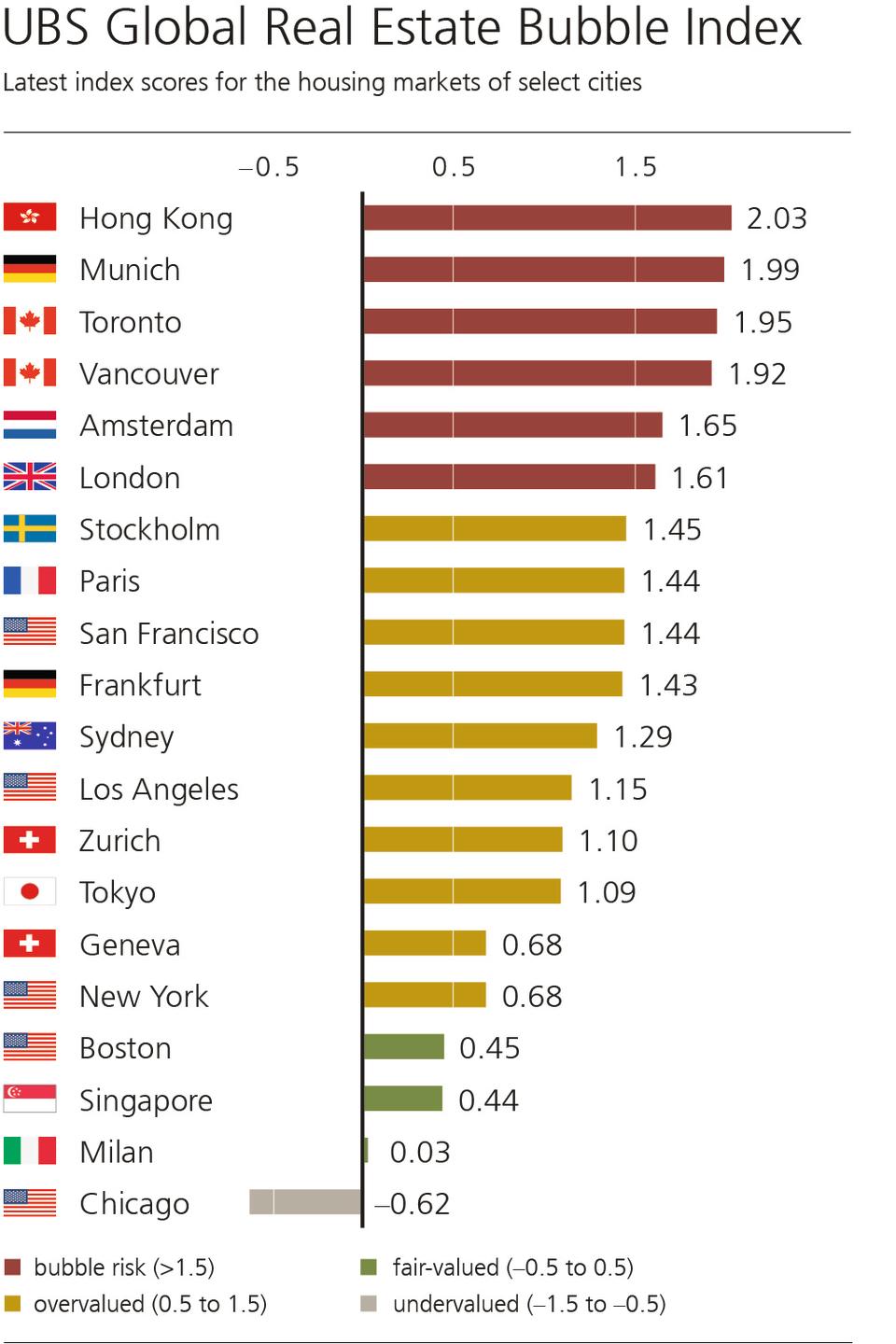

The biggest housing bubbles around the globe

Millennials in Australia are getting priced out of the housing market – and so are retirees from their own homes.

But in comparison to the rest of the world, Sydney – Australia’s most notoriously highly-priced housing market – things might not be so bad.

Also read: Warning: Houses in this city will fall $80,000 by 2021

These are the cities where the risk of a housing bubble are the greatest, courtesy of data from UBS:

“Bubble risk appears greatest in Hong Kong, Munich, Toronto, Vancouver, London and Amsterdam,” according to the UBS report.

“Major imbalances also characterise Stockholm, Paris, San Francisco, Frankfurt and Sydney.”

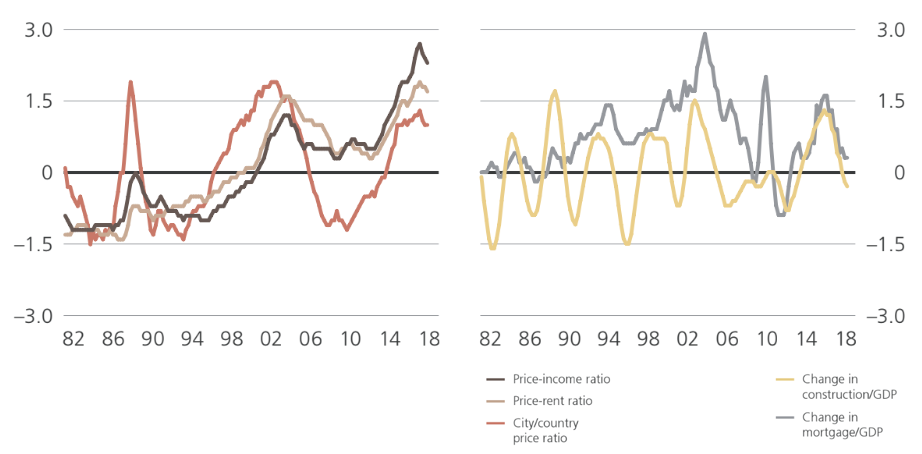

But cracks are beginning to show in the “foundation” of the house price boom, the report warned.

“House prices declined in half of last year’s bubble risk cities – in London, Stockholm and Sydney by more than 5 per cent in real terms.

Spotlight on Sydney

Sydney’s index score dropped “steeply” in the last year and “moved out of bubble risk territory”.

“Prices peaked last summer and have slid moderately since as tighter lending conditions diminished overall affordability.

Also read: Houses are getting cheaper in these regional areas

“To curb foreign demand, the land tax surcharge has also been more than doubled and a vacancy fee has recently been introduced. So the high end of the market has suffered most. The vacancy rate on the rental market has climbed amid higher supply.

“Overall, inflation-adjusted prices remain 50% higher than five years ago, while rents and incomes have grown only at a single-digit rate.”

Yahoo Finance

Yahoo Finance