Better Buy: Freeport-McMoRan Inc. vs. Hecla Mining Company

Freeport-McMoRan Inc. (NYSE: FCX) is one of the world's largest copper and gold miners. Hecla Mining Company (NYSE: HL) is a relatively small silver and gold miner with a North American focus. If you are looking at this pair of miners, however, you'll want to step back and examine some big-picture facts before making any moves -- and you might want to hold off on both names.

A troubled foreign mine

If you are trying to find a copper miner, then Freeport-McMoRan is clearly a better option than Hecla, which doesn't really provide exposure to copper. That said, you'll want to tread cautiously with Freeport today because of the ongoing control issue with Freeport's Grasberg mine in Indonesia.

Image source: Getty Images

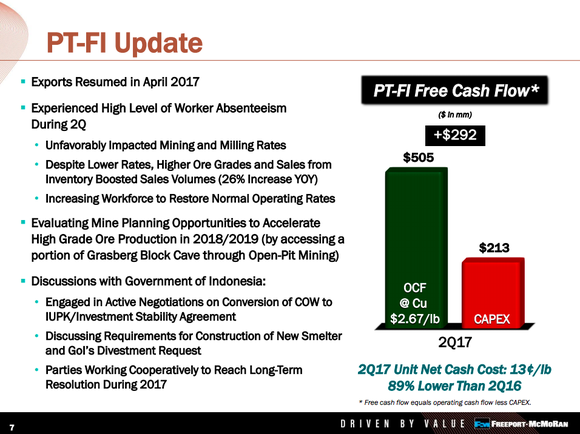

The Indonesian government has decided that it isn't benefiting enough from the giant mine, and is working with Freeport to change the mine's ownership structure, among other things. The two sides have come to a broad agreement that will leave Freeport with a 49% stake, but hammering out the fine details has proven to be difficult. This single mine holds nearly a third of Freeport's copper reserves and basically all of its gold reserves, so a mutually agreeable resolution is important.

There's likely to be a resolution at some point, but until something is hammered out Grasberg news will be a headwind for Freeport's stock. That said, it's a bit concerning that Rio Tinto plc (NYSE: RIO), which has a stake in the mine as well, is reported to be trying to bail out of Grasberg. That suggests that the mine's future prospects may not be as good as they have been historically.

Freeport is trying to keep things positive, but the legal wrangling with Indonesia is dragging on. Image source: Freeport-McMoRan Inc

Any negative news from here could send Freeport's shares sharply lower. The Grasberg situation makes Freeport most appropriate for aggressive investors today, despite the fact that copper prices have been heading generally higher all year.

A troubled domestic mine

Hecla's main commodities are silver, gold, zinc, and lead. If you are looking for a precious metals investment it's a better option than Freeport. All of Hecla's mines, meanwhile, are located in politically stable North America.

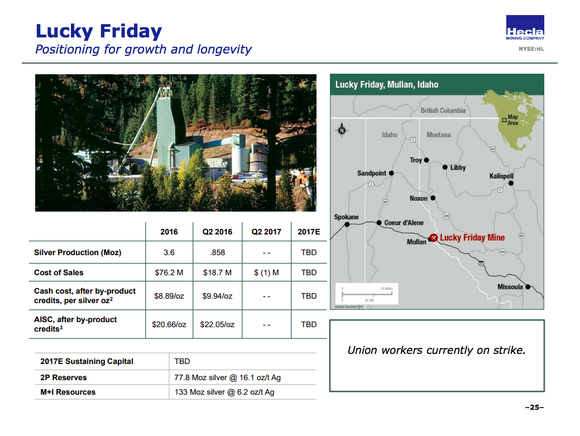

But that doesn't mean the miner is immune to problems. And right now it has a big one: a strike at its Lucky Friday mine in Idaho. This has been a lingering issue for more than a year at this point.

Lucky Friday is an important mine for the company, representing 45% of its 2016 silver production. The strike resulted in silver production falling 23% year over year in the third quarter and 28% through the first nine months of 2017. Gold production increased 21% year over year in the third quarter, helping to offset some of the impact; however through the first three quarters of the year, gold production was only up 1%. This is likely to be tough year for Hecla financially.

Lucky Friday, an important asset that's not working right now. Image source: Hecla Mining Company

Like Freeport, Hecla's trouble at a big mine is a notable headwind today. Although there's likely to be a resolution at some point, the headline risk probably isn't worth the price of admission for most investors right now.

I'd pass on both

Mining is a difficult business and problems pop up all the time. So it would be unfair to suggest that Freeport or Hecla is doing anything wrong per se. But that doesn't make the troubles each is facing at key mines go away. With plenty of other mining options available in the market, all but the most aggressive investors are better off looking elsewhere for metals exposure right now. These two miners look more like special situation plays at the moment.

More From The Motley Fool

NVIDIA Scores 2 Drone Wins -- Including the AI for an E-Commerce Giant's Delivery Drones

Why You're Smart to Buy Shopify Inc. (US) -- Despite Citron's Report

6 Years Later, 6 Charts That Show How Far Apple, Inc. Has Come Since Steve Jobs' Passing

Reuben Gregg Brewer has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

Yahoo Finance

Yahoo Finance