Best Income Stocks to Buy for January 19th

Here are three stocks with buy rank and strong income characteristics for investors to consider today, January 19th:

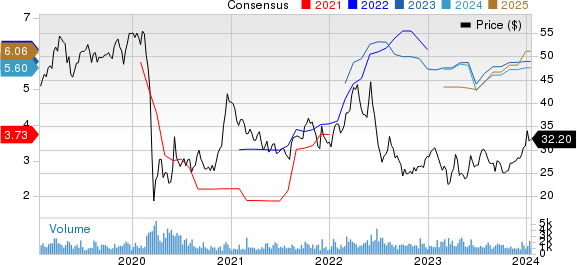

BanColombia CIB: This company which is the largest bank in terms of assets and also has the largest market participation in deposit products and loans, has witnessed the Zacks Consensus Estimate for its current year earnings increasing 0.5% over the last 60 days.

BanColombia S.A. Price and Consensus

BanColombia S.A. price-consensus-chart | BanColombia S.A. Quote

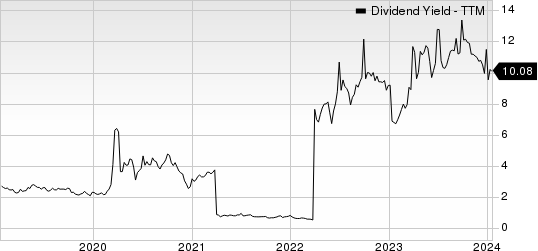

This Zacks Rank #1 (Strong Buy) company has a dividend yield of 10.4%, compared with the industry average of 4.0%.

BanColombia S.A. Dividend Yield (TTM)

BanColombia S.A. dividend-yield-ttm | BanColombia S.A. Quote

Komatsu KMTUY: This company which, is a major manufacturer of construction, mining and utility equipment and industrial machinery with operations all over the world, has witnessed the Zacks Consensus Estimate for its current year earnings increasing nearly 4.0% over the last 60 days.

Komatsu Ltd. Price and Consensus

Komatsu Ltd. price-consensus-chart | Komatsu Ltd. Quote

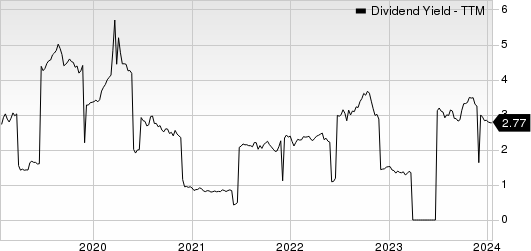

This Zacks Rank #1 company has a dividend yield of 2.8%, compared with the industry average of 1.7%.

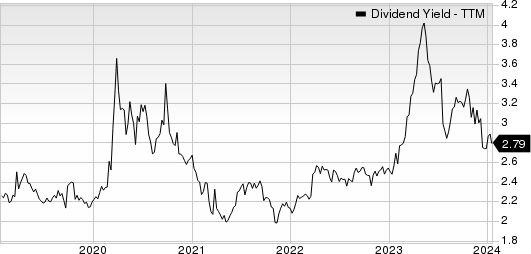

Komatsu Ltd. Dividend Yield (TTM)

Komatsu Ltd. dividend-yield-ttm | Komatsu Ltd. Quote

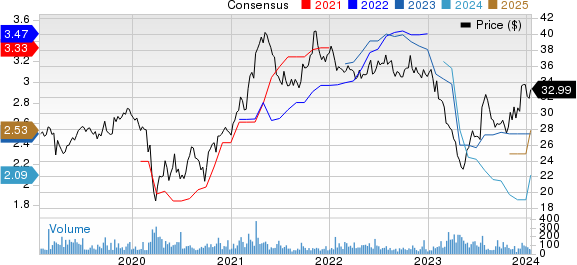

Guaranty Bancshares GNTY: This bank holding company located in the Texas communities which is focused on servicing and investing in the communities that comprise its market, has witnessed the Zacks Consensus Estimate for its current year earnings increasing nearly 0.5% over the last 60 days.

Guaranty Bancshares Inc. Price and Consensus

Guaranty Bancshares Inc. price-consensus-chart | Guaranty Bancshares Inc. Quote

This Zacks Rank #1 company has a dividend yield of 2.8%, compared with the industry average of 0.8%.

Guaranty Bancshares Inc. Dividend Yield (TTM)

Guaranty Bancshares Inc. dividend-yield-ttm | Guaranty Bancshares Inc. Quote

See the full list of top ranked stocks here.

Find more top income stocks with some of our great premium screens

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Komatsu Ltd. (KMTUY) : Free Stock Analysis Report

BanColombia S.A. (CIB) : Free Stock Analysis Report

Guaranty Bancshares Inc. (GNTY) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance