Best Income Stocks to Buy for December 6th

Here are four stocks with buy rank and strong income characteristics for investors to consider today, December 6th:

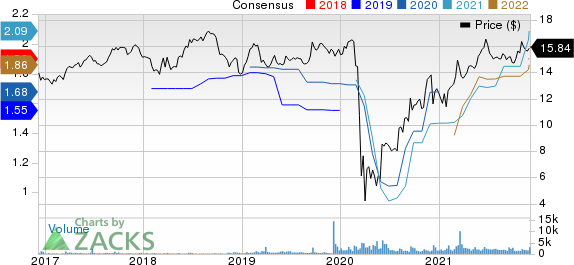

Ready Capital Corporation RC: This real estate finance company has witnessed the Zacks Consensus Estimate for its current year earnings increasing nearly 13% over the last 60 days.

Ready Capital Corp Price and Consensus

Ready Capital Corp price-consensus-chart | Ready Capital Corp Quote

This Zacks Rank #1 (Strong Buy) company has a dividend yield of 10.61%, compared with the industry average of 7.72%. Its five-year average dividend yield is 10.76%.

Ready Capital Corp Dividend Yield (TTM)

Ready Capital Corp dividend-yield-ttm | Ready Capital Corp Quote

GlaxoSmithKline plc GSK: This company that engages in the creation, discovery, development, manufacture, and marketing of pharmaceutical products, vaccines, over-the-counter medicines, and health-related consumer products has witnessed the Zacks Consensus Estimate for its current year earnings increasing 9.3% over the last 60 days.

GlaxoSmithKline plc Price and Consensus

GlaxoSmithKline plc price-consensus-chart | GlaxoSmithKline plc Quote

This Zacks Rank #1 company has a dividend yield of 5.00%, compared with the industry average of 2.62%. Its five-year average dividend yield is 5.22%.

GlaxoSmithKline plc Dividend Yield (TTM)

GlaxoSmithKline plc dividend-yield-ttm | GlaxoSmithKline plc Quote

The Bank of Nova Scotia BNS: This company that provides various banking products and services has witnessed the Zacks Consensus Estimate for its current year earnings increasing 7.1% over the last 60 days.

The Bank of Nova Scotia Price and Consensus

The Bank of Nova Scotia price-consensus-chart | The Bank of Nova Scotia Quote

This Zacks Rank #1 company has a dividend yield of 4.33%, compared with the industry average of 2.85%. Its five-year average dividend yield is 4.70%.

The Bank of Nova Scotia Dividend Yield (TTM)

The Bank of Nova Scotia dividend-yield-ttm | The Bank of Nova Scotia Quote

Simon Property Group, Inc. SPG: This real estate investment trust has witnessed the Zacks Consensus Estimate for its current year earnings increasing 6.5% over the last 60 days.

Simon Property Group, Inc. Price and Consensus

Simon Property Group, Inc. price-consensus-chart | Simon Property Group, Inc. Quote

This Zacks Rank #1 company has a dividend yield of 4.02%, compared with the industry average of 3.42%. Its five-year average dividend yield is 5.54%.

Simon Property Group, Inc. Dividend Yield (TTM)

Simon Property Group, Inc. dividend-yield-ttm | Simon Property Group, Inc. Quote

See the full list of top ranked stocks here.

Find more top income stocks with some of our great premium screens.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

GlaxoSmithKline plc (GSK) : Free Stock Analysis Report

Simon Property Group, Inc. (SPG) : Free Stock Analysis Report

Bank of Nova Scotia The (BNS) : Free Stock Analysis Report

Ready Capital Corp (RC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance