Best Dividend Stock Picks

Jarvis Securities is one of companies on my list of top dividend stocks. Dividend stocks are a safe bet to increase your portfolio value as they provide both steady income and cushion against market risks. Dividends play an important role in compounding returns in the long run and end up forming a sizeable part of investment returns. Today I will share with you my best paying dividend shares you should be considering for your portfolio.

Jarvis Securities plc (AIM:JIM)

Jarvis Securities plc, through its subsidiary, Jarvis Investment Management Limited, provides a range of stock broking services to retail and institutional clients in the United Kingdom. Founded in 2004, and headed by CEO Andrew Grant, the company employs 50 people and with the company’s market capitalisation at GBP £55.41M, we can put it in the small-cap stocks category.

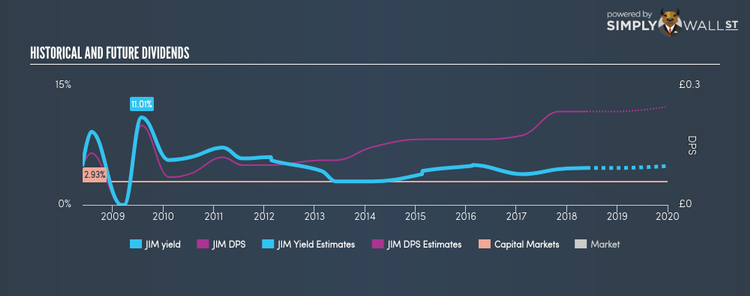

JIM has a large dividend yield of 4.64% and is currently distributing 72.53% of profits to shareholders . While the yield has dropped at times in the last 10 years, dividends per share during this time have increased overall from UK£0.10 to UK£0.23. The company has also had a strong past 12 months, reporting a double digit EPS growth of 22.48%. More detail on Jarvis Securities here.

Dunelm Group plc (LSE:DNLM)

Dunelm Group plc engages in the retail of homewares in the United Kingdom. Founded in 1979, and now run by Nick Wilkinson, the company currently employs 10,000 people and has a market cap of GBP £1.24B, putting it in the small-cap group.

DNLM has a large dividend yield of 4.09% and the company has a payout ratio of 72.32% . DNLM’s dividends have increased in the last 10 years, with DPS increasing from UK£0.04 to UK£0.25. It should comfort existing and potential future shareholders to know that DNLM hasn’t missed a payment during this time. Dunelm Group is a strong prospect for its future growth, with analysts expecting the company’s earnings to increase by 50.40% over the next three years. Interested in Dunelm Group? Find out more here.

Essentra plc (LSE:ESNT)

Essentra plc manufactures and sells specialist plastic, fiber, foam, and packaging products worldwide. Formed in 2005, and currently headed by CEO Paul Forman, the company employs 9,502 people and has a market cap of GBP £1.25B, putting it in the small-cap category.

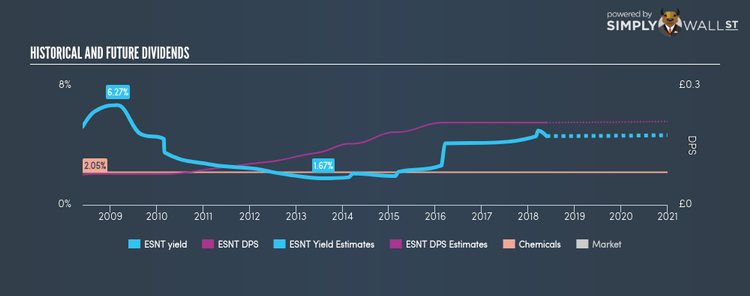

ESNT has a sumptuous dividend yield of 4.32% with a large payout ratio. . Over the past 10 years, ESNT has increased its dividends from UK£0.076 to UK£0.21. Much to the delight of shareholders, the company has not missed a payment during this time. Analyst estimates for Essentra’s future earnings are certainly promising, predicting a triple digit earnings growth over the next three years. Dig deeper into Essentra here.

For more solid dividend paying companies to add to your portfolio, explore this interactive list of top dividend payers.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.

Yahoo Finance

Yahoo Finance