Best Cheap Stocks To Buy

Companies that are recently trading at a market price lower than their real values include New Hope and Dark Horse Resources. Investors can benefit from buying these companies while they are discounted, because they gain when the market prices move towards the stocks’ true values. Below is a list of stocks I’ve compiled that are deemed undervalued based on the latest financial data.

New Hope Corporation Limited (ASX:NHC)

New Hope Corporation Limited explores, develops, produces, and processes coal, and oil and gas in Japan, Taiwan, China, Chile, Korea, and Australia. Formed in 1952, and now led by CEO Shane Stephan, the company employs 566 people and has a market cap of AUD A$2.33B, putting it in the mid-cap group.

NHC’s stock is now hovering at around -41% under its actual level of $4.71, at a price of AU$2.80, according to my discounted cash flow model. The divergence signals an opportunity to buy NHC shares at a low price. Also, NHC’s PE ratio stands at 12.37x relative to its index peer level of, 16.96x implying that relative to other stocks in the industry, we can invest in NHC at a lower price. NHC is also in good financial health, as near-term assets sufficiently cover liabilities in the near future as well as in the long run. NHC also has a miniscule amount of debt on its balance sheet, which gives it headroom to grow and financial flexibility. Dig deeper into New Hope here.

Dark Horse Resources Limited (ASX:DHR)

Dark Horse Resources Limited engages in the exploration and development of mineral resource projects primarily in Argentina. Dark Horse Resources was formed in 1995 and with the company’s market capitalisation at AUD A$35.68M, we can put it in the small-cap stocks category.

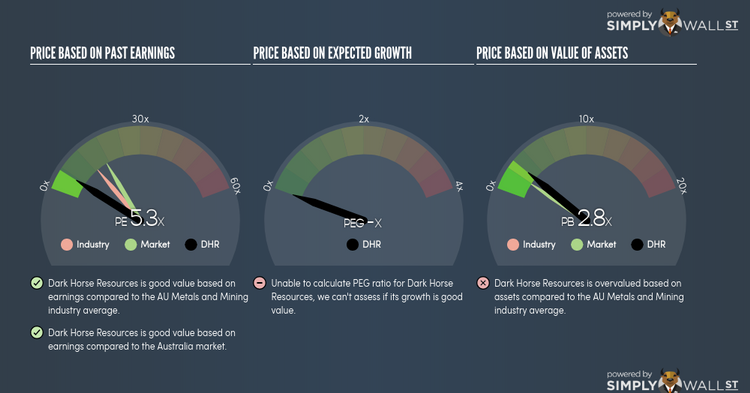

DHR’s stock is now floating at around -41% under its true value of $0.03, at the market price of AU$0.019, according to my discounted cash flow model. This mismatch indicates a chance to invest in DHR at a discounted price. In terms of relative valuation, DHR’s PE ratio is around 5.26x while its Metals and Mining peer level trades at, 13.04x implying that relative to its comparable set of companies, we can invest in DHR at a lower price. DHR is also strong financially, as short-term assets amply cover upcoming and long-term liabilities.

Continue research on Dark Horse Resources here.

Fortescue Metals Group Limited (ASX:FMG)

Fortescue Metals Group Limited engages in the exploration, development, production, processing, and sale of iron ore in Australia, China, and internationally. Started in 2003, and headed by CEO Elizabeth Gaines, the company now has 3,890 employees and has a market cap of AUD A$14.10B, putting it in the large-cap category.

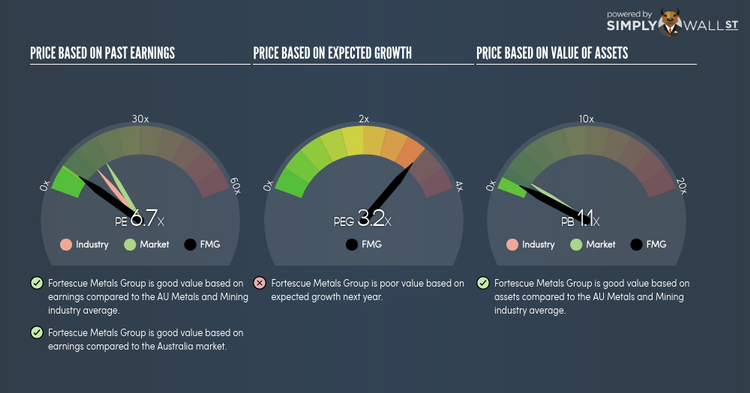

FMG’s shares are currently floating at around -37% under its true level of $7.26, at a price tag of AU$4.56, according to my discounted cash flow model. This discrepancy signals a potential opportunity to buy FMG shares at a low price. Also, FMG’s PE ratio is trading at 6.74x relative to its Metals and Mining peer level of, 13.04x indicating that relative to its comparable set of companies, you can buy FMG’s shares at a cheaper price. FMG is also a financially robust company, as current assets can cover liabilities in the near term and over the long run. Finally, its debt relative to equity is 42.67%, which has been falling for the past few years indicating FMG’s capacity to pay down its debt. Continue research on Fortescue Metals Group here.

For more financially sound, undervalued companies to add to your portfolio, explore this interactive list of undervalued stocks.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.

Yahoo Finance

Yahoo Finance