Best Buy Co., Inc. (NYSE:BBY) is a Value Investors' Dividend Opportunity

This article first appeared on Simply Wall St News.

The company is anticipating more short-term decline due to lower discretionary spending

Management is poised to keep the brand strengthening

Dividend is safe

Despite positive earnings results, Best Buy Co., Inc. (NYSE: BBY) seems to struggle to reverse the negative trend, as it looks to underperform the broad market.

While trading in a single-digit price-to-earnings zone, it looks like a better value compared to its peers – especially given its noteworthy dividend of almost 5%.

BBY Second quarter 2023 results

Non-GAAP EPS: US$1.54 (beat by US$0.25)

Revenue: US$10.3b (beat by US$80m)

Net income: US$306.0m (down 58% from 2Q 2022).

Profit margin: 3.0% (down from 6.2% in 2Q 2022). The decrease in margin was driven by lower revenue.

Revenue was in line with analyst estimates. Earnings per share (EPS) surpassed analyst estimates by 7.3%.

Over the next year, revenue is expected to shrink by 6.0% compared to a 5.4% growth forecast for the Specialty Retail industry in the US. Over the last 3 years on average, earnings per share have increased by 20% per year, but the company’s share price has only increased by 3% per year, which means it is significantly lagging behind earnings growth.

CFO Matt Bilunas is guiding for a slightly higher comparable sales decline than the 12.1% reported for Q2. Meanwhile, CEO Carie Barry praised Totaltech – a unique membership program aimed at brand strengthening and customer retention.

From our standpoint, it seems that the company is investing in the long-term customer retention strategy as a response to the tightening monetary policy that is impacting discretionary spending – as seen by lower revenues. However, strengthening the brand can last much longer than a change in monetary policy, which is cyclical.

Looking Into BBY's Dividend

A high yield and a long history of paying dividends is an appealing combination for Best Buy. It would not be surprising to discover that many investors buy it for dividends. The company also bought back stock equivalent to around 16% of market capitalization this year. When buying stocks for their dividends, you should always run through the checks below to see if the dividend looks sustainable.

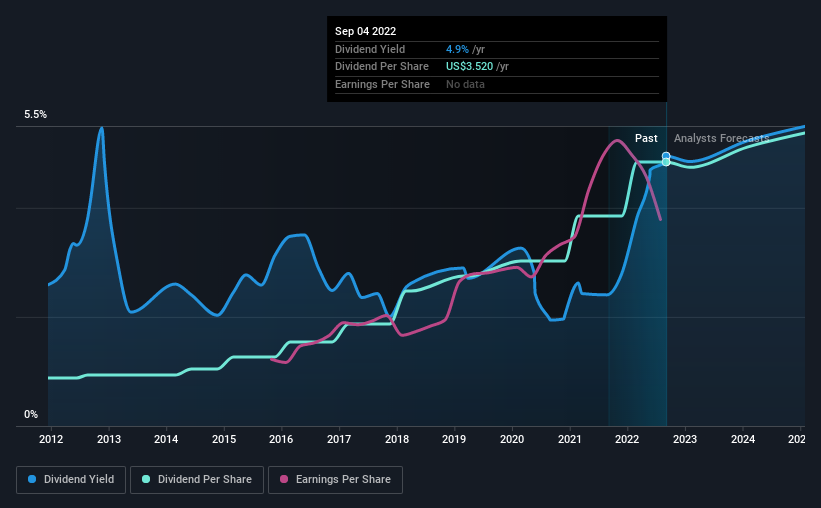

Click the interactive chart for our full dividend analysis

Payout Ratio - Slightly High By the Free Cash Flow

Best Buy paid out 44% of its profit as dividends over the trailing 12-month period. This is a medium payout level that leaves enough capital in the business to fund opportunities that might arise, while also rewarding shareholders. Besides, if reinvestment opportunities dry up, the company has room to increase the dividend.

Another important check we do is to see if the free cash flow generated is sufficient to pay the dividend. The company paid out 89% of its free cash flow as dividends last year, which is adequate but reduces the wriggle room in the event of a downturn. This is surprising to see given that BBY has a rather high return on capital. However, it is possible that the company decided that raising the dividend is the best option in the current monetary environment.

It's positive to see that Best Buy's dividend is covered by both profits and cash flow, since this is generally a sign that the dividend is sustainable, and a lower payout ratio usually suggests a greater margin of safety before the dividend gets cut. We update our data on Best Buy every 24 hours, so you can always get our latest analysis of its financial health, here.

Dividend Volatility and Growth Potential

The dividend has been stable over the past 10 years, which is great. During that period, the first annual payment was US$0.6 in 2012, compared to US$3.5 last year. This works out to be a compound annual growth rate (CAGR) of approximately 19% a year over that time. With rapid dividend growth and no notable cuts to the dividend over a lengthy period of time, this is a solid perspective for a dividend stock.

While dividend payments have been relatively reliable, it would also be nice if earnings per share (EPS) were growing, as this is essential to maintaining the dividend's purchasing power over the long term. It's good to see Best Buy has been growing its earnings per share by 15% a year over the past five years.

Conclusion

Best Buy is experiencing some sales decline as a response to the aggressive monetary policy that is obviously pressing brakes on discretionary spending. In turn, the company is investing in strengthening its brand and working on consumer retention - but also shareholder retention, given the stability and growth of its dividend.

From that side, it is good to see that the dividend payments have been stable, and consistent and that its growth potential is still present. For that measure, Best Buy is a solid dividend prospect.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. Just as an example, we've come across 3 warning signs for Best Buy you should pay attention to if considering this dividend stock.

Looking for more high-yielding dividend ideas? Try our curated list of dividend stocks with a yield above 3%.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Stjepan Kalinic and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here

Yahoo Finance

Yahoo Finance