Best Buy (BBY) Rides on Membership Program, Health Services

Best Buy Company Inc. BBY has effectively navigated a challenging consumer electronics market through strong operational efficiency and strategic initiatives. Its focus on managing costs, adapting to supply-chain disruptions and enhancing customer experience has enabled it to exceed profitability targets and demonstrate resilience.

With initiatives like its membership program and expansion into health services, Best Buy has successfully diversified its revenue streams, contributing to a notable increase in gross profit and margins. Moving forward, the company's investments in technology and customer-centric services are set to support continuous growth and improved market competitiveness. Overall, Best Buy's strategy ensures it is well-positioned for ongoing success in the retail sector.

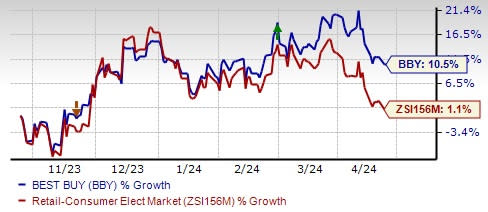

Image Source: Zacks Investment Research

Let’s Dig Deeper

The company prioritizes the enhancement of the customer experience at all interaction points. This commitment is evident through significant investments in both the online shopping platform and in-store technological upgrades, along with a strong emphasis on personalized customer service. Efforts to speed up delivery and streamline the in-store pickup process for online purchases have greatly improved the overall convenience and seamlessness of the shopping experience.

Best Buy is actively progressing in its digital transformation journey by harnessing data analytics and Artificial Intelligence. This strategic approach allows the company to gain deeper insights into customer preferences and behaviors, thus enabling more personalized marketing, product recommendations and services. As a result, there has been a notable increase in customer satisfaction and loyalty.

Additionally, Best Buy has formed strategic partnerships with health systems and technology companies to enhance its Best Buy Health services. These partnerships are designed to extend the reach and enhance the capabilities of its health technology offerings, further diversifying its revenue sources and leveraging its tech expertise.

Best Buy has also adapted its membership program to better align with evolving consumer needs and preferences. The program now features various tiers, each offering distinct benefits designed to enhance the shopping and service experiences at Best Buy. As of the fourth quarter of fiscal 2024, the company reported that it has 7 million members across its paid membership tiers, reflecting strong growth and engagement.

This expansion not only demonstrates the company’s ability to foster customer loyalty and enhance the shopping experience but also significantly impacts its financial performance, contributing approximately 45 basis points to the year-over-year growth in the company's operating margin in the fiscal fourth quarter. This strategic approach is aimed at boosting profitability and deepening customer relationships.

Partnership With Google Cloud for AI-Enhanced Service

Best Buy is enhancing its customer service by partnering with Google Cloud and Accenture to integrate generative AI (gen AI) technologies into its support operations. This collaboration aims to transform customer interactions by emphasizing efficiency and personalization using Google Cloud's gen AI capabilities.

A key feature of this initiative is the introduction of a gen AI-powered virtual assistant, set to launch in late summer 2024. Designed to provide self-service options for troubleshooting, delivery management and subscription handling, this virtual assistant will be accessible through BestBuy.com, the Best Buy mobile app or the customer service line, offering a more autonomous and flexible support experience.

This technology will also enable real-time analysis and summarization of conversations, sentiment assessment and provision of actionable, human-centered recommendations to support agents, thereby enhancing the problem-solving process and overall customer experience.

Stock Performance

While the aforementioned factors raise optimism, softness in comparable sales and challenges in key product categories, such as home theater, appliances, and mobile phones, cannot be ignored. Nonetheless, this current Zacks Rank #3 (Hold) company’s shares have gained 10.5% in the past six months compared with the industry’s 1.1% growth.

Stocks to Consider

A few better-ranked stocks are Pinterest PINS, StoneCo Ltd. STNE and Meta Platforms META.

Pinterest generates revenues by delivering ads on its website and mobile application. The company currently sports a Zacks Rank #1 (Strong Buy). PINS has a trailing four-quarter average earnings surprise of 37.4%. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Pinterest’s current financial-year earnings and sales indicates growth of 22.9% and 17.3% from the year-ago period’s reported figures.

StoneCo provides financial technology solutions. The company carries a Zacks Rank #2 (Buy) at present.

The Zacks Consensus Estimate for StoneCo’s current financial-year earnings indicates growth of 30.9% from the year-ago period’s reported figure. STNE has a trailing four-quarter average earnings surprise of 12.3%.

Meta Platforms is the world’s largest social media platform. The company carries a Zacks Rank of 2 at present.

The Zacks Consensus Estimate for Meta Platforms’ current financial-year earnings and sales indicates growth of 35.7% and 18.2% from the year-ago period’s reported figures. META has a trailing four-quarter average earnings surprise of 19.7%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Best Buy Co., Inc. (BBY) : Free Stock Analysis Report

StoneCo Ltd. (STNE) : Free Stock Analysis Report

Pinterest, Inc. (PINS) : Free Stock Analysis Report

Meta Platforms, Inc. (META) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance