Bel Fuse Inc (BELFB) Q1 2024 Earnings: Exceeds Net Earnings Expectations, Aligns with Revenue ...

Net Sales: Reported at $128.1 million, falling short of the estimated $128.65 million.

Gross Profit Margin: Improved to 37.5% from 31.1% in the previous year's first quarter.

Net Earnings: Reached $15.9 million, surpassing the estimate of $10.41 million.

Earnings Per Share (EPS): Class A shares reported at $1.19 and Class B at $1.26, both exceeding the estimated EPS of $0.97.

Adjusted EBITDA: Totaled $24.5 million, representing 19.2% of sales.

Share Repurchase: Repurchased 109,000 shares at a cost of $6.3 million.

Q2-2024 Sales Guidance: Expected to range between $125 million and $135 million with gross margins projected between 34-36%.

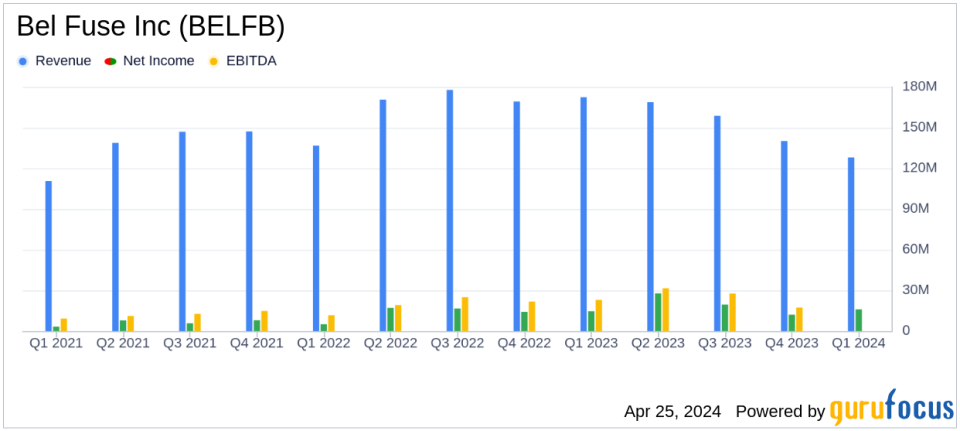

On April 25, 2024, Bel Fuse Inc (NASDAQ:BELFB) disclosed its financial results for the first quarter of 2024 through its 8-K filing. The company, a key player in the design and manufacture of electronic components, reported net sales of $128.1 million, aligning closely with analyst expectations of $128.65 million. However, it surpassed net earnings estimates significantly, posting $15.9 million against the anticipated $10.41 million.

Bel Fuse Inc operates primarily in the United States, with additional facilities worldwide, including in Macao, the United Kingdom, and Germany. The company's products, which include magnetic solutions, power solutions & protection, and connectivity solutions, cater to a diverse range of industries such as telecommunications, military, automotive, and consumer electronics.

Financial Performance and Strategic Highlights

The first quarter saw a decrease in net sales from $172.3 million in Q1 2023 to $128.1 million. Despite the lower sales volume, Bel Fuse achieved a higher gross profit margin of 37.5%, up from 31.1% in the same quarter the previous year. This improvement reflects the company's effective management and strategic initiatives, including facility consolidation and procurement efficiencies initiated in 2023.

Net earnings rose to $15.9 million from $14.6 million year-over-year, with earnings per share (EPS) for Class B common shares increasing to $1.26 from $1.15. The adjusted EBITDA was reported at $24.5 million, or 19.2% of sales, demonstrating a robust profitability metric despite the sales dip.

President and CEO Daniel Bernstein commented on the quarter's outcomes, highlighting the strength in the Connectivity segment and significant margin expansion in the Power Solutions and Protection segments. Challenges in the Magnetics business were acknowledged, attributed to ongoing inventory adjustments by customers and distribution partners.

Operational and Market Challenges

The company's performance is particularly noteworthy given the broader industry challenges, including supply chain disruptions and evolving market demands. CFO Farouq Tuweiq emphasized the durability of the company's transformation, crediting a favorable product mix and strategic customer contract renewals for the strong gross margin performance.

Looking ahead to Q2 2024, Bel Fuse anticipates net sales between $125 million and $135 million with gross margins expected to range from 34% to 36%. This guidance accounts for ongoing destocking activities and is based on current market conditions, which continue to be monitored closely by the management team.

Investor and Analyst Perspectives

Bel Fuse's ability to exceed net earnings expectations while maintaining steady revenue showcases its operational resilience and strategic foresight. The company's focus on margin improvement and cost efficiency is likely to hold investor interest, particularly in a fluctuating economic environment.

For detailed financial metrics and future outlooks, Bel Fuse has scheduled a conference call for April 26, 2024, which will further address these results and provide more insights into the companys strategic plans moving forward.

Bel Fuse Inc's comprehensive approach to navigating market complexities and its continued focus on strategic growth and operational efficiency underscore its potential as a noteworthy contender in the electronic components industry. Investors and stakeholders are recommended to keep a close watch on the company's progression in upcoming quarters.

Explore the complete 8-K earnings release (here) from Bel Fuse Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance