Bear Of The Day: Forward Air Corp (FWRD)

Forward Air Corp (FWRD) missed the Zacks Consensus Estimate at the end of April and the stock is a Zacks Rank #5 (Strong Sell). Let's take a look at what happened and why this stock reached the lowest Zacks Rank in this Bear of the Day article.

Description

Forward Air Corporation, together with its subsidiaries, operates as an asset-light freight and logistics company in the United State and Canada. The company operates through three segments: Expedited Freight, Intermodal, and Pool Distribution. The Expedited Freight segment provides expedited regional, inter-regional, and national less-than-truckload services; local pick-up and delivery services; and other services, which include final mile, truckload, shipment consolidation and deconsolidation, warehousing, customs brokerage, and other handling. It also offers expedited truckload brokerage, dedicated fleet, and high security and temperature-controlled logistics services. The Intermodal segment provides intermodal container drayage services; and contract, and container freight station warehouse and handling services. The Pool segment offers pool distribution services comprising managing high-frequency handling and distribution of time-sensitive products to various destinations through a network of terminals. Forward Air Corporation was founded in 1981 and is headquartered in Greeneville, Tennessee.

Recent Earnings

On April 30, FWRD repored EPS of $0.30 but the Zacks Consensus Estimate called fro $0.41. That 11 cent miss translated into a negative earnings surprise of 26%.

This followed another negative earninngs surprise of 8.6% and the report before that was a meet.

The earnings history plays a role in the Zacks Rank, but it is not the most important factor. Estimate revisions are much more important to the Zacks Rank.

Estimate Revisions

The Zacks Rank will tell you right away if estimate revisions are moving higher or lower. As a Zacks Rank #5 (Strong Sell) we know that the estimates for FWRD have moved lower.

The estimate for the current quarter slipped from 20 cents sixty days ago to the current level of 13 cents.

Next quarter saw a move lower as well, but not as steep. That number went from 40 cents to 35 cents.

The full year numbers carry the most weight, and I see that number slipping from $1.68 to $1.37 over the last 60 days.

The number for next year also fell from $2.69 to $2.41 over the same time period.

FWRD is not alone as many stocks have seen earnings estimate reivions move lower.

Valuation

With back to back earnings reports coming up short and lower earnings estimates you would think that the valuation would have dropped to a more reasonable level... but it hasn't. The stock tradeds at 35x forward earnings and that is pretty stiff for a trucker. Topline growth of 6.5% is nice to see, but it reall needs to double to just that big forward PE multiple.

Price to book is somewhat reasonable at 2.4x as the price to sales mutliple of 1x. I do see margins slipping of late, but that is understandable given the pandemic.

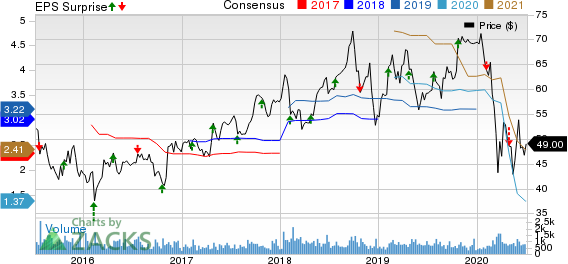

Chart

Forward Air Corporation Price, Consensus and EPS Surprise

Forward Air Corporation price-consensus-eps-surprise-chart | Forward Air Corporation Quote

The Hottest Tech Mega-Trend of All

Last year, it generated $24 billion in global revenues. By 2020, it's predicted to blast through the roof to $77.6 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Forward Air Corporation (FWRD) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance