Bear of the Day: Express (EXPR)

Express, Inc. EXPR is struggling with excess inventory in 2022 and a challenging economic environment. This Zacks Rank #5 (Strong Sell) has now fallen to $1 a share.

Express is a fashion apparel retailer which has brands Express and UpWest. It operates over 550 retail and outlet stores in the United States and Puerto Rico, the express.com online store and the Express mobile app.

Express and WHP Global Enter a Strategic Partnership

On Dec 8, 2022, Express and WHP Global, a global brand management firm, announced they entered into a mutually transformative strategic partnership to advance an omnichannel platform.

Express and WHP Global will form an intellectual property joint venture which will scale the Express brand through new domestic category licensing and international expansion opportunities.

WHP will invest $25 million to acquire 5.4 million newly issued shares of Express at $4.60 per share. It represents approximately 7.4% pro forma ownership.

The deal is closing in the fourth quarter.

A Big Miss in the Fiscal Third Quarter

Also on Dec 8, 2022, Express reported its fiscal third quarter results and missed on the Zacks Consensus Estimate by $0.21. Earnings came in at a loss of $0.50 compared to the Zacks Consensus which was looking for a loss of $0.29.

Sales fell 8% to $434.1 million from $472 million a year ago. Comparable retail sales, which includes both the Express brick and mortar stores and eCommerce, were down 11% compared to the third quarter of 2021. Retail stores were down 6%, as consumers returned to the malls, while eCommerce was down 17% from a year ago.

Comparable outlet store sales remained flat compared to the third quarter of 2021.

Inventory, which is the key item most are watching with the retailers, rose 10% to $422.7 million from $383.6 million at the end of last year's quarter.

Gross margin fell 540 basis points to 27.8% from 33.2% last year as the promotional environment hit hard.

"Our strategy to elevate our brand through higher average unit retails and reduced promotions, which has driven steady growth for the past five quarters, came up against the consumer's reduced spending in discretionary categories and increased appetite for deep discounts," said Tim Baxter, CEO.

"At the same time, we had some misses in our women's business that further impacted our performance. We did, however, post our sixth consecutive quarter of positive comps in our men's business," he added.

Analysts Cut Earnings Estimates for Fiscal 2022 and 2023

Express gave guidance of comparable sales for the year of flat to up 1%.

It also expected inventory to move closer to parity with sales trends by the end of the year.

Earnings guidance was given at a loss of $1.12 to a loss of $1.22.

This was below consensus so the analysts moved to cut their estimates. 2 estimates were lowered for fiscal 2022, pushing it down to a loss of $1.20 from a loss of $0.18. This is an earnings decline of 421% as Express lost only $0.23 last year.

2 estimates were also cut for fiscal 2023, pushing the Zacks Consensus down to a loss of $0.44 from $0.13.

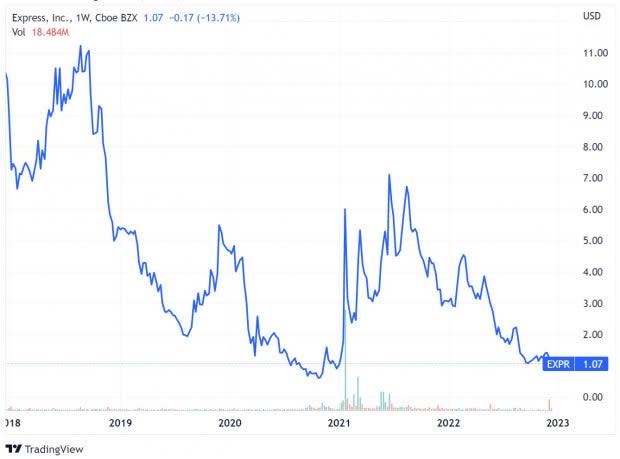

Shares Plunge in 2022

Express shares have been on a wild ride the last 5 years.

Image Source: Zacks Investment Research

In 2022, they have plunged 64% and are back around $1 a share.

Is it a bargain? Investors might want to stay away and look at other retailers with stronger fundamentals, at least until both inventory and earnings turn around. The economic environment in 2023 is likely to be challenging, even for the top retailers.

Buy the Zacks Rank #1 (Strong Buy) retail stocks, not the Zacks Rank #5 (Strong Sells).

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Express, Inc. (EXPR) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance