BankUnited (BKU) Stock Gains on Q2 Earnings Beat, Costs Down

Shares of BankUnited, Inc. BKU gained 9.2%, following the release of second-quarter 2019 results. Its earnings per share of 81 cents surpassed the Zacks Consensus Estimate of 68 cents. However, the bottom line compared unfavorably with the prior-year quarter’s earnings of 82 cents.

Results were aided by a decline in expenses and higher non-interest income. Moreover, the company recorded negative provision for loan losses in the quarter, which was a tailwind. However, lower net interest income was an undermining factor. Notably, the company’s overall loans and deposit balances remained strong.

Net income was $81.5 million, down from $89.9 million recorded in the prior-year quarter.

Revenues & Expenses Decline

Net revenues for the reported quarter were $226.2 million, surpassing the Zacks Consensus Estimate of $224.4 million. However, the top line declined 21.2% year over year.

Net interest income totaled $190.9 million, decreasing 25.2% year over year. This decline was due to a fall in interest income along with higher interest expenses.

Net interest margin contracted 108 basis points year over year to 2.52%.

Non-interest income was $35.3 million, up 10.5% from the year-ago quarter. This rise was due to an increase in net gain on investment securities, net gain on sale of loans, deposit service charges and fees, and other non-interest income.

Non-interest expenses declined 25.5% from the year-ago quarter to $120.1 million. This decrease was due to a fall in employee compensation and benefits costs, and occupancy and equipment costs. Notably, the company did not record any amortization of FDIC indemnification asset in the quarter.

Credit Quality: A Mixed Bag

As of Jun 30, 2019, the ratio of net charge-offs to average loans was 0.05%, down from 0.28% as of Dec 31, 2018. Moreover, recovery of loan losses was $2.7 million against provision for loan losses of $9 million in the prior-year quarter. However, as of Jun 30, 2019, the ratio of non-performing loans to total loans was 0.61%, up from 0.59% as of Dec 31, 2018.

Solid Balance Sheet

As of Jun 30, 2019, net loans were $22.5 billion, up 2.8% from the Dec 31, 2018 level. Total deposits amounted to $23.9 billion, up from $23.5 billion recorded as of Dec 31, 2018.

Capital Position Strong, Profitability Ratios Deteriorate

As of Jun 30, 2019, Tier 1 leverage ratio was 8.6%. Moreover, Common Equity Tier 1 risk-based capital ratio was 12.0%. Further, total risk-based capital ratio was 12.4%.

At the end of the second quarter, return on average assets was 1.00%, down from 1.17% reported at the prior-year quarter end. Additionally, return on average stockholders’ equity was 11.1%, down from 11.7% witnessed at the end of the year-ago quarter.

Our Take

Supported by continued growth in loans and deposits, BankUnited remains on track for top-line improvement in the future. However, despite a decline in expenses in the quarter, an increase in overall costs over the past few years is likely to hinder the company’s bottom-line growth in the near term.

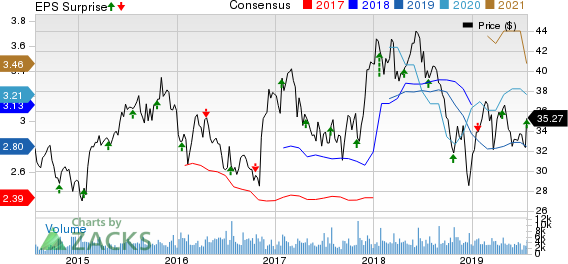

BankUnited, Inc. Price, Consensus and EPS Surprise

BankUnited, Inc. price-consensus-eps-surprise-chart | BankUnited, Inc. Quote

BankUnited currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Other Banks

Washington Federal’s WAFD third-quarter fiscal 2019 (ended Jun 30) earnings were 67 cents per share, surpassing the Zacks Consensus Estimate of 64 cents. The figure reflected year-over-year growth of 10%.

Hancock Whitney Corporation’s HWC second-quarter 2019 operating earnings per share of $1.01 were in line with the Zacks Consensus Estimate. The bottom line was 5.2% higher than the year-ago quarter figure.

Ally Financial Inc.’s ALLY second-quarter 2019 adjusted earnings of 97 cents per share surpassed the Zacks Consensus Estimate of 88 cents. Further, the bottom line compared favorably with 83 cents recorded in the prior-year quarter.

This Could Be the Fastest Way to Grow Wealth in 2019

Research indicates one sector is poised to deliver a crop of the best-performing stocks you'll find anywhere in the market. Breaking news in this space frequently creates quick double- and triple-digit profit opportunities.

These companies are changing the world – and owning their stocks could transform your portfolio in 2019 and beyond. Recent trades from this sector have generated +98%, +119% and +164% gains in as little as 1 month.

Click here to see these breakthrough stocks now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

BankUnited, Inc. (BKU) : Free Stock Analysis Report

Washington Federal, Inc. (WAFD) : Free Stock Analysis Report

Ally Financial Inc. (ALLY) : Free Stock Analysis Report

Hancock Whitney Corporation (HWC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance