Has your bank passed on the RBA’s March interest rate cut?

The Reserve Bank of Australia has slashed rates again to a new record low of 0.50 per cent, after dropping rates to 0.75 per cent in October.

“At its meeting today, the Board decided to lower the cash rate by 25 basis points to 0.50 per cent,” the RBA governor, Philip Lowe stated.

“The Board took this decision to support the economy as it responds to the global coronavirus outbreak.”

Now, those with variable home loans could see some more relief to their mortgage rates, but only if the banks choose to pass the rate on.

Has your bank passed the rate cut on?

Commonwealth Bank has passed on the entire 0.25 per cent rate cut.

Westpac announces it will cut variable interest rates by 0.25 per cent.

NAB announces it will lower home loan variable rates by 0.25 per cent, effective 13 March.

ANZ announces it will reduce variable home loan rates between 0.25 per cent and 0.35 per cent.

Macquarie Bank announces it will reduce variable interest rates by 0.25 per cent.

Athena Home Loans announces it has immediately passed on the RBA rate cut in full to new and existing customers.

We’re decreasing variable interest rates by 0.25% per annum for home loan customers, as well as small business cash-based loans and overdrafts. These changes will take effect on 17 March 2020.

— Westpac Bank (@Westpac) March 3, 2020

NAB has lowered home loan, small business and business overdraft variable rates by 25bps, effective 13 March.

— NAB (@NAB) March 3, 2020

ANZ reduces variable home loan rates between 0.25%pa and 0.35%pahttps://t.co/ljCp582Hi8 pic.twitter.com/VmP7hFVThQ

— ANZ Newsroom (@ANZ_Newsroom) March 3, 2020

Following the RBA’s cash rate decision we have reduced the variable rates for our home loan customers by 0.25% p.a.

— CBA Newsroom (@CBAnewsroom) March 3, 2020

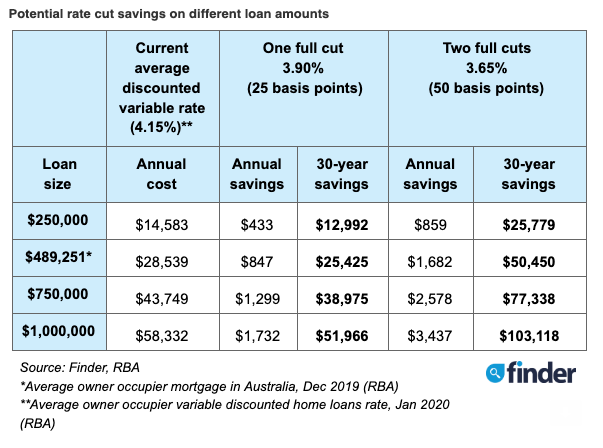

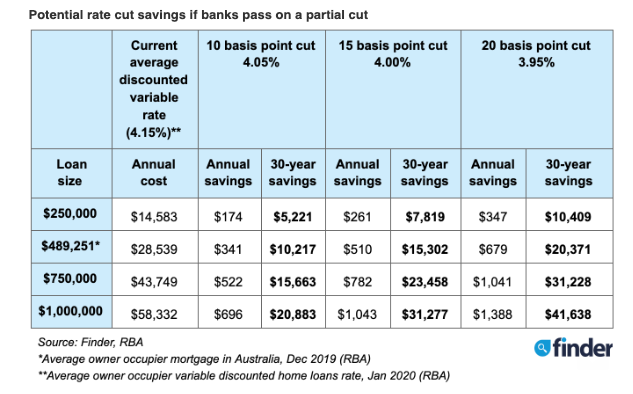

What your new variable home loan could look like

If the banks were pass on the full 25 basis point cut, the average mortgage holder could save around $25,000 over 30 years on their mortgage, Finder data reveals.

But even if banks only pass on a partial rate cut, the average mortgage holder could still save $10,000.

My bank hasn’t passed on the interest rate cut. What can I do?

The RBA has been slashing rates, but the big four banks haven’t passed on the entire cut to consumers.

So, if you’re a customer of the big banks, it might be time to consider switching banks to get a better rate. InfoChoice currently lists 22 three-year fixed rate products from independent lenders with rates under 3 per cent per annum.

If you’d prefer to stay with your current bank, here’s how to talk your way to cheaper home loan too.

Yahoo Finance will keep you updated once we know which banks have passed on the rate cuts.

How low can we go?

It is possible for interest rates to go negative, like in Japan, Europe, Switzerland and Sweden, but RBA governor Philip Lowe has flagged that this is unlikely.

Lowe told the House of Representatives economics committee in February that negative interest rates are "extraordinarily unlikely” but alternative measures like quantitative easing would only be considered if the cash rate hits 0.25 per cent.

Make your money work with Yahoo Finance’s daily newsletter. Sign up here and stay on top of the latest money, news and tech news.

Yahoo Finance

Yahoo Finance