Bank ETFs Rise on the Wave of Big Releases

The financial sector, which accounts for around one-fifth of the S&P 500 index, is now busy with Q2 earnings releases. The going is great so far, with five big banks crushing estimates on both lines and one reporting mixed results. The backdrop should favor the banks along with the course of oil, the stance taken by the Fed and the proposed policies of Trump (read: How Financial ETFs Look After Fed Stress Test).

Though ongoing trade war tensions and a flattening of the yield curve are concerns for the financial funds, the underlying earnings strength has been steady. Let’s take a look at major banking earnings in detail:

Big Bank Earnings in Focus

JP Morgan JPM reported earnings of $2.29 per share, beating the Zacks Consensus Estimate of $2.22 in the second quarter of 2018. Also, the figure reflected a 26% rise from the year-ago period.

Net revenues as reported were $27.8 billion in the quarter, up 8% from the year-ago quarter. Also, the tally topped the Zacks Consensus Estimate of $27.6 billion. Rising rates, loan growth and increase in Markets’ revenues drove the results.

Wells Fargo WFC earned $1.08 per share in Q2, missing the Zacks Consensus Estimate of $1.12 and matching the prior-year quarter earnings. The quarter’s total revenues came in at $21.6 billion, outpacing the Zacks Consensus Estimate of $21.5 billion. However, the reported figure compared unfavorably with the prior-year quarter tally of $22.2 billion.

Citigroup Inc.’s C earnings per share of $1.62 for Q2 came ahead of the Zacks Consensus Estimate of $1.54. Also, earnings were up 28% year over year. Revenues increased 2% year over year to $18.5 billion. Higher revenues from the global consumer banking and institutional clients were satisfactory. The revenue figure surpassed the Zacks Consensus Estimate of $18.4 billion.

Bank of America Corporation’s BAC second-quarter 2018 earnings of 63 cents per share surpassed the Zacks Consensus Estimate of 57 cents. Also, the figure was 43% higher than the prior-year quarter number. Net revenues amounted to $22.6 billion, beating the Zacks Consensus Estimate of $22.5 billion. However, the top line dipped 1% from the year-ago quarter.

Reflecting the highest second-quarter net revenues in nine years, Goldman Sachs’ GS came up with a positive earnings surprise of 28.1%. The company reported earnings per share of $5.98, comfortably beating the Zacks Consensus Estimate of $4.67. Further, the bottom line witnessed 51.4% year-over-year improvement. Goldman’s net revenues were up 19% in the quarter under review. The figure of $9.4 billion handily outpaced the Zacks Consensus Estimate of $8.7 billion.

Morgan Stanley’s MS) second-quarter 2018 earnings from continuing operations of $1.30 per share beat the Zacks Consensus Estimate of $1.08. Net revenues amounted to $10.6 billion, reflecting a rise of 12% from the prior-year quarter. In addition, it surpassed the Zacks Consensus Estimate of $10 billion.

Market Impact

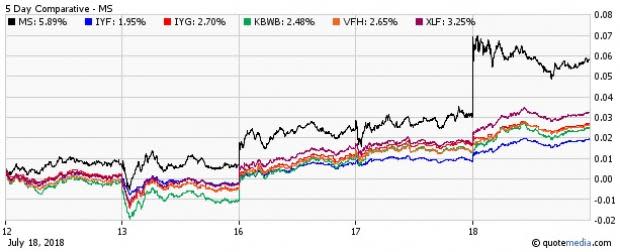

Investors, who still have their hopes pinned on a decent earnings season, Trump’s promises for deregulation and faster Fed policy tightening, must be keen on knowing how financial ETFs like iShares U.S. Financial Services ETF IYG, iShares US Financials ETF IYF, Invesco KBW Bank ETF KBWB, Financial Select Sector SPDR XLF and Vanguard Financials ETF VFH responded to earnings releases. These funds have considerable exposure to the aforementioned stocks (see all Financial ETFs here).

Goldman and Morgan Stanley are not that prominent in the afore-mentioned ETFs, rather they are heavy on iShares U.S. Broker-Dealers & Securities Exchanges ETF (IAI).

ETF Performance

Most of these ETFs gave decent performances in the last five days (as of Jul 18, 2018), in the peak of banking earnings releases.

The funds added in the range of 1.95% to 3.25%. Morgan Stanley’s blockbuster performance at the end of the big-banks reporting season charged up the space.

Apart from the earnings, Fed chair Powell’s testimony drove financial ETFs materially. He sees “the economy growing faster than we currently anticipate.” His testimony has steepened the Treasury yield curve slightly in recent trading (read: Welcome Powell Era With These ETFs).

Want key ETF info delivered straight to your inbox?

Zacks’ free Fund Newsletter will brief you on top news and analysis, as well as top-performing ETFs, each week. Get it free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

JPMorgan Chase & Co. (JPM) : Free Stock Analysis Report

Wells Fargo & Company (WFC) : Free Stock Analysis Report

Citigroup Inc. (C) : Free Stock Analysis Report

Bank of America Corporation (BAC) : Free Stock Analysis Report

The Goldman Sachs Group, Inc. (GS) : Free Stock Analysis Report

SPDR-FINL SELS (XLF): ETF Research Reports

ISHARS-US FN SV (IYG): ETF Research Reports

VIPERS-FINANCL (VFH): ETF Research Reports

PWRSH-KBW BP (KBWB): ETF Research Reports

ISHARS-US FN SE (IYF): ETF Research Reports

Macy's, Inc. (M) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Yahoo Finance

Yahoo Finance