Avino Silver (ASM) Earnings Beat Estimates in Q4, Revenues Down

Avino Silver & Gold Mines Ltd. ASM reported earnings per share of 2 cents for fourth-quarter 2023, which marked a 33% decline from 3 cents reported in the fourth quarter of 2022. The Zacks Consensus Estimate was for break-even earnings for the fourth quarter of 2023.

Including one-time items, the company reported break-even earnings per share in the fourth quarter of 2023 compared with 1 cent in the year-ago quarter.

Avino Silver’s revenues declined 14.5% year over year to $12.5 million in the quarter under review. The top line beat the Zacks Consensus Estimate of $9.5 million.

Avino Silver Price, Consensus and EPS Surprise

Avino Silver price-consensus-eps-surprise-chart | Avino Silver Quote

Operational Update

The company recorded cash costs of $15.04 per silver equivalent payable ounce, indicating a decrease of 28% from the year-ago quarter. Consolidated all-in sustaining costs of $21.67 per silver payable equivalent ounce rose 16% from the year-ago quarter.

Avino Silver reported a mine-operating profit of $2.56 million in the quarter, down 41% from the $4.4 million reported in the year-ago quarter. EBITDA was $1.1 million, plunging 65% from $3.2 million in the year-ago quarter.

Financial Position

Avino Silver ended 2023 with $2.7 million of cash in hand, down from $11.2 million at the end of 2022. Cash provided by operating activities during the quarter was $1.5 million in 2023 compared with $11.8 million in 2022.

Production Update

Avino Silver reported consolidation production of 558,460 silver equivalent ounces in the fourth quarter of 2023, which was down 27% year over year impacted by mining in lower-grade areas. This comprised 224,723 ounces of silver, 1,452 ounces of gold and 1,317,793 pounds of copper. Silver production declined 27%, gold output was down 40% while copper production declined 14%.

For 2023, ASM’s consolidation production was reported at around 2.42 million silver equivalent ounces, down 9%. Gold production was up 27% year over year to 7,335 ounces. Copper production declined 18% to 5.3 million pounds and silver output declined 6% to 928,643 ounces.

2023 Results

Avino Silver reported earnings per share of 4 cents in 2023, which beat the Zacks Consensus Estimate of 1 cent. The bottom line was down 50% compared with earnings of 8 cents reported in 2022.

Including one-time items, the company reported break-even earnings per share in 2023 compared with 3 cents in the year-ago quarter.

Avino Silver’s revenues dipped 1% year over year to $44 million in 2024. The top line beat the Zacks Consensus Estimate of $43 million.

Update on La Preciosa

On Feb 28, 2024, Avino Silver provided an update on the recently completed and ongoing work at La Preciosa. ASM already has the mining equipment to start operations in La Preciosa. The company is dedicated to conducting La Preciosa with minimal environmental impact and at a low cost.

Avino Silver has applied for an environmental permit to the authorities. A new permission will be submitted right after receiving the Environmental permit, which is required to begin construction of the portal, haulage ramp and mining of the Gloria and Abundancia veins.

At La Preciosa, capital for 2024 is estimated between $3 million and $4 million, which will cover surface work and equipment procurement for the Gloria and Abundancia Veins' first phase of mine development. The addition of La Preciosa's mineral resource inventory significantly enhanced ASM's consolidated NI 43-101 mineral resources, which currently comprise 371 million silver equivalent ounces.

Guidance for 2024

For 2024, the company expects output from both the Avino Mine and stockpiles from La Preciosa to be 700,000 - 750,000 tons for mill processing. Production for the year is expected between 2.5 million and 2.8 million silver equivalent ounces.

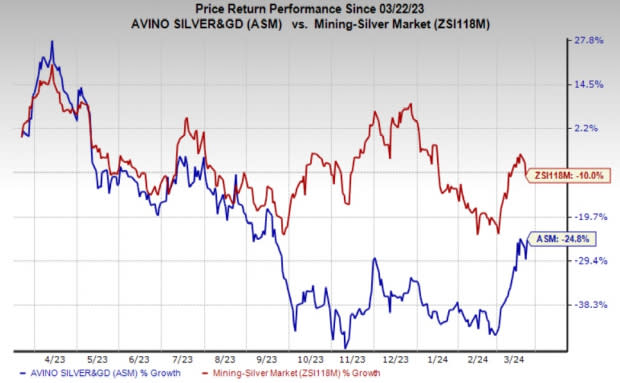

Price Performance

Shares of the company have declined 24.8% over the past year compared with the industry’s 10% fall.

Image Source: Zacks Investment Research

Zacks Rank & Stocks to Consider

Avino Silver currently has a Zacks Rank #3 (Hold).

Some better-ranked stocks from the basic materials space are Ecolab Inc. ECL, Carpenter Technology Corporation CRS and Hawkins, Inc. HWKN. ECL and CRS sport a Zacks Rank #1 (Strong Buy) at present, and HWKN has a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Ecolab’s 2024 earnings is pegged at $6.39 per share, indicating an increase of 22.7% from the prior year’s reported number. It has an average trailing four-quarter earnings surprise of 1.7%. ECL shares have gained 47% in a year.

The Zacks Consensus Estimate for Carpenter Technology’s 2024 earnings is pegged at $4.00 per share. The consensus estimate for 2024 earnings has moved 1% north in the past 60 days. It has an average trailing four-quarter earnings surprise of 14.3%. CRS shares have gained 70% in a year.

The Zacks Consensus Estimate for Hawkins’ fiscal 2024 earnings is pegged at $3.61 per share, indicating a year-over-year rise of 26.2%. The consensus estimate for HWKN’s current-year earnings has been revised 4.3% north in the past 60 days. It has an average trailing four-quarter earnings surprise of 30.6%. The company’s shares have rallied 85% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ecolab Inc. (ECL) : Free Stock Analysis Report

Carpenter Technology Corporation (CRS) : Free Stock Analysis Report

Avino Silver (ASM) : Free Stock Analysis Report

Hawkins, Inc. (HWKN) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance