Avadel Pharmaceuticals Reports First Quarter 2024 Earnings: Revenue Surpasses Estimates but Net ...

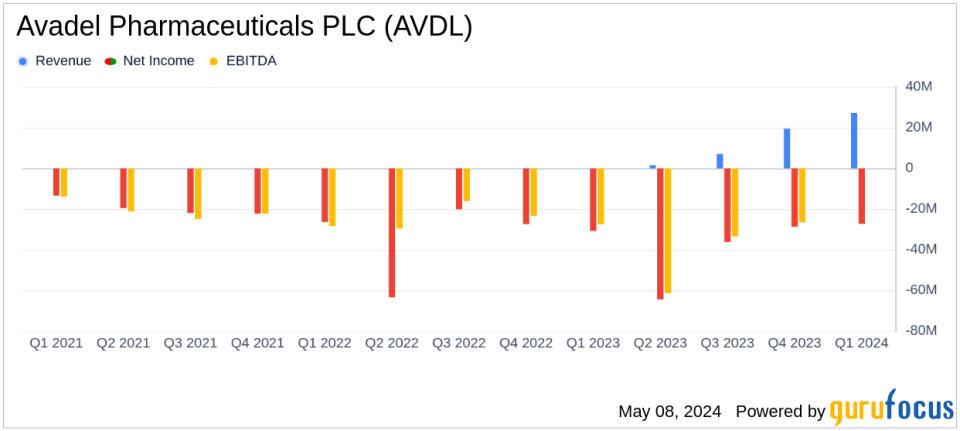

Revenue: Reported $27.2 million in net product revenue, surpassing the estimate of $25.90 million.

Net Loss: Posted a net loss of $27.3 million, exceeding the estimated net loss of $18.99 million.

Earnings Per Share: Recorded a loss of $0.30 per diluted share, above the estimated loss of $0.21 per share.

Gross Profit: Achieved a gross profit of $25.7 million for the quarter.

R&D Expenses: R&D expenses decreased to $3.1 million from $3.8 million in the same period last year.

SG&A Expenses: SG&A expenses increased significantly to $48.6 million, up from $24.5 million in the prior year's quarter.

Cash Position: Ended the quarter with $88.8 million in cash, cash equivalents, and marketable securities.

On May 8, 2024, Avadel Pharmaceuticals PLC (NASDAQ:AVDL) released its 8-K filing, announcing its financial results for the first quarter ended March 31, 2024. The specialty pharmaceutical company, known for its proprietary drug delivery technologies and commercialized product LUMRYZ, reported a net revenue of $27.2 million from LUMRYZ sales, surpassing the analyst's revenue estimate of $25.90 million.

Company Overview

Avadel Pharmaceuticals focuses on developing and commercializing unique pharmaceutical products, particularly in the narcolepsy treatment arena. Their flagship product, LUMRYZ, is an extended-release formulation of sodium oxybate for narcolepsy patients, designed to be taken once at bedtime.

Q1 Performance Highlights

The first quarter saw significant commercial progress with LUMRYZ, highlighted by over 2,800 patients enrolling in Avadel's RYZUP patient support servicesa 50% increase since the end of 2023. This growth is attributed to patients transitioning from first-generation oxybates to LUMRYZ. Additionally, Avadel is exploring expansion opportunities for LUMRYZ in pediatric narcolepsy and plans to initiate a Phase 3 trial for idiopathic hypersomnia in the latter half of 2024.

Financial Performance

Despite the revenue beat, Avadel reported a net loss of $27.3 million, or ($0.30) per diluted share, which is an increase from the net loss of $30.8 million, or ($0.48) per diluted share, in the same period last year. This loss was primarily due to a significant increase in SG&A expenses, which totaled $48.6 million, driven by the commercial launch of LUMRYZ, increased headcount, and higher marketing and legal costs.

R&D expenses decreased slightly to $3.1 million from $3.8 million in Q1 2023, reflecting lower pre-commercial costs for LUMRYZ. The company ended the quarter with $88.8 million in cash, cash equivalents, and marketable securities.

Strategic Developments and Future Outlook

CEO Greg Divis expressed satisfaction with the strong commercial uptake of LUMRYZ and outlined the company's focus for 2024, which includes expanding market growth and exploring new treatment populations. The potential approval of LUMRYZ for pediatric use could significantly alleviate the treatment burden for families and caregivers of children with narcolepsy.

Avadel's strategic initiatives seem well-positioned to capitalize on the unmet needs in narcolepsy treatment, potentially leading to long-term growth. However, the increased operational costs and widening net loss highlight the challenges in scaling up new pharmaceutical products.

Investor and Analyst Perspectives

Investors and analysts might view Avadel's revenue growth positively due to the successful market penetration of LUMRYZ. However, the increased losses and high operational costs could raise concerns about the company's profitability trajectory in the near term. The upcoming trials and potential market expansions will be critical to watch for indications of sustained long-term growth.

For detailed financial figures and future updates, investors are encouraged to refer to the official SEC filings.

Explore the complete 8-K earnings release (here) from Avadel Pharmaceuticals PLC for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance