AutoNation Inc (AN) Q1 2024 Earnings: Mixed Results Amid Market Challenges

EPS: Reported at $4.49, down from $6.07 year-over-year, falling short of estimates of $4.27.

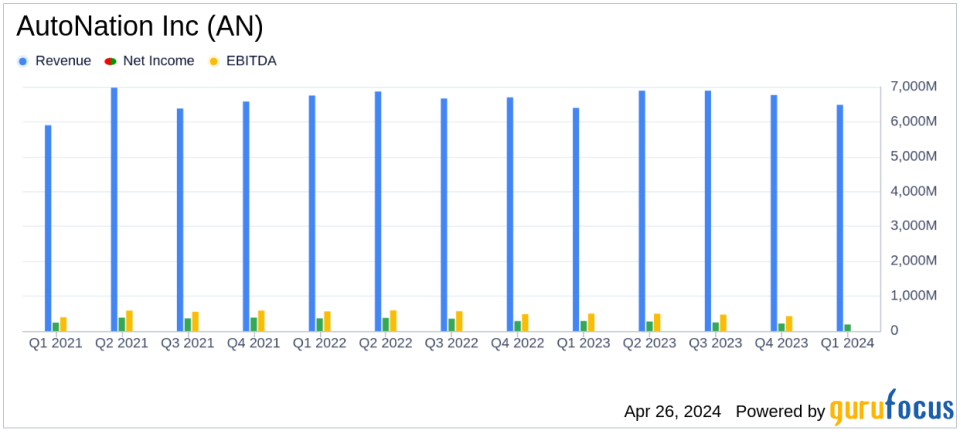

Revenue: Reached $6.5 billion, a slight increase from $6.4 billion the previous year, exceeding estimates of $6494.36 million.

Net Income: Totalled $190.1 million, a significant decrease from $288.7 million year-over-year, surpassing estimates of $181.11 million.

After-Sales Gross Profit: Grew by 9% to a record $556 million, indicating strong performance in this segment.

New Vehicle Sales: Volume increased by 7%, contributing positively to revenue growth.

Share Repurchase: Repurchased 1.6 million shares year-to-date and authorized an additional $1.0 billion for future repurchases, signaling confidence in the companys financial health and future prospects.

Operating Income: Declined by 23% to $340.3 million, reflecting challenges in maintaining profitability levels.

On April 26, 2024, AutoNation Inc (NYSE:AN) disclosed its first-quarter earnings for 2024 through an 8-K filing. The company reported earnings per share (EPS) of $4.49, surpassing the analyst estimate of $4.27. However, the net income of $190.1 million fell short of the expected $181.11 million. Revenue reached $6.5 billion, closely aligning with the forecast of $6494.36 million.

AutoNation, a leading automotive retailer in the United States, operates over 250 dealerships and 53 collision centers across 21 states, primarily in Sunbelt metropolitan areas. The company's diverse operations include new and used vehicle sales, parts and repair services, and auto financing.

Financial Performance Overview

AutoNation's revenue for Q1 2024 saw a slight increase from $6.4 billion in the previous year to $6.5 billion. This growth was driven by a 7% increase in New Vehicle unit sales and an 8% rise in After-Sales revenue. Despite these gains, the company experienced a decrease in gross profit by 7% year-over-year, totaling $1.2 billion, primarily due to lower gross profit per vehicle retailed in both new and used vehicle segments.

The company's net income saw a significant decline of 34% compared to the same period last year, falling to $190.1 million from $288.7 million. This drop was influenced by a decrease in operating income, which fell by 23% to $340.3 million.

Strategic Initiatives and Capital Allocation

AutoNation's CEO, Mike Manley, highlighted the company's robust growth in vehicle sales and its strong position in Customer Financial Services. Manley also noted the company's effective capital allocation, including the repurchase of 1.6 million shares and the authorization to buy back an additional $1.0 billion in common stock.

The company made capital expenditures of $94 million during the quarter and reported $1.7 billion in liquidity as of March 31, 2024. These figures underscore AutoNation's ongoing commitment to maximizing shareholder returns and investing in growth initiatives.

Segment Performance and Market Challenges

AutoNation's segment performance varied, with the Domestic Segment experiencing a 37% decrease in income, while the Import Segment and Premium Luxury Segment saw decreases of 20% and 24%, respectively. These reductions reflect broader market challenges, including economic uncertainty and shifts in consumer demand.

The automotive industry faces ongoing pressures from supply chain disruptions and economic headwinds, which have impacted vehicle availability and pricing. AutoNation's mixed financial results reflect these industry-wide challenges, despite the company's strong sales performance in new and after-sales markets.

Looking Ahead

As AutoNation navigates the evolving automotive landscape, the company remains focused on enhancing its operational efficiency and pursuing strategic growth opportunities. The ongoing investment in digital transformation and customer service initiatives is expected to bolster AutoNation's market position and drive future profitability.

For detailed financial tables and further information, please refer to the full earnings report on AutoNation's investor relations website.

Explore the complete 8-K earnings release (here) from AutoNation Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance