Auto Roundup: F & NSANY's Recalls, LAD's Acquisitions and More

The major auto giants reported second-quarter 2022 vehicle sales numbers last week. Most of them suffered a double-digit decline in sales volumes. Escalating supply chain issues, shortage of components and shipping hurdles continued to hit the production of vehicles, keeping a tight lid on inventory and sales despite robust consumer demand. The seasonally adjusted annual rate for June is expected to decline to close to 13 million units from 15.43 million in June 2021. In fact, June marked the eighth consecutive month of retail inventory below 900,000 cars and light trucks.

Auto giants Ford F and Nissan NSANY issued a recall of some of their models last week on issues related to damaged parts or certain features that compromise the safety of other drivers on the roads. Auto retailer Lithia Motors LAD continued its buyout binge with the acquisition of 12 dealerships. While Cummins CMI and Komatsu entered into a partnership for zero-emission equipment, Ferrari N.V. RACE provided updates on its share repurchase program.

While Lithia presently sports a Zacks Rank #1 (Strong Buy), Cummins and Ferrari carry a Zacks Rank #3 (Hold) and #4 (Sell), respectively. Meanwhile, Ford and Nissan hold a Zacks Rank #5 (Strong Sell) each.

You can see the complete list of today’s Zacks #1 Rank stocks here

Last Week’s Top News

Lithia announced the acquisition of nine Lehman Auto World dealerships. With these buyouts, Lithia expanded its footprint in South Florida. In addition to the nine Lehman dealerships, it has also purchased two Esserman International stores in Miami-Dade County. These 11 dealerships are expected to add $850 to Lithia’s annualized revenues. The company also bolstered its presence in Las Vegas with the buyout of Henderson Hyundai and Genesis. This marks Lithia’s eighth purchase in the Las Vegas metro store and is expected to add $100 million in annual revenues.

With the latest buyout, Lithia’s total expected annualized revenues acquired in 2022 so far have reached over $2.1 billion.LAD targets to generate $50 billion in revenues and $55 in earnings per share by 2025, including 200 plus acquisitions. Thanks to its solid profitability and cash-generating potential, the company remains committed to maximizing shareholders’ value. From the beginning of 2022 through Jun 28, Lithia has bought back approximately 2.1 million shares at a weighted average price of $285, with roughly $116 million remaining under its current authorization.

Ford issued the first recall of its Ford F-150 Lightning electric pickup trucks to fix an issue pertaining to the tire pressure monitoring system. It covers trucks with 20-inch or 22-inch all-season tires. The recall will affect 2,666 Lightning vehicles in the United States and 220 in Canada. The automaker officially began to notify its dealers and owners via email and the FordPass mobile app, beginning Jun 28. Vehicles yet to be delivered will have the issue fixed by Ford dealers. F will also offer automotive repair through a Ford Power-Up software update in the next 30 days for all current Lightning customers.

In separate news, Ford announced that customers leasing any of the company’s all-electric vehicles (EVs) will no longer have the option to buy out the vehicle at the end of the lease. The policy change came into effect in 37 states and will be rolled out nationwide by the year's end. The change impacts the automaker’s three available EVs, namely the F-150 Lightning, the Mustang Mach-E and the E-Transit.It applies to leases initiated on or after Jun 15.

Nissan announced that it is recalling more than 300,000 SUVs in the United States. The recall is over an issue pertaining to the hood, which opens suddenly, obstructing the driver’s view and increasing the risk of a crash. This Japan-based automaker said that 322,671 Pathfinder vehicles for models between 2013 and 2016 are covered under the recall.

Per the National Highway Traffic Safety Administration and Nissan, the accumulation of dirt and dust on the secondary hood latch could cause the malfunction. The latch stays open, even if the hood is closed, potentially popping up without alert. Nissan will shortly send out interim notifications for the remedial measure.

Ferrari announced that it plans to initiate a euro 150-million share buyback program as the initial tranche of the new multi-year share repurchase plan, valued at nearly 2 billion euros and expected to be implemented by 2026. The first tranche is likely to have begun on Jul 1, 2022, and will end no later than Nov 30, 2022. It will be funded through RACE’s available cash, while the common shares repurchased under the first tranche may be used to meet any obligations brought by Ferrari’s equity incentive plan.

The first tranche is likely to have implemented the resolution adopted by the shareholders’ meeting, held on Apr 13, 2022. The meeting authorized the purchase of up to 10% of RACE’s common shares during the 18-month period. The repurchase authorization will expire on Oct 12, 2023, or until the time the authority is extended or renewed before such date. The first tranche replaces any earlier common share buyback program. Ferrari currently has 11,065,110 common shares in treasury.

Cummins signed a memorandum of understanding (MoU) with Komatsu for the development of zero-emissions haulage equipment. Per the agreement, both companies will initially focus on zero-emission power technologies, which include hydrogen fuel cell solutions for large mining haul truck applications. Together they will work toward building a partnership of diesel engines across a wide range of mining and construction equipment. The venture is part of Cummins’ Destination-Zero strategy to bring down its products’ greenhouse gas and air quality impacts and reach net zero emission by 2050.

In another development, Cummins joined forces with Hyliion. The deal will optimize Cummins’ natural gas engine as the generator for the Hypertruck ERX powertrain. The production of the Hypertruck ERX with the ISX12N Cummins’ natural gas power is slated to begin in late 2023.The collaboration will be a stepping stone toward a more sustainable transportation industry and offer a portfolio of powertrains across many fuel options.

Price Performance

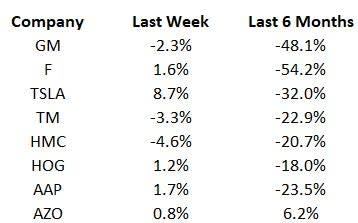

The following table shows the price movement of some of the major auto players over the last week and six-month period.

Image Source: Zacks Investment Research

What’s Next in the Auto Space?

Industry watchdogs will keep an eye on June auto sales in China, likely to be released by the China Association of Automobile Manufacturers soon. Also, stay tuned for any update on how automakers will tackle the semiconductor shortage — compounded by the Russia-Ukraine war— and make changes in business operations.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ford Motor Company (F) : Free Stock Analysis Report

Cummins Inc. (CMI) : Free Stock Analysis Report

Nissan Motor Co. (NSANY) : Free Stock Analysis Report

Lithia Motors, Inc. (LAD) : Free Stock Analysis Report

Ferrari N.V. (RACE) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance