Australia’s most reliable property market revealed

Known for its foodie culture and wineries, this one location is also among the nation’s most consistent property markets.

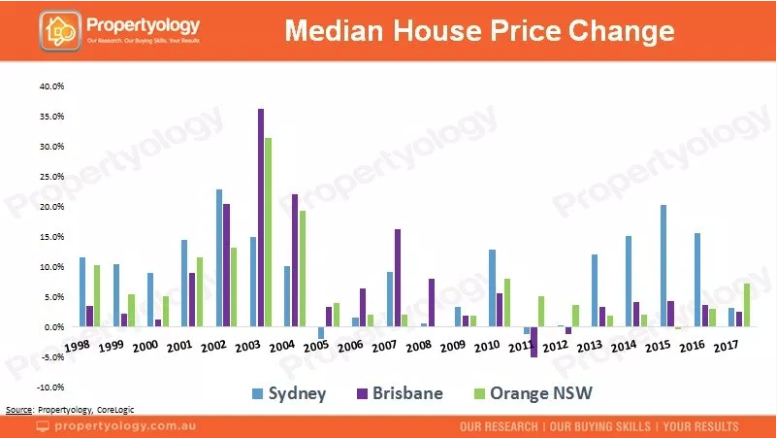

The quality lifestyle and enviably low unemployment rate has continued to draw Australians to New South Wales’ regional city of Orange, where property price growth has averaged 6.6 per cent per annum over the last 20 years.

Also read: Three reasons why interest rates could be set to fall

Additionally, the median house price has only declined once in a calendar year over that same period. That was in 2015, with the decline a “miniscule” 0.4 per cent.

“This city may well be the most consistent and safest in Australia,” managing director at buyers’ agency Propertyology, Simon Pressley said.

“There are plenty of people who set out planning a two to four-year relocation to Orange to study at its Charles Sturt university or to gain valuable experience working at the world-class hospital and subsequently opt to never leave. With a median house price of just $400,000 you get big bang for your buck in Orange.”

Also read: Mystery couple raffle off their $4.2m home

He said while big cities like Sydney tend to make headlines, regional cities also have housing booms. Orange saw the median house price increase 31.3 per cent in 2003 – bigger than Sydney’s best-ever 22.9 per cent in 2002.

And, it recorded an increase in median house price in 2011, when all eight capital cities actually saw price declines.

“And, whereas a typical investment property in Sydney today costs circa $25,000 per year to hold, in Orange it’s more like $2,500,” Pressley added.

Also read: The property market shift which puts the power back in buyers’ hands

“With fundamentals that include a great lifestyle, affordable housing and a diverse economy, there’s no reason to think that it won’t continue to be one of Australia’s most consistent and reliable investment locations in the future.”

Get Yahoo Finance’s top news and tips straight to your inbox. Sign up here.

Yahoo Finance

Yahoo Finance