‘Impossible to fathom’: Warning signs for housing market

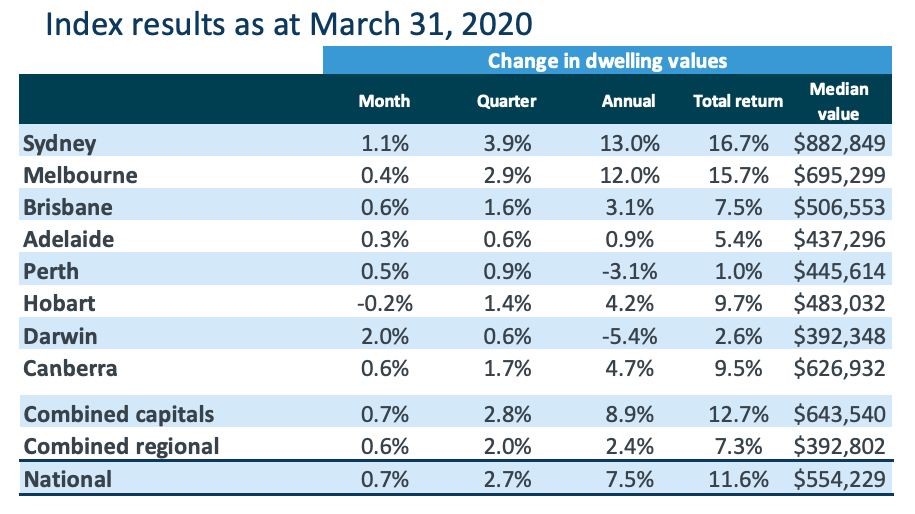

The national housing market rose 0.7 per cent over March in its weakest performance since July last year, as coronavirus’ impact on sales volumes began to be felt.

Selling a house during coronavirus? Here’s what you need to know

Eviction: What the 6-month ban on evictions means for tenants and landlords

Emergency rate cut: RBA throws kitchen sink at coronavirus

The first two weeks of March saw prices across the country rise, before softening in the second half of the month as the government introduced restrictions on open houses and auctions designed to slow the spread of coronavirus, the latest CoreLogic home value index revealed on Wednesday.

Darwin had the strongest monthly growth, up 2.0 per cent, while Sydney saw growth of 1.1 per cent.

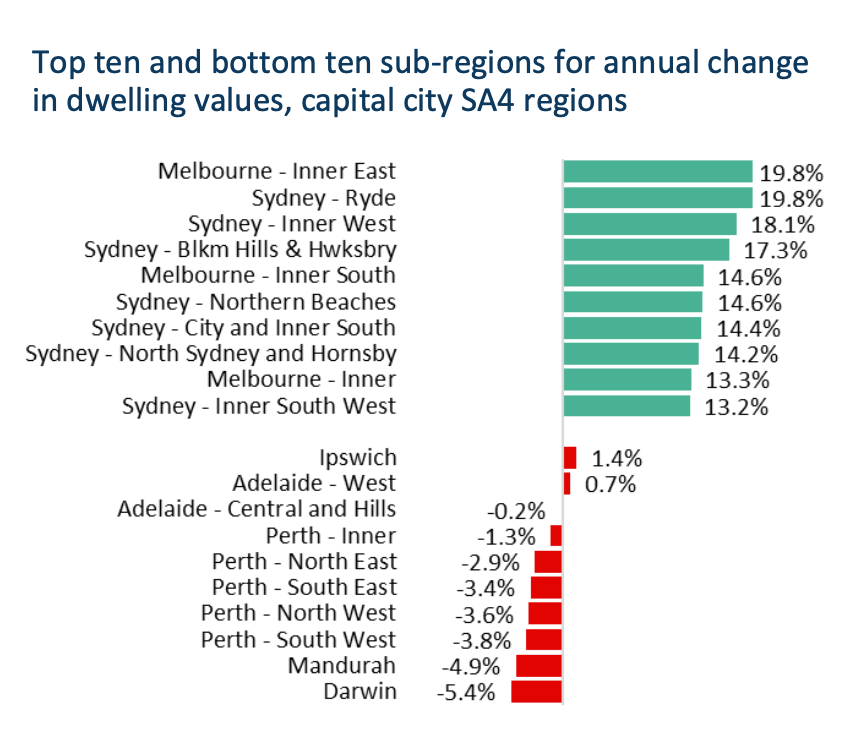

Over the last year, Sydney has also seen the strongest growth, up 13.0 per cent, followed by Melbourne, which has seen value growth of 12.0 per cent.

In fact, in the last 12 months, all capital cities bar Perth and Canberra have recorded positive growth, with all regions recording positive quarterly growth.

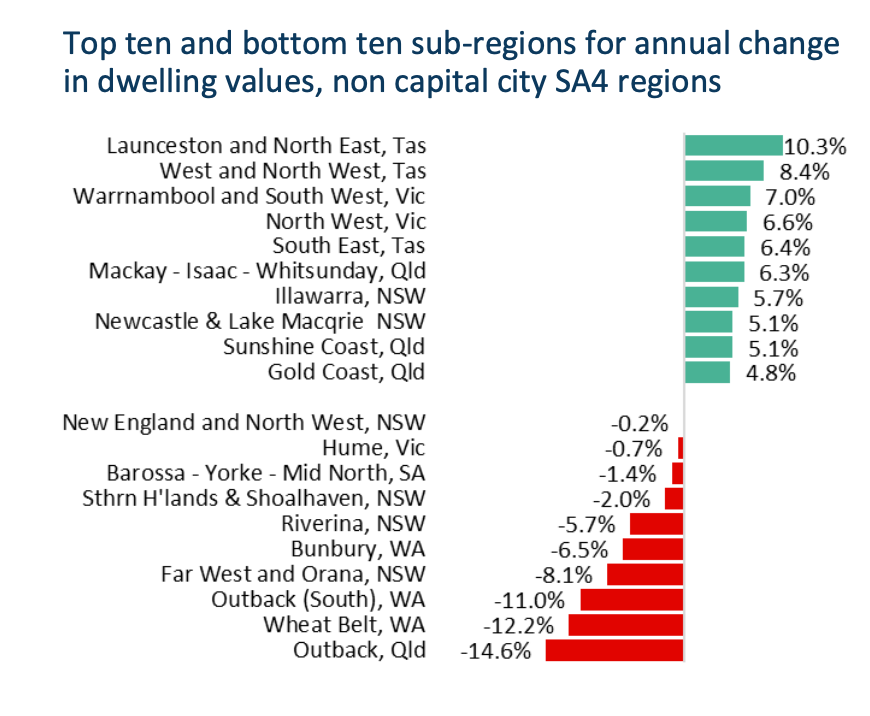

Each capital city sub-region recorded positive value growth in March, while only 5 of the 42 non-capital city sub-regions saw a decline in value.

But that positive growth is unlikely to linger, CoreLogic head of research Tim Lawless said.

The only thing that’s certain? Uncertainty

The words ‘uncertain’ or ‘uncertainty’ were used five times in the report released this morning, with CoreLogic noting that even its ability to conduct timely analysis of housing market conditions would be challenged by the drop in transaction volumes.

“The housing market won’t be immune to a drop in sentiment and weaker economy, however the extent of the impact on dwelling values remains highly uncertain,” Lawless said.

“Capital growth trends will be contingent on how long it takes to contain the virus, and whether additional constraints on business or personal activity are introduced.”

The number of homes that are selling will fall dramatically in the coming month, Lawless predicted, as Australians lose jobs and consumer confidence tanks.

“Restrictions on open homes and on-site auctions will compound the slowdown in buyer activity, as would any future policy announcements related to peripheral services such as building and pest inspections, conveyancing and furniture removals.”

In the week to 30 March, 40 per cent of auctions were pulled from the market, up from 7.5 per cent a week earlier, pushing the preliminary clearance rate down to its lowest reading since June last year.

Polling of real estate agencies found the majority of agents have seen activity decline by half, with the majority expecting it to fall further in coming weeks.

Despite this, Lawless said the temporary nature of the crisis and the truckloads of stimulus being deployed to save the economy should serve to keep home values fairly insulated.

“The extent of any fall in housing values is impossible to fathom without first understanding the length of time this health and economic crisis persists. Arguably, the longer it takes to contain the virus and bring economic operations back to normal, the higher the downside risk to housing values.”

Leniency from banks should also help cushion the blow to the housing market and stem the flow of distressed properties coming onto market.

“No doubt there is a rising level of downside risk to housing values which is compounded by the fragile state of household balance sheets, which on average, are heavily leveraged. The wildcard remains the sheer uncertainty of how long this health crisis and associated economic disruption will persist.”

But when recovery comes, it will be swift as consumer spirits rebound, Lawless said.

“When that will be, remains highly uncertain.”

Make your money work with Yahoo Finance’s daily newsletter. Sign up here and stay on top of the latest money, news and tech news.

Follow Yahoo Finance Australia on Facebook, Twitter, Instagram and LinkedIn.

Yahoo Finance

Yahoo Finance