Is Australia in the next stage of the property cycle?

The media seems so preoccupied with what’s going wrong in Australia, they’re missing all the things that are going right.

Also read: Inside Melbourne’s $45m penthouse – the city’s most expensive apartment

The newspapers and online media outlets continually deliver house price collapse headlines, probably because it gets clicks but our property markets are not collapsing and our economy is not heading for a recession.

The economy is chugging along nicely and our property markets are experiencing a soft landing.

Also read: Good news ahead for Aussie property buyers

Corelogic reports that combined capital city dwelling values fell -2.4% over the last year, while combined regional dwelling values increased 1.6% over the year.

Sure Sydney property values dropped 5.4% over the last 12 months, but that’s not a crash and Melbourne property values fell 0.5%. Now that’s hardly worth a headline.

Of course the media’s negative sentiment could end up becoming a self-fulfilling prophecy, scaring off potential home buyers and reducing demand making the market downturn worse than it needs to be.

Some locations are still hot, and others are really not.

The upper end of the market is suffering most

As is normally the case at this stage of the cycle more expensive properties, which are more subject to discretionary spending, are the weakest segment of the market.

And not surprisingly this is more evident in Sydney and Melbourne, while in most other cities have seen relatively little difference in the performance of properties across the broad valuation spectrums.

Also read: The one-bedroom Sydney apartments that sell for over $2 million

As always, there are substantial differences in the housing markets performance across each of the capital cities.

SYDNEY HOUSING MARKET

The Sydney property market peaked a year ago – in July 2017 -and is now experiencing a soft landing with dwelling values falling by -5.4% over the last year.

While the top end of the market is suffering from lack of buyers for prestige home and the lower end markets like Sydney’s South West or the Central Coast are being held back by affordability issues, some of the inner and middle ring suburbs are strongly outperforming the averages.

While Sydney is the most expensive city in Australia, it is also clearly the most valuable and will continue to experience a chronic shortage of homes.

Strong economic growth and jobs creation is leading to population growth and ongoing demand for property in Sydney with underlying demand is well ahead of supply and the rental market is tightening. At the same time international interest from tourists, migrants and investors continues.

However now more than ever, critical property selection will be more important to find an investment grade property that will outperform the property markets.

MELBOURNE HOUSING MARKET

The Melbourne property market peaked in November last year dwelling values fell by 1.8% over the last year.

Even though it is taking a breather after 5 years of exceptional growth, there is no sign of a collapse in sight.

The most affordable quarter of the Melbourne market is still performing strongly with house prices rising by 9.3% over the past year while the most expensive quarter of the market has recorded a fall of 2.5%.

While Melbourne’s property prices are likely to fall a little more – maybe a further 3% this year, they will be underpinned by a robust economy, jobs growth (around 72,000 jobs were created last year), Australia’s strongest population growth and the influx of 35% of all overseas migrants.

Melbourne now rates as one of the 10 fastest growing large cities in the developed world, with its population likely to increase by around 10% in the next 4 years.

While the national population grew by 1.6% in the year ended 30 June 2017, the highest growth was in Victoria, with a 2.3% increase in population and experts have predicted it is likely to surpass Sydney as the largest city of Australia by as early as 2031.

The ripple effect of house price growth caused significant house price growth in Melbourne’s outer suburbs over the last few years.

Similarly, some regional centres including Geelong have performed well, but moving forward it is likely that the more affluent middle rings suburbs which are going through gentrification are likely to exhibit the best property price growth.

As Melbourne residents trade their backyards for balconies and courtyards, villa units with renovation potential and townhouses in Melbourne’s middle ring suburbs will make excellent investments

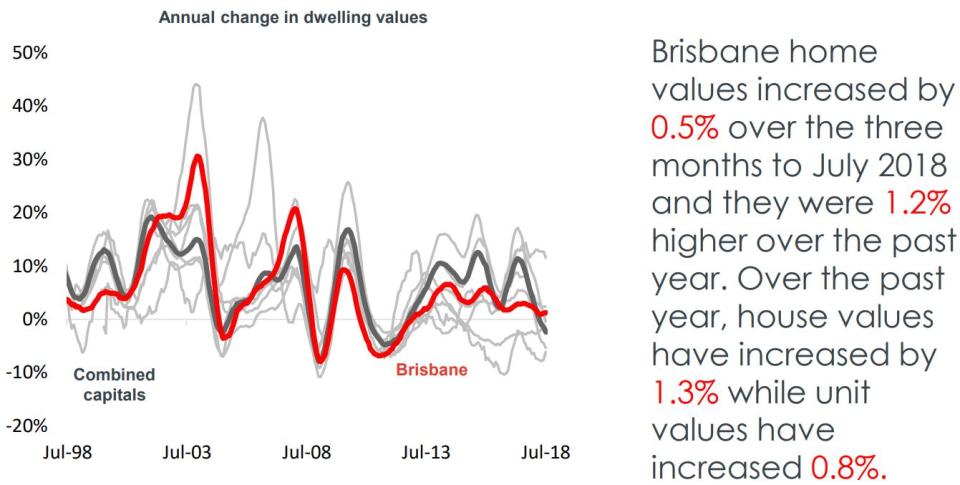

BRISBANE HOUSING MARKET

The Brisbane property market languished over the last few years.

However, while overall dwelling values increased 1.3% over the past year, a number of gentrifying middle ring suburbs exhibited double digit growth.

Yet Brisbane is the market with the most potential for growth over the next 3 years.

In the first seven months of the year Brisbane dwelling values rose by 0.4%. While this may look trifling, because of falling property values elsewhere, this is the second highest growth rate after Hobart.

Importantly, the local unit apartment market, which was heavily oversupplied for the last few years, seems to be finally turning around.

At the same time local government infrastructure spending and a growing economy are creating more jobs, the unemployment rate remains stubbornly high.

ADELAIDE HOUSING MARKET

Adelaide dwelling values increased by 0.7% over the last year, down from 5.4% growth a year ago, however this is the 5th consecutive year in which values have increased.

Like the rest of Australia, the Adelaide property market is very fragmented with some suburbs growing faster than others.

I know some investors are looking for opportunities in Adelaide hoping (“speculating”) prices will increase but there are few growth drivers in Adelaide which is experiencing above average unemployment rates and poor employment growth.

In my mind, there are better places to invest than Adelaide.

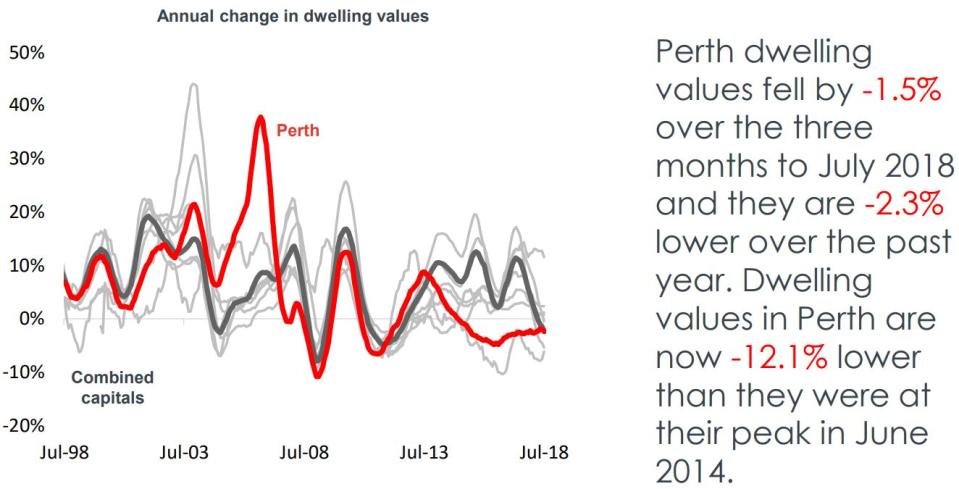

PERTH HOUSING MARKET

Perth dwelling values fell by -2.3% over the last year.

The Perth property market peaked in June 2014 and now, more than four years later, has yet to bottom, with dwelling values 12.1% below their June 2014.

While the market may level out in the next six months, it’s much too early for a countercyclical investment in the west – I can’t see prices rising significantly for a number of years.

HOBART MARKET UPDATE

Hobart has been the strongest performing capital city over the last year returning overall capital growth of 11.5% and is likely to be the top performer this year driven, in part, by investors chasing the “next hot spot.”

However, the pace of growth is slowing down and it’s important to keep in mind that Hobart is a very small market, so learn for the past…this year’s hot spot can easily become next year’s “not spot.”

Last year, some 5,200 dwellings sold in Hobart, which is just 1% of the Australian market.

It also accommodates a 1% share of Australia’s annual population growth. Hobart is a small place and it doesn’t take much to influence its property market – in both directions.

Despite the current fast rate of growth, dwelling values in the Apple Isle have barley kept up with inflation over the last decade and with few long-term growth drivers, I would avoid investing in Hobart.

DARWIN HOUSING MARKET

The Darwin property market peaked in August 2010 is still suffering from the effects of the end of our mining boom 8 years later falling a another 6.2% over the last year, and our research suggests that house prices are likely to keep falling for some time yet.

As opposed to the east coast capital cities where many jobs are being created, Darwin had a net loss of jobs last year, showing how its economy is languishing.

Darwin does not have significant growth drivers on the horizon and would be best avoided by investors.

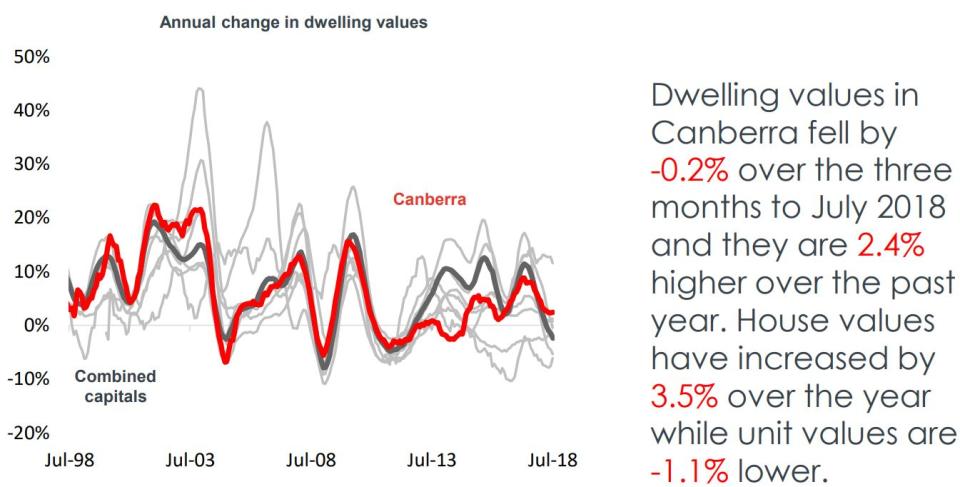

CANBERRA MARKET UPDATE

Canberra’s property market is a “quiet achiever” having grown 3.5 % over the last year and is likely to continue to perform well underpinned by a stable economy which has led to steady employment and to above average population growth (+1.8% per annum.)

Houses price growth has outpaced its flatter apartment market.

The ACT Government predicts ongoing strong population growth of 6% in Canberra by 2020. Around 60% of this growth will be due to natural increase and about 40% through net overseas and interstate migration.

In Summary

We’re clearly in the next stage of the property cycle, one of moderate growth in some regions and virtually no growth in others and falling prices in yet others and currently many regional markets are outperforming the big capital cities

Australia’s property markets are very fragmented, driven by local factors including jobs growth, population growth, consumer confidence and supply and demand.

This makes it an opportune time for both home buyers and investors to buy property at a time when they’ll face less competition.

However correct asset selection will be more important now than ever, so only buy in areas where there are multiple growth drivers such as employment growth, population growth or major infrastructure changes.

Similarly, suburbs undergoing gentrification are likely to outperform.

Michael Yardney is a director of Metropole Property Strategists, which creates wealth for its clients through independent, unbiased property advice and advocacy. He is a best-selling author, one of Australia’s leading experts in wealth creation through property and writes the Property Update blog.

Yahoo Finance

Yahoo Finance