The Aussie jobs that will boom under a Biden America

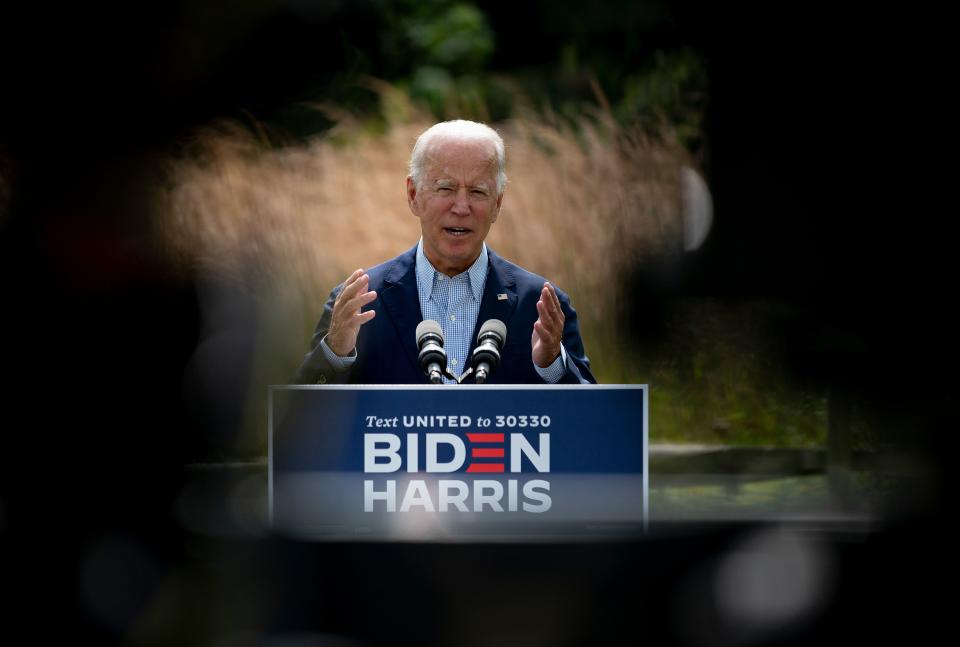

Australians working in the renewables, export, innovation and defence industries will be beneficiaries of an America under President-elect Joe Biden’s leadership, experts have said.

Though Biden won’t be moving into the White House until 20 January, the Democrat victory means a number of decisive policy shifts, according to US Studies Centre senior research fellow Jared Mondschein.

“The Biden team has made clear that they have four priorities: Covid-19, economic crisis, calls for racial justice, and climate change,” he told Yahoo Finance.

The new focus areas will have consequences for Australia. Here’s what the experts said:

Winner: Renewable energy

Renewable energy will be a particular focus for Biden, who declared climate change was the “number one issue facing humanity”.

“Climate change is the existential threat to humanity,” the US President-elect stated in a podcast episode released last month. “Unchecked, it is going to actually bake this planet. This is not hyperbole. It’s real. And we have a moral obligation.”

According to Mondschein, the Biden team has “made clear it wants to make green investments in infrastructure, the auto industry, transit, power sector, buildings, housing, innovation, agriculture and conservation”. And Biden’s efforts in this area will have flow-on effects for the world, including Australia.

“Greater investment in green technologies and infrastructure in the United States is likely to flow through to a further improvement in the efficiency and economies of scale of green technologies worldwide,” said IBISWorld senior industry analyst Jason Avaranis.

But not all aspects of the energy sector will benefit from a US more gung-ho about renewables: Australia’s fossil fuel industry will be placed under renewed scrutiny.

"The bad news for Australia might be renewed focus on fossil fuel and extractive industries (drilling and mining) as the US likely re-commits to the Paris agreement on climate change,” said Motley Fool chief investment officer Scott Phillips.

Today, the Trump Administration officially left the Paris Climate Agreement. And in exactly 77 days, a Biden Administration will rejoin it. https://t.co/L8UJimS6v2

— Joe Biden (@JoeBiden) November 5, 2020

This could also introduce a new layer of complexity to the US-Australia relationship.

“Biden has pledged to put pressure on other countries to adopt more ambitious targets, using American economic leverage and by integrating climate change initiatives into security and trade policy,” said US Studies Centre CEO Simon Jackman said in an analysis piece.

“This could have significant implications for Australia, which ranks last in the OECD in greenhouse emissions per capita.”

Winner: Australian exporters

Though a Biden administration does not mean Washington will stop eyeing Beijing as a strategic competitor, it likely does mean a less antagonistic approach to trade.

“President-elect Biden is also likely to try to remain tough on China but also dial down the tension, which hopefully improves the international trade picture,” Phillips said.

“If he's successful, we might see our own government take a more conciliatory approach, removing roadblocks for agriculture, wine and consumer goods being sold into China.”

China dialled up the rhetoric against Australia as recently as last week after a China Daily editorial stated Australia would “pay tremendously” for its “misjudgement” in “colluding” with the US against China.

Last Friday, China blocked a number of new exports from entering China, although the blocks were specific in nature rather than total blanket bans.

But if US-China tensions cool down and Australia follows in its stead, Aussie exporters could see more of their product back in Chinese markets, AMP Capital chief economist Shane Oliver said.

“Less tariff wars and a greater focus on diplomatic solutions to trade tensions with China could encourage Australia to resolve its issues with China via diplomacy too which would benefit Australian exporters to China – notably those that have recently been hurt including coal, barley, wheat, copper, fisheries etc.”

Winner: Defence and innovation

Australia’s defence and innovation industries will also benefit from stronger relationships with the US. After years of Trump alienating America’s allies, Biden will be looking to strengthen these ties – and Australia is in a particularly strong position.

The US invests more in Australian “future-oriented sectors” than any other nation and is also the biggest importer of Australian innovation. US firms taken together also employ, sell, own, spend and export and contribute more to Australia’s GDP than firms from any other foreign nation.

“The Biden team has talked about needing to not just apply counterpressure to China but to also improve upon American competitiveness, economically, technologically and militarily,” said Mondschein.

“Under a Biden administration, competition with China will be viewed through a more multilateral lens, meaning Australia could potentially be included in more US defence industry and innovation collaboration.

“More US investments and collaboration with Australian partners in these industries would not be a surprising development.”

Want to get better with money and investing in 2021? Sign up here to our free newsletter and get the latest tips and news straight to your inbox.

Follow Yahoo Finance Australia on Facebook, Twitter, Instagram and LinkedIn.

Yahoo Finance

Yahoo Finance