Aussie Dollar Ticks Down as RBA Stands Pat

DailyFX.com -

Talking Points

The RBA left its key rate at the 1.5% record low

This was close to universally expected by the market

Still, the Aussie Dollar backtracked a little. Rates may be going nowhere fast from here

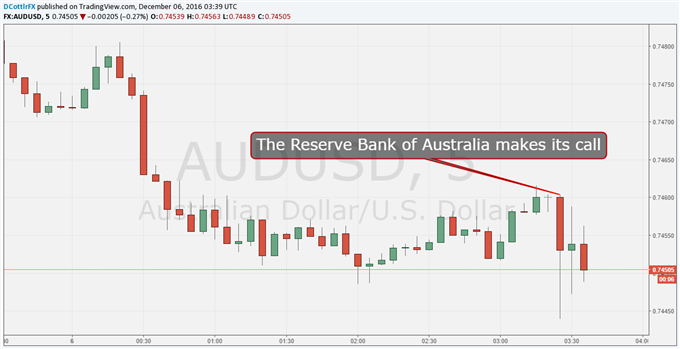

The Australian Dollar ticked lower on Tuesday after the Reserve Bank of Australia opted to leave rates at their record low of 1.5%, despite the fact that markets overwhelmingly expected the result.

The RBA’s statement was little changed from that it issued last month. Essentially the central bank feels that steady policy settings remain consistent with its growth and inflation targets. The global picture remains one of sub-trend growth, the RBA said, even though Australia’s crucial export market, China, is showing signs of stabilization.

The RBA continues to feel that Australian Dollar strength could complicate its inflation mandate if it endures. This reiteration might be behind some of the Aussie’s post-data slip, but this sort of comment is not new.

Elsewhere, while some areas of the Australian housing market remain uncomfortably hot, the RBA seems quite relaxed about it overall. Indeed, it pointed out that while prices in some parts are rising “briskly,” a number of new apartment blocks will be coming to the market next near.

The official cash rate has been at 1.5% since August, and the markets were close to certain that rates are going nowhere this month. The big policy question for Aussie investors is whether this represents the trough for this cycle or whether rates can go lower.

Wednesday’s Gross Domestic Product release might shed some more light on that question.

AUD/USD slipped to 0.74546 from around 0.74800 before the numbers.

A modest slide: AUD after the decision

Chart compiled using TradingView

Want our analysts' latest takes on the markets and trading themes?Check out the DailyFX Webinars.

--- Written by David Cottle, DailyFX Research

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from IG.

Yahoo Finance

Yahoo Finance