AUD/USD Seesaws as RBA Opts to Keep Policy at Status Quo

DailyFX.com -

Talking Points:

- The Australian Dollar slightly lower versus other major currencies

- RBA keeps cash rate at record low 1.75%, as expected

- Further information to refine growth and inflation assessment for a possible adjusment to policy

Showcase your trading skills against your peers in FXCM's $10,000 Monthly Challenge Here, but learn good trading habits with the “Traits of successful traders” series

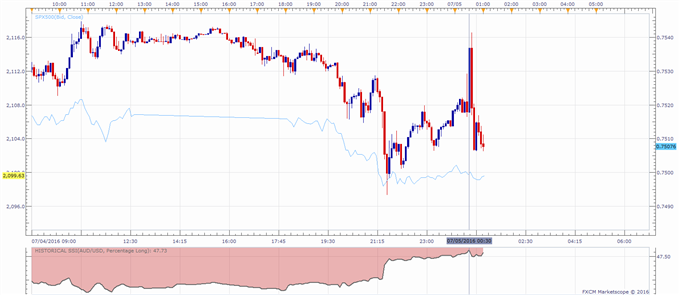

The Australian Dollar saw an initial move higher overturned versus other major currencies (at the time this report was written) after today’s Reserve Bank of Australia (RBA) rate decision saw interest rates unchanged at record low 1.75%, as was expected by economists.

With the decision highly expected, attention quickly turned to the press release for further information.

Looking into the statement, the RBA said the financial markets have been volatile recently due to “Brexit”, but most markets have continued to function effectively. Interestingly, the bank said that any effects of the referendum outcome on global economic activity remains to be seen and, outside the effects on the UK economy itself, may be hard to discern.

The bank remarked that inflation has been quite low due to subdued growth in labour costs and very low cost pressures globally, and the bank expects this to remain the case for some time.

The closing remarks of the statement saw an interesting change from the prior one, as the bank said further information ahead could help refine assessment of the outlook for growth and inflation which could lead to adjustments to policy. In contrast, the last announcement said that holding policy unchanged was consistent with sustainable growth and inflation returning to target over time.

Taking this into consideration, the market might have reacted initially to the decision itself, that on face value could imply that the bank is in a “wait and see mode”, while the latter comments appear to imply the possibility of further easing down the line. In turn, this is view might have been seen as consistent with the way the RBA’s outlook is perceived by the market, which may help to explain the overall limited price action following the decision.

AUD/USD 5-Minute Chart with SPX 500 Overlay: July 05, 2016

--- Written by Oded Shimoni, Junior Currency Analyst for DailyFX.com

To contact Oded Shimoni, e-mail oshimoni@dailyfx.com

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.

Yahoo Finance

Yahoo Finance