AUD/USD Multi-Year Trendline at Risk on Weak Data, Dovish RBA

DailyFX.com -

Talking Points:

- AUD/USD Eyes Multi-Year Trendline Ahead of Australia Retail Sales, RBA Meeting.

- USD/CAD Marks Fresh 2015 Highs to Start August; Canada Employment Report in Focus.

- USDOLLAR Remains Stuck in Narrow Range to Start August.

For more updates, sign up for David's e-mail distribution list.

AUD/USD

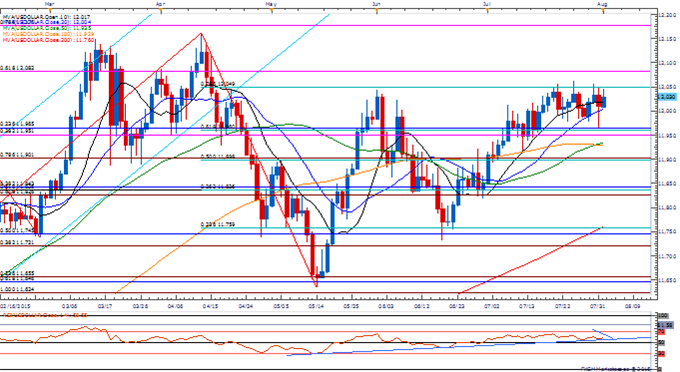

Chart - Created Using FXCM Marketscope 2.0

Despite the recent range-bound price action in AUD/USD, the pair remains at risk for a further decline as price & the Relative Strength Index (RSO) retain the bearish formation carried over from May; may threaten the long-term upward trendline from back in 2001 should the key event risk coming out of Australia dampen the appeal of the higher-yielding currency.

Even though the Reserve Bank of Australia (RBA) is largely expected to keep the cash rate at 2.00%, a marked slowdown in Retail Sales paired with a toughened verbal intervention may drag on the exchange rate as Governor Glenn Stevens tries to further assist with the rebalancing of the real economy.

Nevertheless, the DailyFX Speculative Sentiment Index (SSI) shows retail crowd remains net-long AUD/USD since May 15, with the ratio approaching extremes as it sits at +2.93 as 75% of traders are long.

USD/CAD

USD/CAD extends the advance from the previous week to breakout of the near-term range and climbs to a fresh 2015 high of 1.3174; topside targets remain favored as long as RSI retains the bullish momentum and pushes back into overbought territory.

Despite market expectations for a rebound in Canada Employment, fears of a double-dip recession may encourage the Bank of Canada (BoC) to further endorse a dovish outlook for monetary policy as the growth rate contracted for the fifth consecutive month in May.

Will favor the topside targets as long as price & RSI maintain the bullish trend, with the next region of interest coming in around 1.3210 (78.6% expansion) following by 1.3280 (78.6% expansion).

Join DailyFX on Demand for Real-Time SSI Updates Across the Majors!

Read More:

The Weekly Volume Report: USD/CAD Turnover Supports Broader Trend

USDOLLAR(Ticker: USDollar):

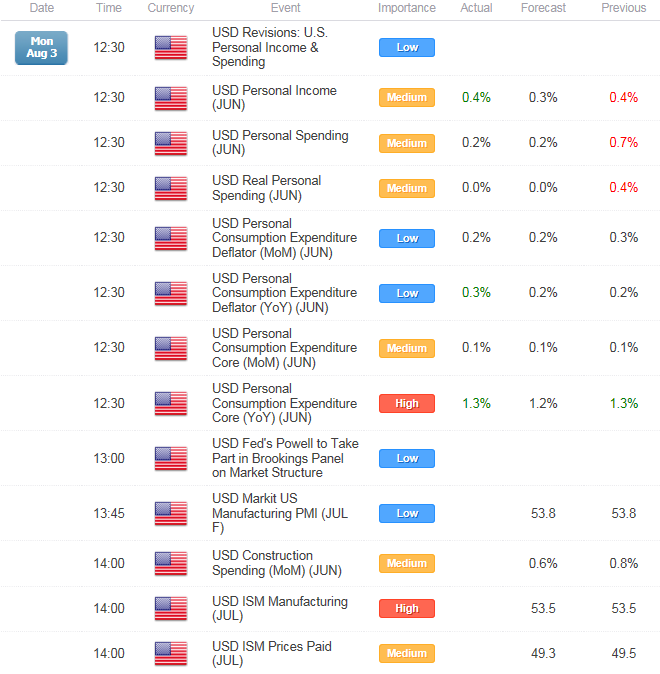

Index | Last | High | Low | Daily Change (%) | Daily Range (% of ATR) |

DJ-FXCM Dollar Index | 12030.69 | 12047.39 | 12012.16 | 0.12 | 68.66% |

Chart - Created Using FXCM Marketscope 2.0

Bullish sentiment surrounding the Dow Jones-FXCM U.S. Dollar may gather pace in August as the fresh data prints coming out of the U.S. economy points to sticky price growth along with prospects for a stronger recovery in the second-half of 2015.

Even though the U.S. Non-Farm Payrolls (NFP) report highlights the biggest event risk for the greenback, the ADP Employment figure along with the ISM surveys may produce increased volatility in the exchange rate as there’s only so much time left ahead of the Federal Open Market Committee’s (FOMC) September 17 interest rate decision.

Will continue to look for range-bound prices until we get a closing price below the Fibonacci overlap around 11,951 (38.2% expansion) to 11,965 (23.6% retracement) or above 12,049 (78.6% retracement).

Join DailyFX on Demand for Real-Time SSI Updates!

--- Written by David Song, Currency Analyst

To contact David, e-mail dsong@dailyfx.com. Follow me on Twitter at @DavidJSong.

To be added to David's e-mail distribution list, please follow this link.

Trade Alongsidethe DailyFX Team on DailyFX on Demand

Looking to use the DailyFX Trade Signals LIVE? Check out Mirror Trader.

New to FX? Watch this Video

Join us to discuss the outlook for the major currencies on the DailyFXForums

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.

Yahoo Finance

Yahoo Finance