AUD/USD Forex Technical Analysis – Trader Reaction to .7740 Sets the Tone into the Close

The Australian Dollar is up sharply against the U.S. Dollar on Tuesday as riskier currencies found a firmer footing after a weaker opening. The rebound may have been fueled as tensions eased over vaccine rollouts and the outlook for U.S. fiscal stimulus. These two factors boosted demand for the safe-haven dollar the previous session.

At 17:21 GMT, the AUD/USD is trading .7739, up 0.0027 or +0.34%.

According to CNBC, mounting coronavirus cases and caution ahead of the U.S. Federal Reserve’s policy meeting this week has dulled appetite for risk, lending support to the greenback against a basket of currencies in recent sessions, but investors were once again nibbling at riskier currencies late Tuesday.

Early Wednesday, Australia will release data on Consumer Inflation, Trimmed Mean CPI and NAB Business Confidence.

Daily Swing Chart Technical Analysis

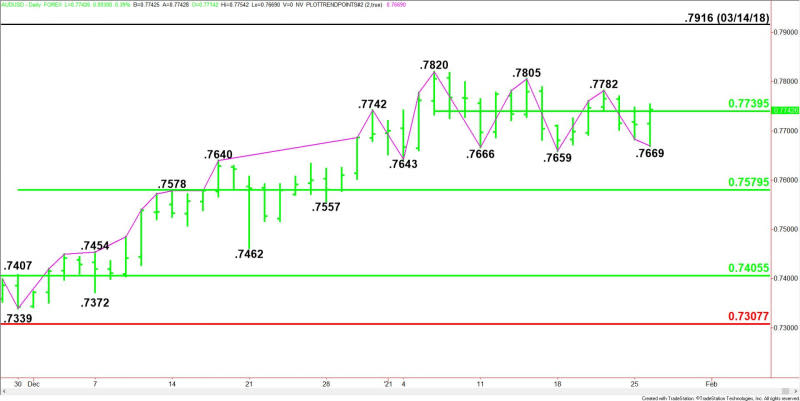

The main trend is down according to the daily swing chart. A trade through .7659 will signal a resumption of the downtrend. A move through .7782 will change the main trend to up.

The minor range is .7820 to .7659. The AUD/USD is currently straddling its 50% level at .7740. Trader reaction to this level could set the tone into the close.

The short-term range is .7339 to .7820. If the downtrend resumes then look for a potential test of its 50% level at .7579.

Daily Swing Chart Technical Forecast

Based on the current price at .7739, the direction of the AUD/USD into the close will be determined by trader reaction to the pivot at .7740.

Bullish Scenario

A sustained move over .7740 will indicate the presence of buyers. If this move creates enough upside momentum then look for the rally to extend into the main top at .7782. Taking out this level will change the main trend to up, putting the Aussie in a position to challenge a pair of tops at .7805 and .7820.

Bearish Scenario

A sustained move under .7740 will signal the presence of sellers. The first downside target is an intraday pivot at .7712, followed by .7669 and .7659. Taking out another main bottom at .7643 could trigger an acceleration into the pivot at .7579.

For a look at all of today’s economic events, check out our economic calendar.

This article was originally posted on FX Empire

Yahoo Finance

Yahoo Finance