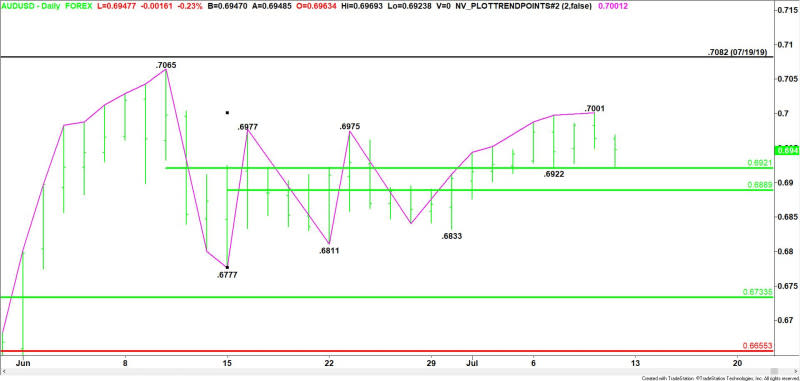

AUD/USD Forex Technical Analysis – Strengthens Over .6921, Weakens Under .6889

The Australian Dollar finished lower on Friday despite a surge in demand for higher-risk assets. The Aussie finished well off its low, however, after the U.S. Dollar weakened.

Driving the price action on Friday were hopes of a potential vaccine for the novel coronavirus after Gilead Sciences Inc said additional data from a late-state study showed its antiviral remdesivir reduced the risk of death and significantly improved the conditions of severely ill COVID-19 patients.

That news helped push U.S. equities higher while dampening the appeal of the U.S. Dollar as a safe-haven asset.

On Friday, the AUD/USD settled at .6948, down 0.0016 or -0.23%.

Gains were likely limited as sentiment for the Aussie continued to take a hit after coronavirus lockdown measures were reimposed in Australia’s second biggest city of Melbourne on Tuesday.

Daily Swing Chart Technical Analysis

The main trend is up according to the daily swing chart, however, momentum shifted to the downside on July 9 with the formation of a closing price reversal top. A trade through .7001 will negate the closing price reversal top and signal a resumption of the uptrend. The main trend will change to down on a move through the nearest swing bottom at .6833.

The minor trend is also up. A trade through .6922 will change the minor trend to down. This will confirm the shift in momentum.

The first short-term range is .7065 to .6777. Its 50% level at .6921 is potential support.

The second short-term range is .6777 to .7001. Its 50% support level comes in at .6889.

Short-Term Outlook

The next major move in the AUD/USD will be determined by how investors handle the two 50% levels at .6921 and .6889.

The bullish tone is likely to remain intact if buyers can hold above .6921. A bearish tone is likely to develop if the selling is strong enough to take out the 50% level at .6889.

For a look at all of today’s economic events, check out our economic calendar.

This article was originally posted on FX Empire

More From FXEMPIRE:

Crude Oil Price Forecast – Crude Oil Markets Form Bullish Candles

EOS, Ethereum and Ripple’s XRP – Daily Tech Analysis – July 11th, 2020

Natural Gas Weekly Price Forecast – Natural Gas Markets Rally Again

US Stock Market Overview – Stocks Rise Led by Financials; the Nasdaq Hits a Fresh All-time High

Yahoo Finance

Yahoo Finance