AUD/USD Forex Technical Analysis – Trader Reaction to .6842 Will Determine Direction on Thursday

The Australian Dollar is edging lower early Thursday against the U.S. Dollar following the release of disappointing economic reports. The currency is trading inside yesterday’s trading range, which suggests investor indecision and impending volatility.

The Australian Bureau of Statistics said Retail Sales for October came in at 0.0%. Trader were looking for a reading of 0.3%. The Australian Trade Balance for October was 4502 Million versus a 6100 M forecast. Imports rose 0% and Exports fell 5%.

At 01:17 GMT, the AUD/USD is trading .6842, down 0.0006 or -0.09%.

Daily Swing Chart Technical Analysis

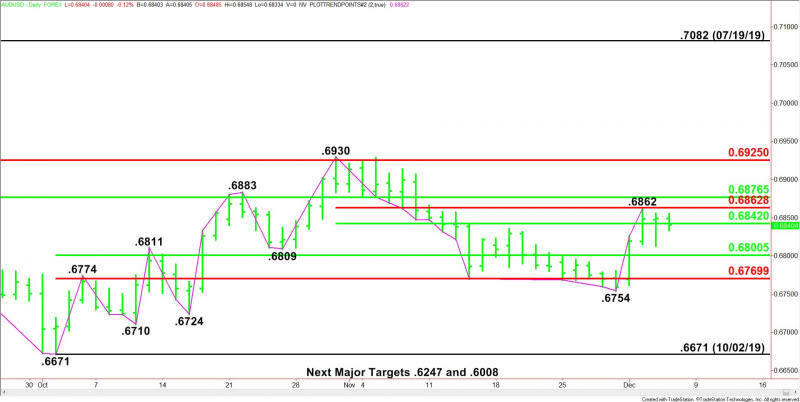

The main trend is down according to the daily swing chart. A trade through .6754 will signal a resumption of the downtrend. The main trend will change to up on a move through .6930.

The minor trend is also down. A new minor top was formed at .6862 on Wednesday. A trade through this minor top will change the minor trend to up. This will also shift momentum to the upside.

The intermediate range is .6671 to .6930. Its retracement zone at .6800 to .6770 is support.

The short-term range is .6930 to .6754. Its retracement zone at .6842 to .6863 is currently being tested.

The main range is .7082 to .6671. Its retracement zone at .6877 to .6925 is major resistance. It is controlling the longer-term direction of the AUD/USD.

Daily Swing Chart Technical Forecast

Based on the early price action and the current price at .6842, the direction of the AUD/USD on Thursday is likely to be determined by trader reaction to the short-term 50% level at .6842.

Bearish Scenario

A sustained move under .6842 will indicate the presence of sellers. The first downside target is yesterday’s low at .6813. This is followed by the intermediate 50% level at .6800. This is a potential trigger point for an acceleration into the Fibonacci level at .6770.

Bullish Scenario

A sustained move over .6842 will signal the presence of buyers. This could lead to a labored rally with upside targets lined up at .6862, .6863 and .6877. The latter is a potential trigger point for an acceleration to the upside with the next key targets coming in at .6925 and .6930.

This article was originally posted on FX Empire

Yahoo Finance

Yahoo Finance