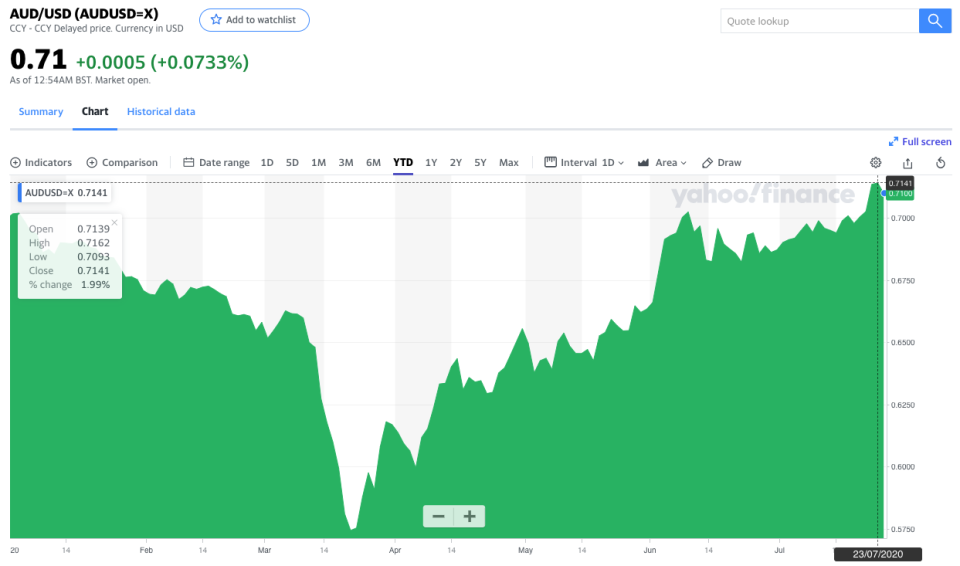

Aussie dollar hits 15-month high: What this means for your money

There’s a bit of buzz around the Aussie dollar at the moment, which has broken above the US$0.70 mark for the first time in a while.

On Thursday the AUD hit 71.41 US cents, the highest it’s been all year.

But prior to the recent uptick, the dollar had been falling for years. It was most recently hamstrung by Australia’s weak economy – which was already weak before the twin bushfire and coronavirus crises – as well as rising trade tensions between China and the US.

And while the economy is in an even worse position than this time last year, with the budget deficit slated to hit $281 billion across 2019-20 and 2020-21, a higher Australian dollar is a bit of good news for some (but bad news for others).

First things first: Why has the AUD risen?

According to economists, there are a few factors driving the rise.

Demand for the USD has fallen as investors stop turning to it as a safe haven; the US Federal Reserve is printing more US dollars than our Reserve Bank is printing Aussie dollars; and iron ore prices are rising.

“[It may also] be optimism that Australia will recover faster than the US,” AMP Capital chief economist Shane Oliver told Yahoo Finance.

“I expect it will continue to rise.”

The Euro has also risen as well, off the back of a historic €750 billion stimulus package that was agreed to by European Union leaders earlier this week.

There are also hopes for another round of US stimulus, and any signs that the global economy is improving is a positive for the AUD, said Commonwealth Bank currency strategist and international economist Kimberly Mundy.

“Australia, as a relatively small export-oriented economy, benefits from a stronger global economy. A stronger global economy typically means increased demand for Australian exports.”

What does a higher AUD mean for Aussies?

Usually, the most significant thing this would mean to Australians would be the cheaper cost of international travel.

“But at the moment, Australians won’t be able to take advantage of this because of travel restrictions,” said Mundy.

However, there’s still an upside: it does bring down the cost of imported goods – like cars, clothing, electronic goods, and it does mean it’s not a bad time for Aussies to shop online for items priced in the US dollar.

But Oliver warned that it would be difficult to see a huge difference in consumer prices.

It’s not great news for exporters, however: a higher Australian dollar means greater competition for local companies selling their goods in other countries.

“For Australia’s export businesses, a higher AUD can increase the relative cost of Australia’s goods. This can lower demand for Australian goods relatively to the importing country’s own domestically produced goods, or goods from another country with a lower cross rate,” Mundy said.

But Australian-made products might be looking pretty attractive at the moment, she also noted.

“A stronger global economy typically means increased demand for Australian exports. This increase in offshore demand can then play an important role in Australia’s own economic recovery.”

Bell Direct market analyst Jessica Amir said now was the time to invest in gold.

Gold tends to do better when the US dollar falls, and this in turn encourages demand for gold and pushes its price up.

“Gold is expected to continue to rally after already hitting a nine year peak,” she told Yahoo Finance.

“So, for Aussie investors, it doesn’t mean to go out and get gold teeth as the gold price is likely to rally up, it means they should consider taking a position in gold.”

You could consider investing in gold through exchange-traded funds (ETFs) such as ETFS Physical Gold (ASX:GOLD), Perth Mint Gold (ASX:PMGOLD) and BetaShares Gold Bullion ETF (ASX:QAU)."

Will this last?

The Australian dollar has risen, but not by that much.

“It’s worth noting that at 0.7150, AUD is still within our estimate of the 'fair-value' range for AUD,” said Mundy.

But global tensions, or a reason to lose confidence in the global economic recovery, could rattle investors and see it come tumbling down again – just like last time.

“The risk is that this recent AUD strength is short-lived if we see any further escalation in US-China tensions.

“We think rising tensions between the US and Chinese governments could lead to some near‑term AUD weakness and push it back inside its recent 0.68 to 0.70 range.”

Make your money work with Yahoo Finance’s daily newsletter. Sign up here and stay on top of the latest money, economy, property and work news.

Follow Yahoo Finance Australia on Facebook, Twitter, Instagram and LinkedIn.

Yahoo Finance

Yahoo Finance