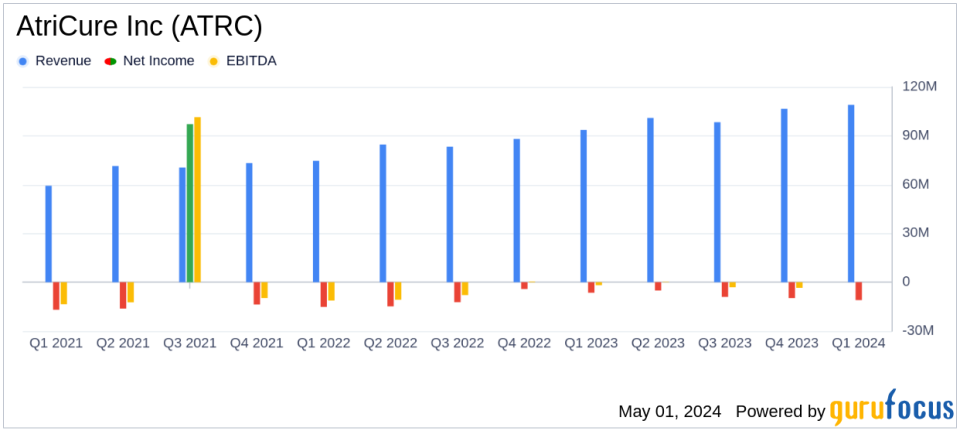

AtriCure Inc (ATRC) Surpasses Revenue Estimates in Q1 2024 Despite Wider Losses

Revenue: Reported at $108.9 million, marking an increase of 16.4% year-over-year and surpassing estimates of $106.90 million.

Net Loss: Stood at $13.27 million, significantly above the estimated net loss of $10.70 million.

Earnings Per Share (EPS): Recorded at -$0.28, falling short of the estimated -$0.23.

Gross Margin: Improved slightly to 74.7%, up from 74.5% in the same quarter the previous year.

U.S. Revenue: Grew by 15.4% to $90.2 million, driven by sales across key product lines.

International Revenue: Increased by 21.5% to $18.6 million, reflecting strong activity across all franchises and geographic regions.

Full Year Revenue Guidance: Projected to be between $459 million to $466 million, indicating a growth of approximately 15% to 17% over the previous year.

On May 1, 2024, AtriCure Inc (NASDAQ:ATRC) released its 8-K filing, revealing a notable increase in revenue but a deeper net loss for the first quarter of 2024. The company, a leader in surgical treatments for atrial fibrillation and related conditions, reported a revenue of $108.9 million, surpassing the analyst's expectation of $106.90 million. However, the net loss widened to $0.28 per share compared to the estimated $0.23.

Company Overview

AtriCure Inc is at the forefront of developing surgical treatments and therapies for atrial fibrillation (Afib), left atrial appendage (LAA) management, and post-operative pain management. The company markets its diverse product range, including minimally invasive ablation devices and access tools, primarily in the United States, which constitutes the bulk of its revenue.

Financial Performance Insights

The first quarter of 2024 saw AtriCure achieving a 16.4% year-over-year increase in global revenue, driven by robust sales across its key product lines in the U.S. and significant growth in international markets. U.S. revenue climbed to $90.2 million, a 15.4% increase, while international revenue rose 21.5% to $18.6 million. Despite these gains, the company's net loss deepened, attributed partly to the absence of a one-time legal settlement gain that benefited the previous year's results.

Gross profit for the quarter was impressive at $81.3 million, with a gross margin of 74.7%, slightly up from the previous year. However, increased operating expenses, primarily from research and development and selling, general, and administrative costs, contributed to a loss from operations of $10.9 million.

Strategic Initiatives and Future Outlook

Michael Carrel, President and CEO of AtriCure, emphasized the company's commitment to expanding its product reach and enhancing clinical research initiatives. For 2024, AtriCure projects revenues to be between $459 million and $466 million, indicating a potential growth of 15% to 17% over 2023. The adjusted EBITDA is also expected to improve significantly, forecasting an increase of 34% to 49% compared to the previous year.

Challenges and Market Position

Despite the positive revenue growth, AtriCure faces challenges such as increased operational costs and market pressures, particularly in minimally invasive appendage management products. However, the company's strong market position and ongoing innovations in Afib treatment and pain management are expected to support its long-term growth trajectory.

Investor Considerations

Value investors might find AtriCure's growth in revenue and strategic expansions appealing, though the widening losses could be a concern. The company's ability to manage expenses and innovate in its product offerings will be crucial for improving profitability and shareholder value in the upcoming quarters.

AtriCure's financial health and strategic direction suggest a resilient approach to navigating market challenges, making it a noteworthy consideration for investors interested in the medical devices and instruments sector.

Explore the complete 8-K earnings release (here) from AtriCure Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance